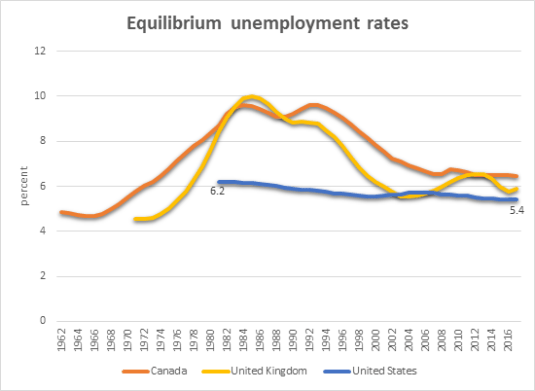

The equilibrium unemployment rate in the USA has been dead flat at a little under 6% as far back as the OECD Economic Outlook November 2015 can estimate. The Canadian and British equilibrium unemployment rates have gone up and down to the point of near doubling at times. Institutions cannot be so stable in the USA and so unstable Canada and Britain in terms of the incentives to post vacancies, for search for work in the same in different industries and occupations and revise asking wages. We’re talking about a 35 year stretch macroeconomic and labour market policy in the USA.

Source: OECD Economic Outlook November 2015 Data extracted on 10 Nov 2015 07:07 UTC (GMT) from OECD.Stat.

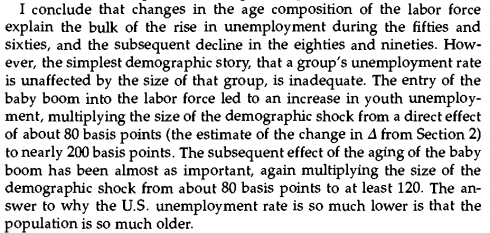

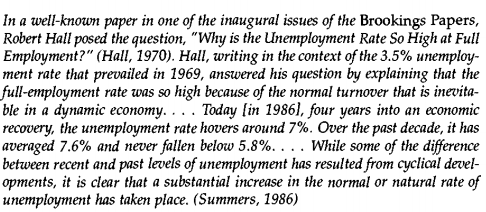

Furthermore, there is a large literature in the early 1970s and late 1990s arguing that the US equilibrium unemployment rate dropped as low as 4%.

Source: Robert Shimer, Why is the U.S. Unemployment Rate So Much Lower? (1999).

More correctly, for the early 1970s literature, the equilibrium unemployment rate had risen to 4% after being at an equilibrium rate of about 3%. Something doesn’t add up.

Source: Robert Shimer, Why is the U.S. Unemployment Rate So Much Lower? (1999).

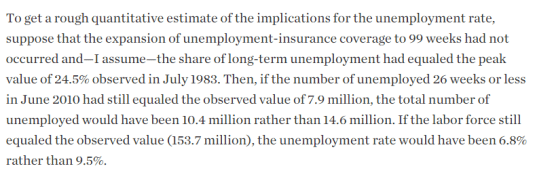

This estimate of an unchanging US equilibrium unemployment rate doesn’t add up even more when you consider the discussions after the Great Recession about how the extensions to unemployment insurance from a time limit of 26 weeks to 99 weeks would increase the equilibrium unemployment rate. Something really doesn’t add up for the US equilibrium unemployment rate to be so stable and the British and Canadian equilibrium unemployment rates to be so volatile.

Source: Robert Barro: The Folly of Subsidizing Unemployment – WSJ.

2 Comments (+add yours?)