Robert Barro recounts in his macroeconomics textbook a marvellous example where swindlers induced a British manufacturer of bank notes to print and deliver to them 3 million pounds’ worth of Portuguese escudos, which was equivalent to about 1% of Portugal’s nominal GDP in 1926.

This company, Waterlow and Sons Ltd. of London, also printed the legitimate notes for the Bank of Portugal. These bogus notes were,at first pass, indistinguishable from the real thing (except that the serial numbers were duplicates of those from a previous series of legitimate notes).

It was impossible to differentiate between the original and most of the duplicate banknotes because they were printed by the same printer using the same plates. 135,318 of the duplicate notes could be identified as part of the swindle because they were printed on plates not used for any other Portuguese banknotes. These bogus notes printed with the new plates could be differentiated from older legitimate banknotes because of a few marks that could be identified by an expert using a magnifying glass.

Central to the scam was taking advantage of the practice of the privately owned Bank of Portugal of secretly printing banknotes and neither recorded such transactions in the books, nor informing the government of the increase in the number of circulating banknotes.

(At the time, the Bank of England was also privately owned and only in 1921 had it obtained a monopoly on the issue banknotes in England and Wales. The Bank of Scotland still prints Scottish banknotes that are not legal tender in England. Three northern Irish banks still print banknotes that are legal tender in Northern Ireland. The entire northern Irish currency was withdrawn from circulation after a major bank robbery by the IRA a few years ago and replaced with new notes).

After the scheme unravelled, the Bank of Portugal made good on the fraudulent notes by exchanging them for newly printed, valid notes. The fraud may have contributed to the military coup, some six months later.

In the interim, by illegally increasing the monetary base and investing heavily in currency, land, building, and businesses, the swindlers created a boom in the Portuguese economy.

From the standpoint of monetary economics, I cannot think of a more unanticipated monetary shock. Of a surprise burst of monetary inflation and price inflation and led to the writing of books with titles such as The Man who Stole Portugal.

The final part of the swindle was to actually buy a controlling interest in the Bank of Portugal to validate the fraud by erasing all records that might inconvenience the swindlers.

The chief swindler with accomplices set up a bank of his own to facilitate fast distribution of the forged currency. A bank of their own was necessary because they had the modern equivalent of $150 billion to launder.

This Bank of Angola & Metropole set up to launder the bogus notes was also the initial place of suspicion of something fishy going on because it grew so quickly, while taking no deposits. Germans are also involved with this bank. Germany was suspected by the Portuguese government to have ambitions to take over Portuguese Angola, so this attracted additional attention from the authorities.

The chief swindler, Alves Reis, was depicted in a 50-episode TV series in 2000 as well as several books about the fraud over the decades.

At the time of the swindle, Reis was 28 years old engineering dropout from an undistinguished middle-class Lisbon family. He already had a conviction for cheque fraud. As such, one of the greatest swindles of all time was pulled off by a petty conman.

The swindle unravelled because of the duplicate banknote serial numbers, which was an error the swindler made himself. But for that, the swindle would have been immensely difficult to uncover. The swindlers duplicated the existing serial numbers and hoped they were able to successfully release all the banknotes before they were caught.

Reis, the architect of the swindle, work out the sequence of bank governor names and serial numbers used by the Portuguese central bank, but had neglected to eliminate numbers already ordered.

When the British printer realised this, Reis convinced the London firm that the reuse of existing serial numbers for their purported place of circulation in the Portuguese colony of Angola was not a cause for alarm. Fortunately for the swindlers, a letter from the British printers to the Banco de Portugal, in that he spoke about the agreements to print the banknotes for distribution in Angola went missing in the post.

The Bank of Portugal was not supposed to issue its currency in Angola, but often did circulate its currency in Angola.

This was a clever part of the swindle. By pretending that the Bank of Portugal was doing something slightly dodgy but still standard practice, and thus had to do so in secrecy, the swindlers could induce a whole range of other more legitimate people than them to cooperate quietly with what they were doing.

The shady nature of these dealings to surreptitious circulate Bank of Portugal banknotes in Angola stamped with “Angola” was passed over by the British dupes to the swindle as another example of the corruption of Portuguese officials. The stamp “Angola” was so they wouldn’t be confused with notes from the mother country.

In addition, bank notes for the Portuguese colonies were printed at the time by a competitor. The British printer saw this on the quiet contract as an opportunity to take away some of their trade.

The swindlers said that they would take care of stamping “Angola” on the banknotes once they were delivered to them. The swindlers had accomplices in the Portuguese diplomatic service, who issued them with fake diplomatic passports, which was helpful in persuading the British printers to deliver the bogus banknotes personally to them. Consignments were delivered to the swindlers in February, March and November 1925.

the basis of the scam was forging a contract in the name of Banco de Portugal authorising Reis to print banknotes in return for an alleged loan from a consortium to develop Angola. The whole affair had to be kept secret lest Angola fall into further financial difficulties due to rumours of a pending economic ruin.

The London based specialty printer worked, for among other clients, for the English court system and printed the transcripts of its own trial! This printer tried to have the trial postponed for a year while its chief executive completed his one-year term as Lord Mayor of London to save embarrassment.

The British printing company was found liable in subsequent four years of litigation, but the key question for the court was the amount of damages.

- The Bank argued that the damages were £1 million (less funds collected from the swindlers).

- The British printer duped by the swindlers argued was that the only true costs to the Bank were the expenses for paper and printing of the replacement notes.

The House of Lords determined in 1932 that £610,000 was the correct measure. This award of damages was the £1 million less the funds recovered from the swindlers

The proper measure of damages, in the view of the majority of the Law Lords, was the face value expressed in sterling of the genuine currency given in exchange for the spurious notes.

As these damages would be paid initially in British pounds, this damages award was a real windfall for the Bank of Portugal. Worthless Portuguese banknotes exchanged for good British pounds that could buy imports.

The majority decision of the Law Lords was the correct measure of damages because that is what the bank had to outlay to make itself whole again after the breach of contract. The chief swindler got 20 years.

One of the two Law Lords in dissent had another view of the proper measure of damages:

The judgment of Wright J. should be set aside and judgment entered for the Bank for the sum of £8,922

This law lord and an appeal court justice held this view because the swindle cost the Bank of Portugal nothing bar printing costs to replace the spurious banknotes, which were widely accepted as valid currency in a cash economy.

The Bank of Portugal could issue banknotes in any number at little cost to itself up to the limit provided by Portuguese law. Ropke wrote that:

The English courts presently discovered that the case involved issues of unusual subtlety and complexity, adjudication of which necessitated the admission of testimony by leading monetary theorists.

The question before the courts was: how great were the actual losses incurred by the Bank of Portugal?

If it had been postage stamps instead of bank notes in which the swindlers had trafficked, it is perfectly clear that the loss of the Portuguese government would have equalled the total value of the stamps.

With respect to the bank notes, however, no such simple calculation could be made.

Among the many questions which troubled the experts the following stand out as particularly relevant to our study: would the Bank of Portugal have issued the same amount of notes even if the swindlers had not done so?

If not, was the increase in the supply of money resulting from the introduction of the fraudulent notes good or bad for Portugal?

No one disputes, as several of the Law Lords noted, that the theft of a postage stamp must be made good at face value. People hesitate in this case involving swindling access to banknote plates and printing currency for yourself because what exactly was stolen?

When Reis died in 1955 , The Economist said of the counterfeiting scheme:

The perpetrators, however reprehensible their motives, did Portugal a very good turn according to the best Keynesian principles.

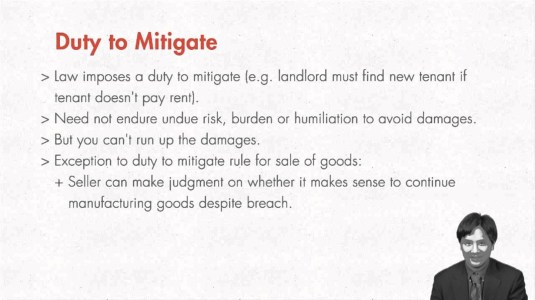

The House of Lords case is a major British legal precedent regarding the duty of the wronged party to mitigate damages in the case of breach of contract.

The House of Lords held that this duty did not apply if it would give your business a bad name in the trade. The Bank of Portugal could have repudiated the duplicate banknotes rather than exchange them for genuine new notes, but chose not to do so because this repudiation of banknotes would have ruined what little reputation it had.

The House of Lords also upheld the right of the wronged party to choose between different methods to mitigate damages from the breach of contract.

Recent Comments