Lindsay Mitchell writes – When news media took a pummelling last week at both TVNZ and TV3, a number of critics said part of the reason ratings are poor is the public don’t trust them. The public believe that the media is biased. The print media is similarly suspect. An article in Stuff on Sunday […]

What media bias looks like

What media bias looks like

11 Mar 2024 Leave a comment

in labour economics, labour supply, politics - New Zealand, poverty and inequality, welfare reform Tags: marriage and divorce

Child poverty – complex or simple?

26 Feb 2024 Leave a comment

in applied price theory, applied welfare economics, labour economics, labour supply, politics - New Zealand, poverty and inequality, unemployment, welfare reform Tags: child poverty, family poverty

Question: Do you understand how the child poverty statistics are derived? Clearly some people do not. Last week the latest child poverty statistics were all over the media. But there are a number of misunderstandings that need addressing. Like this one from NewstalkZB’s John MacDonald who wrote: “Living in households that get-by on less than…

Child poverty – complex or simple?

My TLS essay on the Clinton administration

10 Feb 2024 Leave a comment

in human capital, labour economics, labour supply, poverty and inequality, welfare reform

Here is the link, I am reviewing a bad book on the Clinton administration (A Fabulous Failure, by Lichtenstein and Stern). Here is one excerpt: Clinton-era welfare reform is another area where many commentators go astray, and Lichtenstein and Stein are no exception. The Clinton pronouncement “I have a plan to end welfare as we […]

My TLS essay on the Clinton administration

LINDSAY MITCHELL: Labour hid developing welfare crisis

08 Feb 2024 Leave a comment

in applied price theory, economics of education, gender, human capital, labour economics, labour supply, occupational choice, politics - New Zealand, poverty and inequality, welfare reform Tags: child poverty, family poverty

Lindsay Mitchell writes- When National became government in 2008, Finance Minister Bill English’s determination to understand the extent of benefit-dependency led them to commission Taylor Fry to produce annual actuarial reports. These were duly published at the MSD website every year but ceased when the government changed in 2017. Now however, an Official Information request […]

LINDSAY MITCHELL: Labour hid developing welfare crisis

Breaking the Culture of Welfare Dependency

02 Feb 2024 Leave a comment

in comparative institutional analysis, development economics, economic history, economics of education, entrepreneurship, health economics, human capital, income redistribution, labour economics, labour supply, law and economics, liberalism, property rights, Public Choice, unemployment, welfare reform Tags: Canada

One hope that has occasionally been expressed since the beginning of the modern era of Treaty of Waitangi (ToW) settlements, has been that the Iwi showered with money and empowered with control of hundreds of millions or even billions of dollars worth of assets, would be able to then make a difference to all the […]

Breaking the Culture of Welfare Dependency

The Right and Wrong Way to Reduce Poverty, Part II

16 Jan 2024 Leave a comment

in applied price theory, economic history, human capital, income redistribution, labour economics, labour supply, occupational choice, politics - USA, poverty and inequality, Public Choice, public economics, welfare reform Tags: child poverty, family poverty

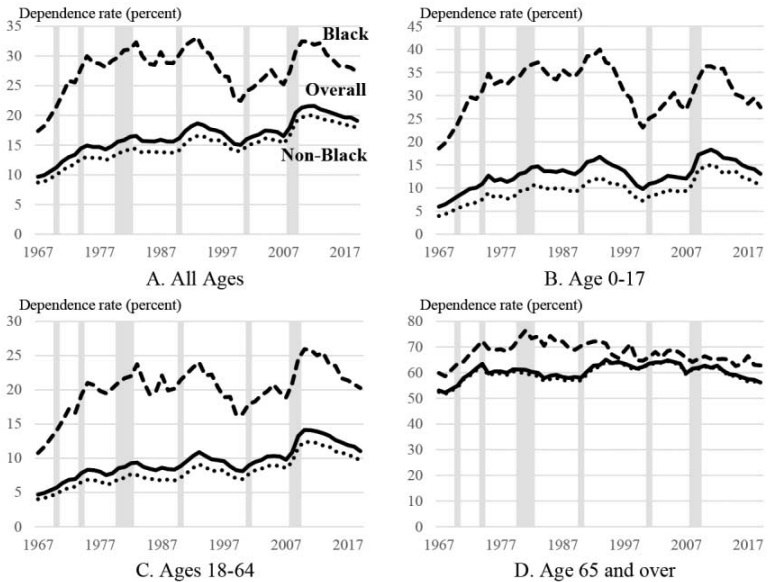

In Part I of this series, I explained that the War on Poverty, launched by Lyndon Johnson and expanded by other profligate presidents, has been bad news for both taxpayers and poor people. More specifically, I shared some academic research showing how it led to a big increase in dependency on government. Let’s expand on […]

The Right and Wrong Way to Reduce Poverty, Part II

Zwolinski on the UBI

11 Jan 2024 Leave a comment

in applied price theory, history of economic thought, income redistribution, labour economics, labour supply, Public Choice, public economics, welfare reform Tags: negative income tax, universal basic income

Philosopher Matt Zwolinski, co-author of Universal Basic Income: What Everyone Needs to Know, was a core member of the old Bleeding Heart Libertarians blog, which shut down in 2020. Now’s he’s singledly-handed revived the BHL brand on his new Bleeding Heart Libertarian substack. Matt recently published a critique of my response to Chris Freiman on…

Zwolinski on the UBI

LINDSAY MITCHELL: Oh, the irony

08 Dec 2023 Leave a comment

in labour economics, labour supply, occupational choice, poverty and inequality, welfare reform Tags: child poverty, economics of fertility, family poverty

Appointed by new Labour PM Jacinda Ardern in 2018, Cindy Kiro headed the Welfare Expert Advisory Group (WEAG) tasked with reviewing and recommending reforms to the welfare system. Kiro had been Children’s Commissioner during Helen Clark’s Labour government but returned to academia subsequently. In 2019 the WEAG reported back with 42 recommendations including:Recommendation 11: Remove…

LINDSAY MITCHELL: Oh, the irony

On the 50th anniversary of the DPB

16 Nov 2023 Leave a comment

in economics of education, gender, labour economics, labour supply, occupational choice, poverty and inequality, welfare reform Tags: economics of fertility, marriage and divorce

The Domestic Purposes Benefit has been variously described as a “disaster” (David McLoughlin 1995), an “economic lifeline” (Jane Kelsey 1995) and “an unfortunate experiment” (Muriel Newman 2009).Its effect on family formation can never be definitively ascertained. But the growth of the sole parent family dependent on welfare has correlated with more poverty, more child abuse…

On the 50th anniversary of the DPB

Why Sweden Isn’t an Example of Socialism

04 Oct 2023 Leave a comment

in economic growth, economic history, economics of regulation, history of economic thought, industrial organisation, labour economics, macroeconomics, welfare reform Tags: Sweden

When I meet Americans who self-identify as “socialists,” it is quite uncommon for them to advocate the abolition of private property and the “collective or governmental ownership and administration of the means of production and distribution of goods”–which is the dictionary definition of socialism. Instead most of the American “socialists” I meet favor a more…

Why Sweden Isn’t an Example of Socialism

Aaronson on Feminism: My Reply

26 Jan 2023 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, discrimination, economics of education, gender, health and safety, human capital, labour economics, labour supply, minimum wage, occupational choice, occupational regulation, poverty and inequality, welfare reform Tags: gender wage gap

Here’s my point-by-point reply to Scott Aaronson’s thoughts on Don’t Be a Feminist. He’s in blockquotes, I’m not. Hi Bryan, Sorry for the delay! I just finished reading your book. 1,251 more words

Aaronson on Feminism: My Reply

Talking Poverty With Chris Arnade

20 Jan 2023 Leave a comment

in applied price theory, economic history, economics of education, human capital, labour economics, labour supply, minimum wage, occupational choice, poverty and inequality, unemployment, welfare reform Tags: child poverty, family poverty

Chris Arnade is the storied author of Dignity: Seeking Respect in Back Row America. He’s also a very cool guy. Last October, we “debated” poverty for the Acton Institute, though it was really more of an… 78 more words

Talking Poverty With Chris Arnade

Good Intentions 1of3 Introduction and Public Schools with Walter Williams

13 Sep 2022 Leave a comment

in applied price theory, Austrian economics, comparative institutional analysis, discrimination, economic history, economics of education, human capital, labour economics, labour supply, poverty and inequality, unemployment, unions, welfare reform Tags: child poverty, family poverty, racial discrimination

Walter Williams: Up From the Projects

12 Sep 2022 Leave a comment

in applied welfare economics, Austrian economics, discrimination, economic history, economics of education, human capital, labour economics, labour supply, occupational choice, occupational regulation, poverty and inequality, unemployment, welfare reform Tags: Walter Williams

The Destructive Lies of James Baldwin And Other Progressive Intellectuals | Thomas Sowell

26 Jun 2022 Leave a comment

in discrimination, economic history, economics of crime, economics of education, human capital, labour economics, labour supply, law and economics, liberalism, Marxist economics, occupational choice, politics - USA, poverty and inequality, property rights, Thomas Sowell, unemployment, welfare reform Tags: racial discrimination, regressive left

Recent Comments