Taxes on #wages rising, even tho most governments did not raise rates in #OECD area. Why? See bit.ly/1IHNOvQ http://t.co/pX1v1rlFFf—

(@OECD) April 14, 2015

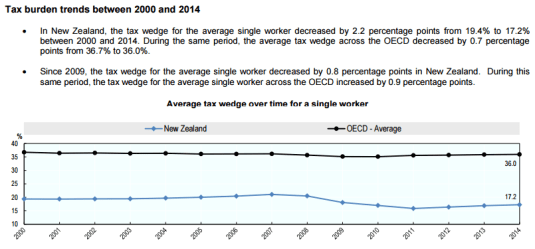

Taxes on wages have risen by about 1 percentage point for the average worker in OECD countries between 2010 and 2014 even though the majority of governments did not increase statutory income tax rates…

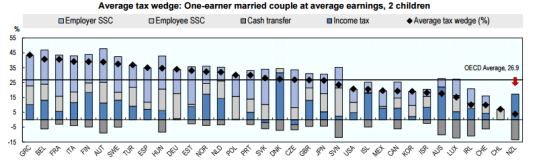

The highest tax wedges for one-earner families with two children at the average wage were in Greece (43.4%), Belgium (40.6%) and France (40.5%). New Zealand had the smallest tax wedge for these families (3.8%), followed by Chile (7%), Switzerland (9.8%) and Ireland (9.9%). The average for OECD countries was 26.9%… Child related benefits and tax provisions tend to reduce the tax wedge for workers with children compared with the average single worker. In New Zealand in 2014, this reduction (13.4 percentage points) was greater than for the OECD average (9.1 percentage points).

via OECD tax burdens on wages rising without tax rate increases – OECD.

Recent Comments