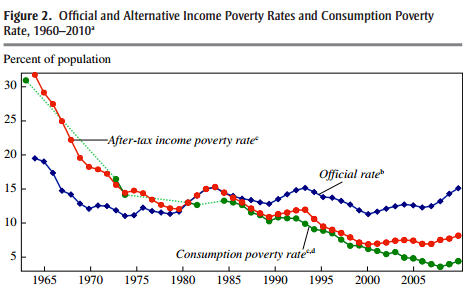

The official poverty rate in the USA missed poverty falling to near zero by the eve of the Global Financial Crisis in 2007 as shown in the chart below. That is no small oversight. It calls into question whether the official poverty rate which is based on a percentage of the median income is a useful guide to the magnitude of social problems before us.

Source: Meyer and Sullivan (2012), p. 153.

Meyer and Sullivan calculated a consumption based measure of poverty and found that the poverty rate fell much faster than previously single digits.

People worry about poor not have enough, not how much income they have before taxes and social insurance. The official poverty rate is before tax and social insurance and therefore before how much the poor actually have to get by with after receiving social assistance of all types and sources.

Interestingly, the divergence between consumption-based poverty and income-based poverty started with the election of Reagan and picked up the US federal welfare reforms in 1996. The number of children in poverty in deep poverty fell immediately after those 1996 US welfare reforms. There is a lesson in that for New Zealand.

It is widely agreed that the official poverty rate is flawed. Measuring poverty as a percentage of median income, usually 60% of the median income, means that poverty may not fall despite incomes doubling every generation and more.

Indeed, increases in the median income can increase poverty without anyone being poorer. This is because the gap between the median income earners and the poor increased such as the New Zealand in 2014 without any of the poor experiencing a fall in income and social support.

The reason why the median is pulling away from the bottom – the reason why income distribution is fanning out – is more people going to university and securing the associated wage premium and the greater rewards for talent in a globalised world.

The forces behind greater educational attainment and the globalisation of markets benefit all and in particular those of bottom of the income distribution through a more prosperous, dynamic, innovative society.

Recent Comments