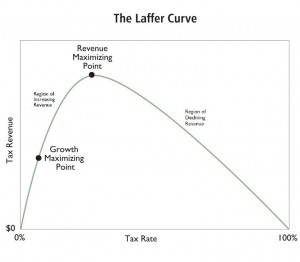

I’m a big advocate of the Laffer Curve.

Simply stated, it’s absurdly inaccurate to think that taxpayers and the economy are insensitive to changes in tax policy.

Yet bureaucracies such as the Joint Committee on Taxation basically assume that the economy will be unaffected and that tax revenues will jump dramatically if tax rates are boosted by, say, 100 percent.

In the real world, however, big changes in tax policy can and will lead to changes in taxable income. In other words, incentives matter. If the government punishes you more for earning more income, you will figure out ways to reduce the amount of money you report on your tax return.

In the real world, however, big changes in tax policy can and will lead to changes in taxable income. In other words, incentives matter. If the government punishes you more for earning more income, you will figure out ways to reduce the amount of money you report on your tax return.

This sometimes means that people will choose to be less productive. Why bust your derrière, after all, if government confiscates a big chunk of your additional earnings? Why make the sacrifice to set aside some of your…

View original post 1,014 more words

Recent Comments