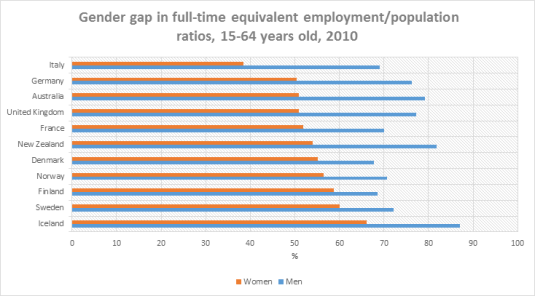

The gender employment gap is much smaller in Scandinavian. The reason is their taxes are high but then are paid back through churning. A considerable amount of those taxes fund employment contingent payments for child care and elder care.

Source: Closing the Gender Gap: Act Now – © OECD 2012.

Richard Rogerson found in Taxation and market work: is Scandinavia an outlier? that how the government spends tax revenues imply different rates of labour supply with regard to tax rate increases.

Rogerson considered that differences in the composition of government spending can potentially account for the high rate of labour supply in Sweden and elsewhere in Scandinavia. Examining the conditions on which how tax revenue is returned to Swedes as income transfers or other conditional payments is central to understanding the labour supply effects of taxes:

- If higher taxes fund disability payments which may only be received when not in work, the effect on hours worked is greater relative to a lump-sum transfer with no conditions; and

- If higher taxes subsidise day care for individuals who work, then the effect on hours of work will be less than under the lump-sum transfer with no conditions.

A much higher rate of government employment and greater expenditures on child care and elderly care explain the high rates of Swedish labour supply. Swedes are taxed heavily, but key parts of this tax revenue are then given back to them conditionally if they keep working.

Recent Comments