Thomas Sowell and Jordan Peterson on why Marxism is so appealing

28 Jun 2022 Leave a comment

in applied price theory, development economics, econometerics, economic history, economics of bureaucracy, economics of regulation, history of economic thought, labour economics, labour supply, liberalism, Marxist economics, minimum wage, poverty and inequality, Public Choice, taxation, Thomas Sowell

New Rule: White Shame | Real Time with @BillMaher

11 Jun 2020 Leave a comment

in discrimination, politics - USA, taxation, television Tags: political correctness, racial discrimination, regressive left, virtue signaling

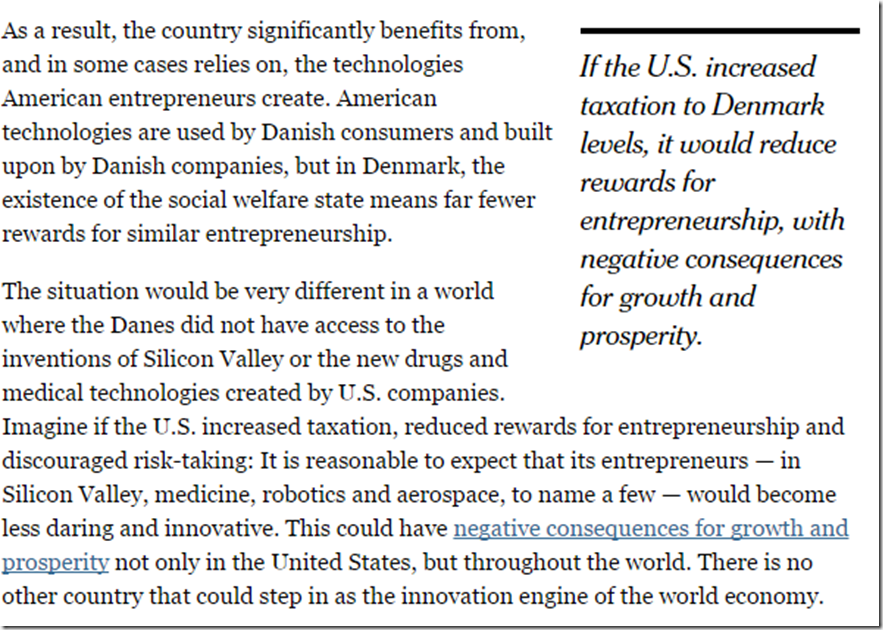

Do the European welfare states free ride off American entrepreneurship and innovation?

12 Nov 2015 1 Comment

in applied price theory, applied welfare economics, comparative institutional analysis, constitutional political economy, economic history, economics of regulation, entrepreneurship, industrial organisation, politics - USA, public economics, survivor principle, taxation, technological progress Tags: creative destruction, Daron Acemoglu, Denmark, entrepreneurial alertness, Eurosclerosis, international technology diffusion, taxation and entrepreneurship, taxation and innovation, taxation and investment, taxation and labour supply, technology followers, welfare state

Source: Daron Acemoglu A Scandinavian U.S. Would Be a Problem for the Global Economy – NYTimes.com.

Cuts in spending less costly than tax increases @jeremycorbyn @johnmcdonnellMP

01 Nov 2015 Leave a comment

The average worker doesn’t pay much in income taxes in New Zealand. Then who does?

17 Jul 2015 Leave a comment

in politics - Australia, politics - New Zealand, politics - USA, public economics, taxation Tags: growth of government, size of government, tax burdens, taxation and the labour supply

Who pays income tax in the USA?

23 Jun 2015 Leave a comment

in politics - USA, taxation Tags: top 1%

Average tax rates versus tax revenue as a percentage of the GDP

31 May 2015 Leave a comment

in economic history, politics - USA, public economics, taxation Tags: average tax rates, growth of government, size of government

French, German, British and US tax revenues as % of GDP, 1965 – 2013

28 May 2015 Leave a comment

in economic history, politics - USA, public economics, taxation Tags: British economy, France, Germany, growth of government

Figure 1: Tax revenue as percentage of French, German, British and US GDP, 1965–2013

Source: OECD StatExtract.

Does tax reform lead to lower taxes?

14 May 2015 Leave a comment

in politics - Australia, politics - New Zealand, politics - USA, public economics, taxation Tags: efficient taxes, tax reform

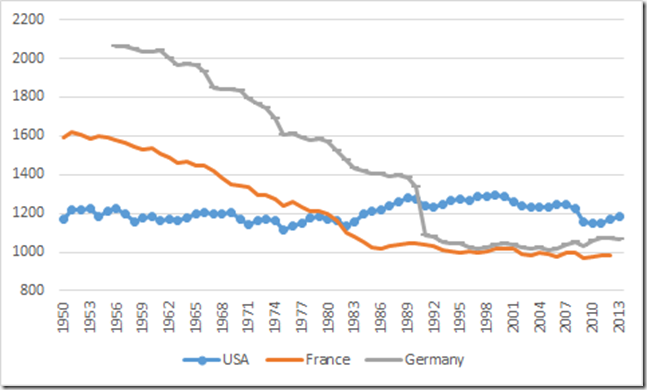

Annual hours worked per working age American, German and French, 1950–2013

12 May 2015 Leave a comment

in applied price theory, economic growth, economic history, great depression, labour economics, labour supply, macroeconomics, politics - USA, Public Choice, public economics, taxation Tags: Edward Prescott, Euroclerosis, France, Germany, labour supply, Robert Lucas, taxation and labour supply

Figure 1 shows that Americans work the same hours per year pretty much the entire post-war period. By contrast, there is been a long decline in hours worked in Germany and France. The large drop in 1992 was German unification.

Figure 1: annual hours worked per working age American, German and French, 1950 – 2013

Source: OECD StatExtract and The Conference Board Total Economy Database™,January 2014, http://www.conference-board.org/data/economydatabase/

The long decline seemed to tally with the disproportionately sharp rise in the average tax rate on labour income, including social security contributions in France and Germany. When tax rates on labour income, including social security contributions stabilised in about 1980, hours worked stabilised in all countries.

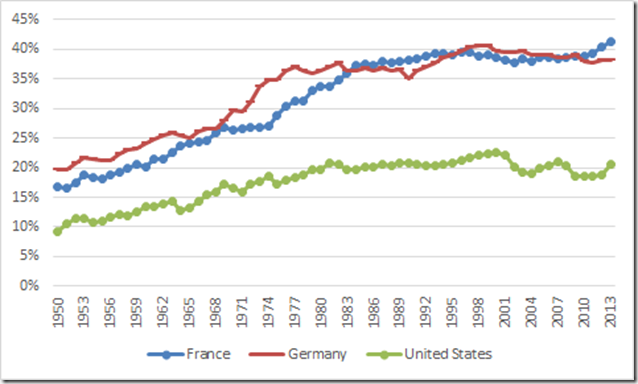

Figure 2: average tax rate on labour income,USA, Germany and France, 1950 – 2013

Source: Source: Cara McDaniel.

Some pander to the great vacation theory of European labour supply. This is the hypothesis of a large increase in the preference for leisure in the European Union member states. That is, mass voluntary unemployment and mass voluntary reductions and labour supply by choice by Europeans. They just decided to work less.

This is not the first outing for the great vacation theory of labour supply. In the late 1970s, Modigliani dismissed the new classical explanation of Lucas and Rapping (1969) of the U.S. great depression in which the 1930s unemployment was voluntary unemployment – the great depression was just a great vacation – with the following remarks:

Sargent (1976) has attempted to remedy this fatal flaw by hypothesizing that the persistent and large fluctuations in unemployment reflect merely corresponding swings in the natural rate itself.

In other words, what happened to the U.S. in the 1930’s was a severe attack of contagious laziness!

I can only say that, despite Sargent’s ingenuity, neither I nor, I expect most others at least of the non-Monetarist persuasion, are quite ready yet. to turn over the field of economic fluctuations to the social psychologist!

As Prescott has pointed out, the USA in the Great Depression and France since the 1970s both had 30% drops in hours worked per adult. That is why Prescott refers to France’s economy as depressed. The reason for the depressed state of the French (and German) economies is taxes, according to Prescott:

Virtually all of the large differences between U.S. labour supply and those of Germany and France are due to differences in tax systems.

Europeans face higher tax rates than Americans, and European tax rates have risen significantly over the past several decades.

Countries with high tax rates devote less time to market work, but more time to home activities, such as cooking and cleaning. The European services sector is much smaller than in the USA.

Time use studies find that lower hours of market work in Europe is entirely offset by higher hours of home production, implying that Europeans do not enjoy more leisure than Americans despite the widespread impression that they do. Europeans did not work less. They worked more on activities that were not taxed.

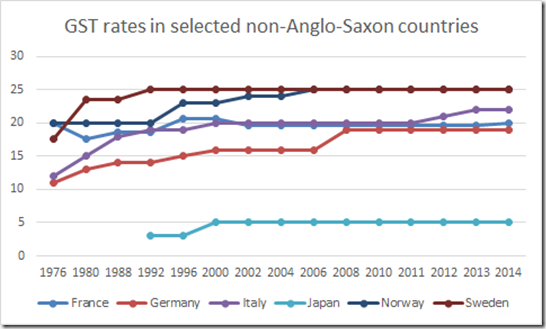

Tax reform leads to higher taxes – the evidence on the GST

31 Mar 2015 Leave a comment

in constitutional political economy, politics - Australia, politics - New Zealand, Public Choice, public economics, taxation Tags: Geoffrey Brennan, James Buchanan, tax reform

The GST increased from 10 to 15% in New Zealand; more than doubled in the UK; but GST rates were stable or went up and down in the remaining Anglo-Saxon countries.

As for a selection of other non-Anglo-Saxon countries , Brennan and Buchanan were right. Tax reforms such as a broad-based consumption tax leads to higher taxes through time.

ICYMI: How does Australia's GST compare with other nations? ab.co/1eBsdrS #factcheck http://t.co/QFP05xonEB—

ABC Fact Check (@ABCFactCheck) July 31, 2015

The GST (goods and services tax) in Europe is known as the value added tax (VAT).

Source: OECD Tax Database – OECD.

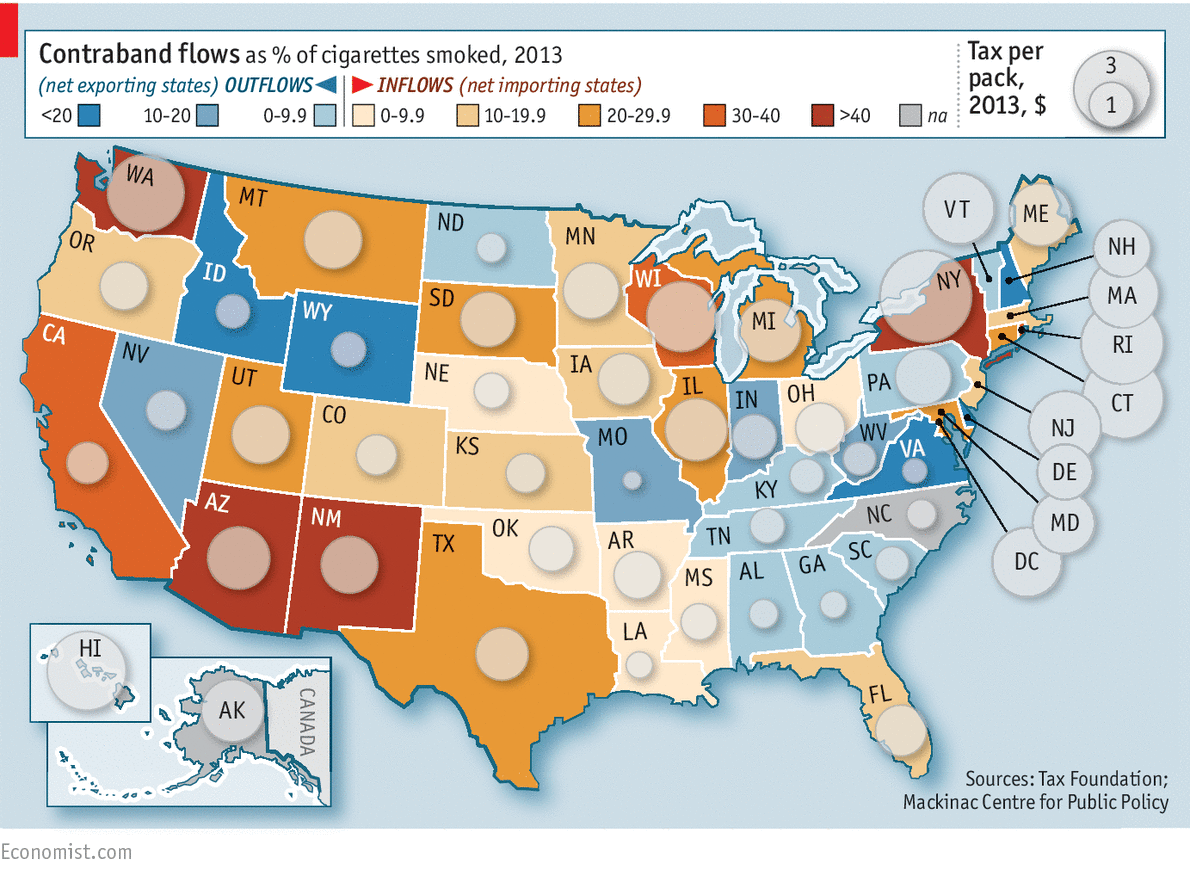

Cigarette smuggling in the United States on a state-by-state basis

18 Feb 2015 Leave a comment

in applied price theory, applied welfare economics, economics of crime, law and economics, macroeconomics, politics - Australia, politics - New Zealand, public economics, taxation Tags: smuggling, tax avoidance, tobacco regulation, tobacco taxation

A great chart that may be misleading because so many taxpayers pay no net income tax

15 Jan 2015 Leave a comment

in Public Choice, taxation Tags: expressive voting, rational ignorance, tax incidence

Very useful #DataViz! UK now gives a breakdown of what your taxes were spent on.

Example via bit.ly/1BAz9vh http://t.co/Ero8h6kHCM—

Max Roser (@MaxCRoser) January 05, 2015

Recent Comments