From former DOJ Economist Greg Werden: The governments case suggests that its exclusive deals with Apple and Mozilla to be the default search engine on their browsers “allowed Google to maintain its monopoly power [in “general search”] in violation of Section 2 of the Sherman Act.” However, the government’s brief also suggests that Google’s scale is very important,…

US v. Google: do complaints have to be internally consistent?

US v. Google: do complaints have to be internally consistent?

26 Apr 2024 Leave a comment

in applied price theory, entrepreneurship, industrial organisation, law and economics, managerial economics, organisational economics, politics - USA Tags: competition law, creative destruction

Handbag authenticators (creative destruction and how the economy just keeps creating new types of occupations & professions)

10 Apr 2024 Leave a comment

in applied price theory, development economics, economics of information, human capital, industrial organisation, labour economics, labour supply, occupational choice, poverty and inequality Tags: consumer fraud, creative destruction

I’ve posted about many new jobs like this. See related posts below. Also, this post is based on yesterday’s post You Spent $6,000 on a Secondhand Chanel Bag. Now Find Out if It Is Real. It had excerpts from an article by Chavie Lieber of The WSJ. Here are excerpts related to today’s post:”Many secondhand luxury shoppers…

Handbag authenticators (creative destruction and how the economy just keeps creating new types of occupations & professions)

An Open Letter to Nobel-laureate Economist Angus Deaton

13 Mar 2024 Leave a comment

in applied price theory, applied welfare economics, Austrian economics, comparative institutional analysis, economic history, entrepreneurship, history of economic thought, income redistribution, international economics, labour economics, labour supply, poverty and inequality, Public Choice, rentseeking, survivor principle, unemployment Tags: creative destruction, free trade, tariffs

TweetProf. Angus Deaton Princeton University Prof. Deaton: Over the years I’ve learned much from your writings, and I regard your 2013 The Great Escape as one of the most important books published in the past 15 years. So I was quite surprised and disappointed to read that you, as you say, are now “much more…

An Open Letter to Nobel-laureate Economist Angus Deaton

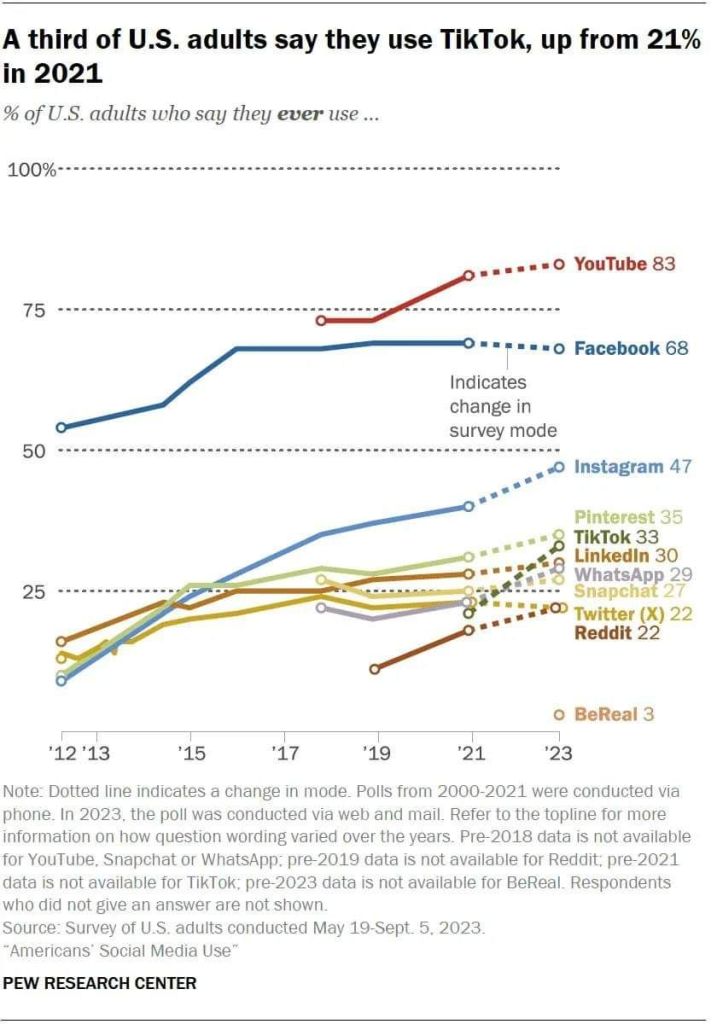

DAVID FARRAR: Meta withdraws Facebook News in Australia

09 Mar 2024 Leave a comment

in applied price theory, entrepreneurship, industrial organisation, survivor principle Tags: creative destruction, market selection, media bias

David Farrar writes – Stuff reports: Facebook owner Meta has refused to continue paying for news in Australia, announcing it will end its deals with local publishers when they expire this year in a decision that news companies say blatantly ignores the value of their journalism. The government also blasted the move, describing it as “a […]

DAVID FARRAR: Meta withdraws Facebook News in Australia

ROBERT MacCULLOCH: Economics 101 explains why Newshub Bankrupted

02 Mar 2024 Leave a comment

in economics of information, economics of media and culture, industrial organisation, market efficiency, politics - New Zealand, survivor principle, theory of the firm Tags: creative destruction

Economics 101 explains why Newshub Bankrupted – it was the fault of its own journalists who should recognize they were the architects of their own demise. A thousand books and papers in economics and business strategy are about the topic of product differentiation – ensuring that what you sell is different from others in order…

ROBERT MacCULLOCH: Economics 101 explains why Newshub Bankrupted

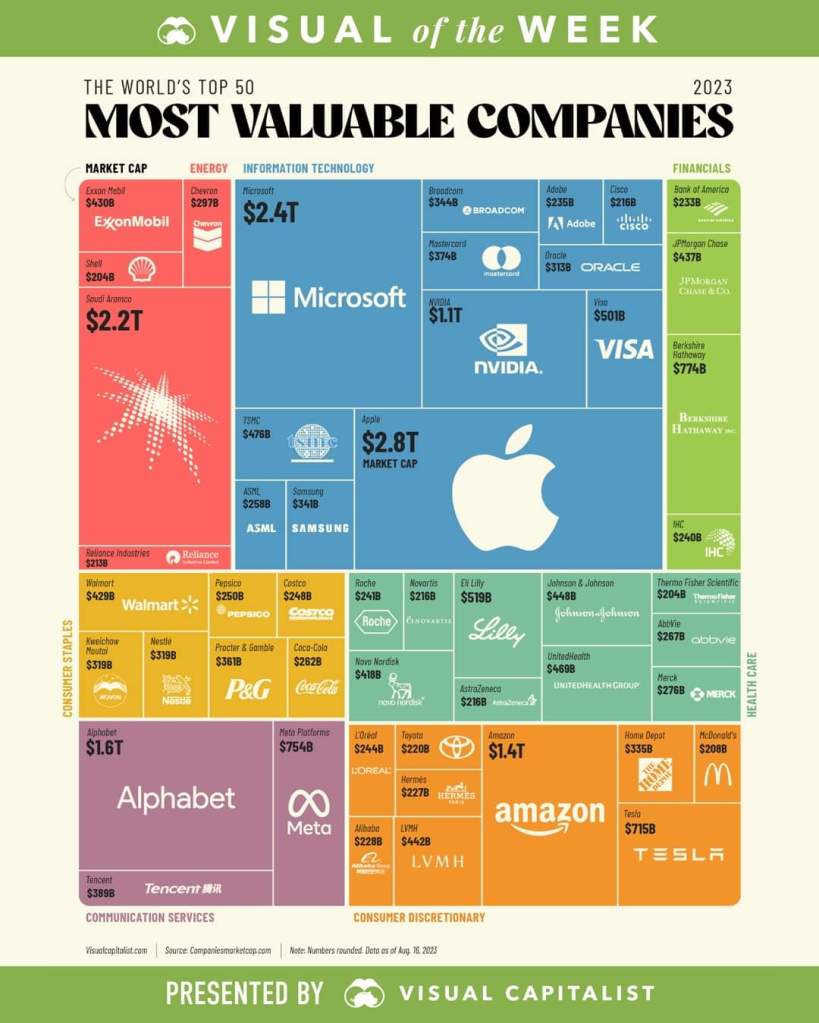

The Economics of Creative Destruction, Part II

29 Feb 2024 Leave a comment

in applied price theory, comparative institutional analysis, economic history, industrial organisation, survivor principle Tags: creative destruction

I’ve referred to “creative destruction” as the “best and worst part of capitalism.” This short video from the Fraser Institute is a good tutorial on the topic. The core message is that entrepreneurs improve our lives by coming up with new ideas, new technologies, and new products. That’s the good news. The bad news is […]

The Economics of Creative Destruction, Part II

Creative destruction

13 Feb 2024 Leave a comment

in economic history, entrepreneurship, financial economics, industrial organisation, survivor principle Tags: creative destruction

Creative destruction

05 Feb 2024 Leave a comment

in economic history, entrepreneurship, industrial organisation, survivor principle Tags: creative destruction

Creative destruction

31 Jan 2024 Leave a comment

in entrepreneurship, industrial organisation, survivor principle Tags: creative destruction

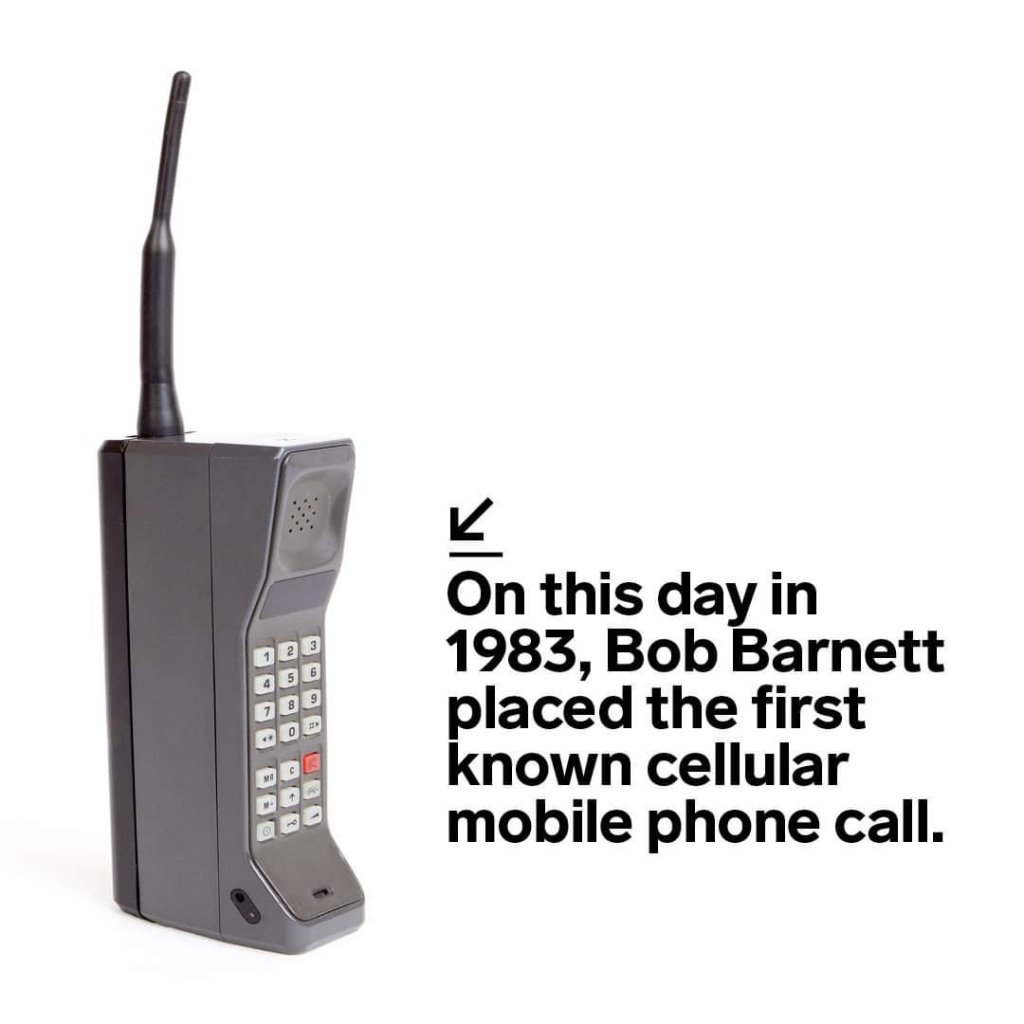

Creative destruction

23 Jan 2024 Leave a comment

in economic history, economics of information, entrepreneurship, industrial organisation, survivor principle Tags: creative destruction

📸 Look at this post on Facebook

https://www.facebook.com/share/R7xogU9mejANPGQZ/?mibextid=RXn8sy

Technology disruption

13 Jan 2024 Leave a comment

in transport economics Tags: creative destruction

📸 Look at this post on Facebook

https://www.facebook.com/share/6Jszghdj5wgtEoA1/?mibextid=RXn8sy

24 Dec 2023 Leave a comment

in economics of media and culture, entrepreneurship, industrial organisation, movies, survivor principle, television Tags: creative destruction

Recent Comments