Thomas Sowell – The Real World Effects of Preferential Policies

12 Aug 2022 Leave a comment

in applied price theory, comparative institutional analysis, discrimination, economic history, economics of education, human capital, income redistribution, labour economics, labour supply, law and economics, occupational choice, poverty and inequality, Public Choice, rentseeking, Thomas Sowell Tags: affirmative action, offsetting behaviour, racial discrimination, unintended consequences

Create a Black Market the Easy Way!

20 May 2022 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, economic history, economics of natural disasters, economics of regulation Tags: offsetting behaviour, price controls, The fatal conceit, unintended consequences

David Friedman: Law, Economics and Liberty

18 May 2022 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, constitutional political economy, David Friedman, defence economics, economics of bureaucracy, economics of crime, history of economic thought, income redistribution, law and economics, liberalism, libertarianism, property rights, Public Choice, rentseeking Tags: economics of pandemics, offsetting behaviour, The fatal conceit, unintended consequences

If skilled labour is being kept out of the workplace for unreasonable reasons then that’s an opportunity for someone else to gain that labour on the cheap. Which is exactly what Dame Steve Shirley did

05 Apr 2022 Leave a comment

in applied price theory, discrimination, economic history, entrepreneurship, gender, human capital, industrial organisation, labour economics, labour supply, occupational choice, survivor principle Tags: entrepreneurial alertness, offsetting behaviour, sex discrimination, unintended consequences

Always worth remembering

03 Apr 2022 Leave a comment

in F.A. Hayek Tags: offsetting behaviour, The fatal conceit, unintended consequences

Offsetting behaviour #COVID19

03 Feb 2022 Leave a comment

in health economics Tags: economics of pandemics, offsetting behaviour, unintended consequences

The Real Reason NYC Is Always Covered In Scaffolding

19 Jan 2022 Leave a comment

in economics of crime, law and economics, property rights, urban economics Tags: offsetting behaviour, unintended consequences

Why economists are unpopular

01 Jan 2022 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, economics of bureaucracy, economics of crime, entrepreneurship, environmental economics, history of economic thought, income redistribution, industrial organisation, international economics, labour economics, labour supply, law and economics, liberalism, macroeconomics, managerial economics, minimum wage, organisational economics, personnel economics, poverty and inequality, property rights, Public Choice, public economics, rentseeking, survivor principle, theory of the firm, unemployment, unions, welfare reform Tags: offsetting behaviour, The fatal conceit, unintended consequences

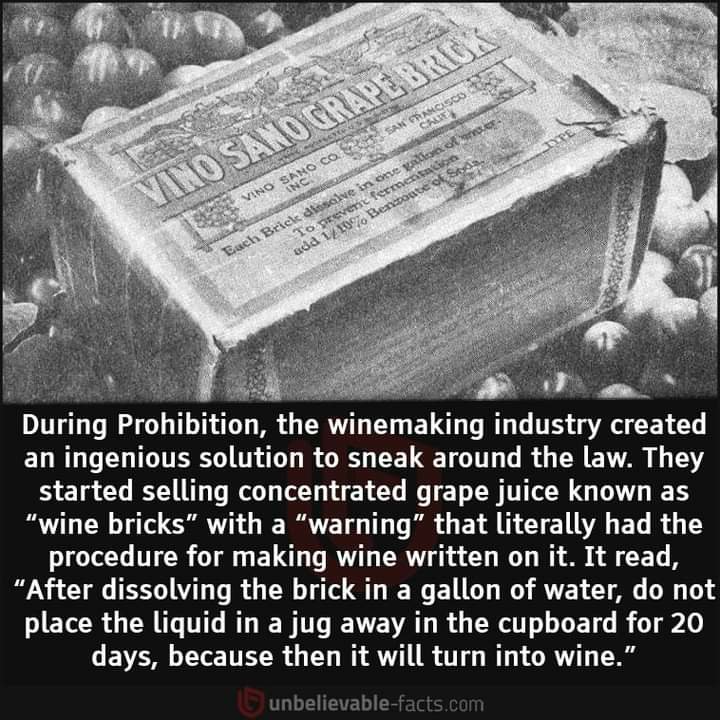

Cheap wine that made casket wine look like chateau de chateau

11 Dec 2021 Leave a comment

in economics of bureaucracy, economics of crime, economics of regulation, entrepreneurship, law and economics, Public Choice Tags: economics of prohibition, offsetting behaviour, unintended consequences

Liberal Hypocrisy is Fueling American Inequality. Here’s How. | NYT Opinion

21 Nov 2021 Leave a comment

in economics of education, human capital, income redistribution, labour economics, labour supply, politics - USA, poverty and inequality, Public Choice, public economics Tags: offsetting behaviour, top 1%, unintended consequences

Recent Comments