Five years ago, I shared this video explaining why trade deficits generally don’t matter. The most important thing to understand is that a trade deficit is the same thing as a financial account surplus (formerly known as a capital surplus), which is easy to understand when reviewing this graph. And that type of surplus occurs […]

Dumb Idea of the Month: Currency Devaluation

Dumb Idea of the Month: Currency Devaluation

23 Apr 2024 Leave a comment

in applied price theory, applied welfare economics, industrial organisation, international economics

Globalization is Win-Win

11 Apr 2024 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, development economics, economic history, industrial organisation, international economics Tags: free trade

TweetIn this wonderful new video, John Stossel and Scott Lincicome bust six myths – peddled by the likes of Trump and Biden – about globalization. The post Globalization is Win-Win appeared first on Cafe Hayek.

Globalization is Win-Win

How credible is the Milei plan?

24 Mar 2024 Leave a comment

in applied price theory, budget deficits, business cycles, development economics, economic growth, financial economics, fiscal policy, growth disasters, income redistribution, international economics, macroeconomics, monetary economics, Public Choice, public economics Tags: Argentina

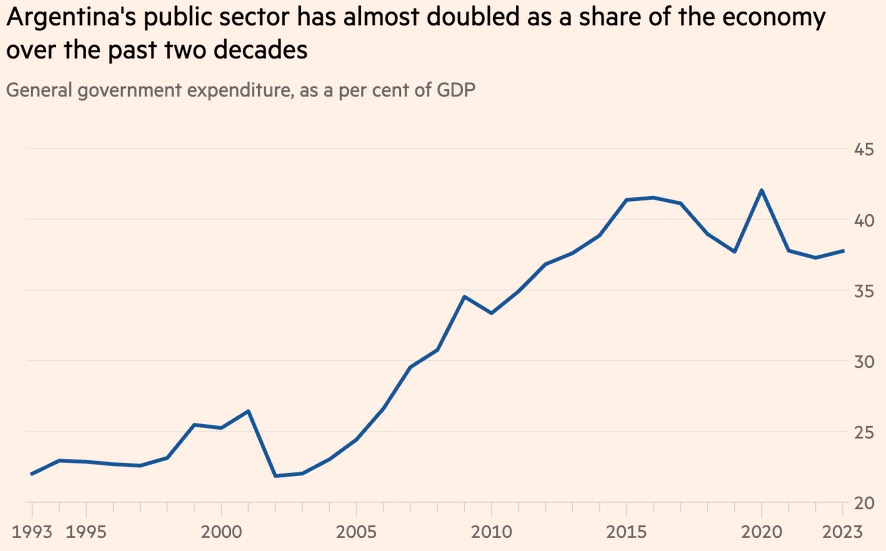

Here is a good Substack essay by Nicolas Cachanosky, excerpt: Inflation expectations depend on what is expected to happen to the budget in the months to come. It is natural, then, to ask whether the observed surpluses are sustainable in the months ahead. Answering this question requires looking at two things. First, how was the fiscal […]

How credible is the Milei plan?

An Open Letter to Nobel-laureate Economist Angus Deaton

13 Mar 2024 Leave a comment

in applied price theory, applied welfare economics, Austrian economics, comparative institutional analysis, economic history, entrepreneurship, history of economic thought, income redistribution, international economics, labour economics, labour supply, poverty and inequality, Public Choice, rentseeking, survivor principle, unemployment Tags: creative destruction, free trade, tariffs

TweetProf. Angus Deaton Princeton University Prof. Deaton: Over the years I’ve learned much from your writings, and I regard your 2013 The Great Escape as one of the most important books published in the past 15 years. So I was quite surprised and disappointed to read that you, as you say, are now “much more…

An Open Letter to Nobel-laureate Economist Angus Deaton

NZ should go further than Australia

13 Mar 2024 Leave a comment

in international economics, politics - New Zealand Tags: free trade, tariffs

New Zealand sensibly got rid of most tariffs years ago. We should go further than Australia plans to do and abolish the rest: The Taxpayers’ Union is renewing its calls to abolish all tariffs following reports that Australia plans to unilaterally abolish nearly 500 of its tariffs. Taxpayers’ Union Campaigns Manager, Connor Molloy, said: “With the stroke […]

NZ should go further than Australia

Worry Not About So-Called “Trade Deficits”

10 Feb 2024 Leave a comment

in applied price theory, applied welfare economics, economic history, international economics, politics - USA Tags: current account

TweetThis piece by Rapoza also features a discussion of the U.S. trade deficit in “goods” – any mention of which is a sure sign that the writer is a poor economist. A trade deficit in tangible things is no more economically meaningful than is a trade deficit in yellow things or things that start with…

Worry Not About So-Called “Trade Deficits”

Once were a trading nation

07 Feb 2024 Leave a comment

in economic history, international economics, macroeconomics, politics - New Zealand

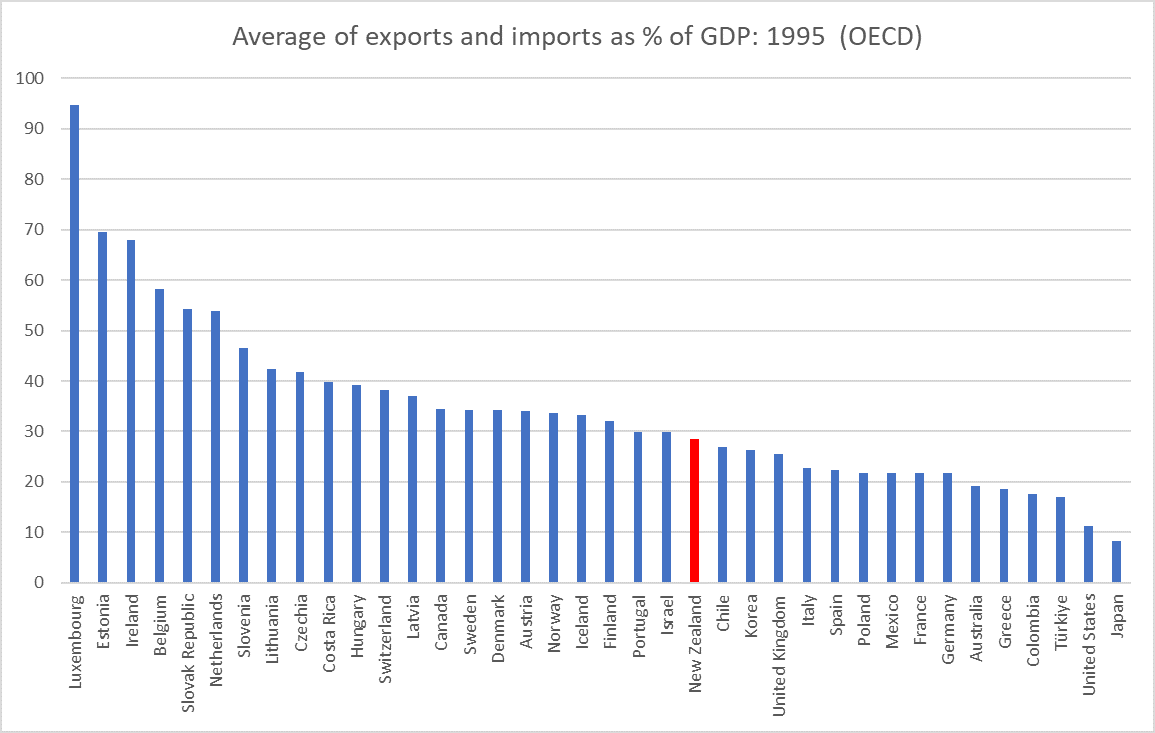

I’ve used here before the snippet from older books that in the decades before the Second World War it was generally accepted that New Zealand had the highest value of foreign trade per capita of any country. Estimates of historical GDP per capita suggest we also had among the very highest levels of real GDP […]

Once were a trading nation

Quotation of the Day…

24 Jan 2024 Leave a comment

in applied price theory, applied welfare economics, history of economic thought, international economics

Tweet… is from page 4 of the 1976 second edition of my late, great teacher Leland Yeager’s magisterial International Monetary Relations: Theory, History, and Policy (original emphases; footnote deleted): Our opportunity for gain is genuine regardless of why foreigners sell so cheaply. Perhaps the foreign widgets are cheap because the climate is ideal for their…

Quotation of the Day…

Unfettered: Fishback 25 Years Later

17 Jan 2024 Leave a comment

in applied price theory, discrimination, economic history, economics of information, economics of regulation, health and safety, history of economic thought, human capital, industrial organisation, international economics, labour economics, labour supply, liberalism, macroeconomics, Marxist economics, minimum wage, occupational choice, occupational regulation, poverty and inequality, unemployment, unions

A quarter century ago, economist Price Fishback published “Operations of ‘Unfettered’ Labor Markets: Exit and Voice in American Labor Markets at the Turn of the Century” in the prestigious Journal of Economic Literature. Fishback’s article is packed with insight… and understatement. But let’s back up. Virtually every standard history textbook describes U.S. labor markets before…

Unfettered: Fishback 25 Years Later

40 years on

08 Jan 2024 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, economic growth, economic history, fiscal policy, inflation targeting, international economics, labour economics, macroeconomics, monetary economics, politics - New Zealand

Creative destruction

05 Jan 2024 Leave a comment

in development economics, economic history, growth miracles, international economics

📸 Look at this post on Facebook

https://www.facebook.com/share/TgCAeEMNorGerYDm/?mibextid=RXn8sy

Argentina Milei reform impressions

23 Dec 2023 Leave a comment

in applied price theory, budget deficits, business cycles, comparative institutional analysis, constitutional political economy, development economics, economic growth, economics of bureaucracy, economics of regulation, fiscal policy, growth disasters, history of economic thought, income redistribution, international economics, labour economics, law and economics, liberalism, libertarianism, macroeconomics, Marxist economics, monetary economics, property rights, Public Choice, public economics, rentseeking, unemployment Tags: Argentina

I didn’t have much time in Argentina, but I can pass along a few impressions about how Milei is doing, noting I hold these with “weak belief”: 1. He is pretty popular with the general population. He is also popular in B.A. in particular. People are fed up with what they have been experiencing. It […]

Argentina Milei reform impressions

Detours

20 Dec 2023 Leave a comment

in defence economics, international economics, International law, transport economics, war and peace Tags: war against terror

📸 Look at this post on Facebook

https://www.facebook.com/share/RzXkxTwTvi1p1Toi/?mibextid=RXn8sy

Fritz Machlup (1902-1983)

19 Dec 2023 Leave a comment

in applied price theory, Austrian economics, history of economic thought, international economics

TweetAmong the many bits of unearned good fortune that have come my way in life was to have been a student in two of Fritz Machlup‘s classes at NYU. (In Spring 1981 I was a student in the last graduate course he taught on one of his specialities, International Trade. That course was phenomenally good.…

Fritz Machlup (1902-1983)

Recent Comments