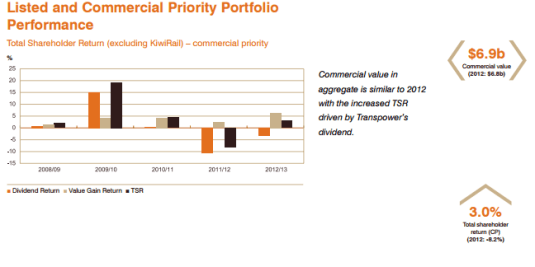

KiwiRail is such a dog that the Treasury reports on the rate of return to the taxpayer on the state owned enterprises portfolio by excluding KiwiRail from its calculations of rates of return.

The Treasury doesn’t do similar adjustments for state owned enterprises that are performing unusually well, so total shareholder return figures should be reported without this KiwiRail exception. If you buy a dog, you should own up to the fleas it spreads to the rest of your portfolio.

Trying to pretend that KiwiRail is just not there, or survives on the largess of someone other than the one and only New Zealand taxpayer, does no one any favours. This KiwiRail exception will have to apply for at least 10 years to the annual commercial portfolio report of the Treasury. I want to know the total shareholder return, including KiwiRail every year without exception or special pleading.

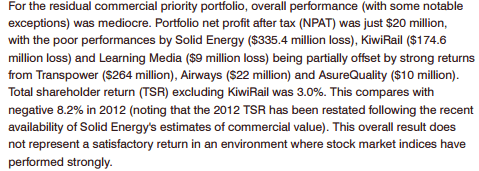

That total shareholder return of -8.2% in 2012 is worthy of comment too:

The portfolio generated a net loss after tax of $1.8 billion driven by a restructuring of KiwiRail’s balance sheet and reductions in bottom line results for Meridian and Solid Energy, affected by hydrology and coal market deterioration respectively.

Recent Comments