Become a United States senator. Their share portfolios out-perform the best of the best hedge fund managers, and the best hedge fund manager was paid 3 1/2 billion dollars last year; to get on the list for the top hedge fund manager, you make at least $300 million a year. Good things that politicians know how to outperform them on their modest salaries and busy schedules of public engagements and parliamentary sittings.

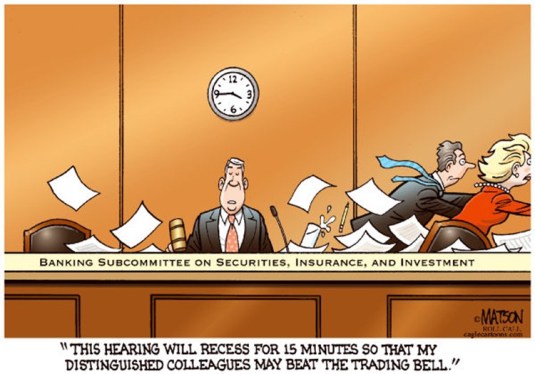

Using the financial disclosures of politicians, "Abnormal Returns From the Common Stock Investments of Members of the U.S. House of Representatives," built model portfolios and charted their performance. They found that House members outperform the market by 6 percentage points. Senators do even better, the authors say, citing their own earlier research from 2004.

Senate portfolios "show some of the highest excess returns ever recorded over a long period of time, significantly outperforming even hedge fund managers," with gains that are "both economically large and statistically significant."

These results suggest that congressmen and senators have access to non-public information on particular businesses, industries or the economy as a whole and invest on the basis that information. The good returns of Senators and Congressmen last far too long to be no more than luck.

Recent Comments