Source: John Cochrane

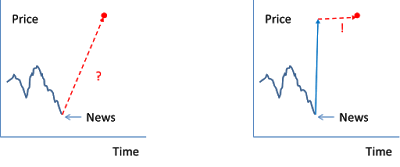

A share market that jumps suddenly when there is news of change in economic corporate fortunes is efficient.

This means that an efficient market can be highly volatile because it is rapidly incorporating changes in information. An efficient market is a volatile market.

As for smart money managers beating an efficient market, John Cochrane explains:

…efficiency implies that trading rules — “buy when the market went up yesterday”– should not work.

The surprising result is that, when examined scientifically, trading rules, technical systems, market newsletters, and so on have essentially no power beyond that of luck to forecast stock prices.

This is not a theorem, an axiom, a philosophy, or a religion: it is an empirical prediction that could easily have come out the other way, and sometimes does.

Efficiency implies that professional managers should do no better than monkeys with darts. This prediction too bears out in the data.

It too could have come out the other way. It should have come out the other way! In any other field of human endeavour, seasoned professionals systematically outperform amateurs. But other fields are not as ruthlessly competitive as financial markets.

Recent Comments