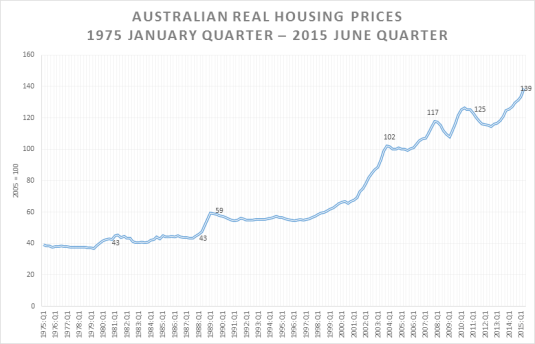

When I left university, all my mates were in a fever pitch about buying a house because it was such a good investment. They didn’t mention that housing had been a dog of investment for the previous 10 years. Housing was a good investment for a couple years around the time of this feverish home buying by my friends as the chart below shows. I didn’t buy a house because I could rent houses that were far nicer and more convenient to work and that any I could buy in Canberra. That pretty much applies to today.

Source and notes: Dallas Fed International Housing Database July 2015 – The author acknowledge use of the dataset described in Mack and Martínez-García (2011); real housing prices are nominal housing prices deflated by a personal consumption deflator.

Through all the 1990s as the chart above shows in retrospect, I was too polite to inquire of friends about their house prices in case they had no equity in their own house after the bank took its slice. For all of the 1990s, investing in a house was a dog of an investment in Australia if the above chart is a reasonable national summary of what is a medium-sized country. Things then hit a fever pitch at the end of the 1990s with house prices doubling and then some across Australia.

Recent Comments