by Zach Bethune, Thomas Cooley and Peter Rupert

Final Revision to Q1 GDP: UGH!

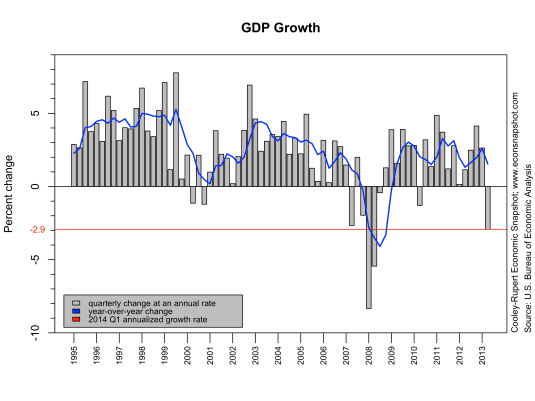

Yesterday the BEA announced another large downward revision to first quarter GDP growth from -1.0% to -2.9%. The final estimate was primarily attributed to downward revisions in consumption (3.1% to 1.0%) and exports (-6.0% to -8.9%). In addition, there was a major hit to the late-2013 inventory overbuild and construction.

All of this, obviously, leaves the FOMC and the administration in a tough position. While many analysts recount weather-related setbacks and changes in depreciation allowances (such as I.R.C. 179), there is certainly real concern that the weakness is, well, weakness. Before the downward revisions, the weak Q1 GDP figures were already on the Fed’s mind. From Janet Yellen’s congressional testimony on May 8 (emphasis added):

“Although real GDP growth is currently estimated to have paused in the first quarter of this year, I see that pause as mostly…

View original post 364 more words

Recent Comments