In “Future Economists Will Probably Call This Decade the ‘Longest Depression‘”, Brad DeLong writes:

Back before 2008, I used to teach my students that during a disturbance in the business cycle, we’d be 40 percent of the way back to normal in a year. The long-run trend of economic growth, I would say, was barely affected by short-run business cycle disturbances. There would always be short-run bubbles and panics and inflations and recessions. They would press production and employment away from its long-run trend — perhaps by as much as 5 percent. But they would be transitory.

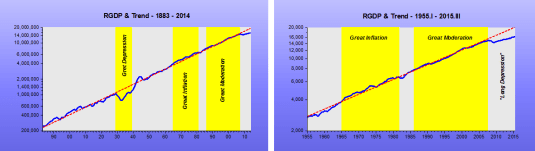

The charts illustrate DeLongs conjecture, both from a very long-run perspective and for the past 60 years.

Even during the Great Depression, by this time improvement was palpable.

And boy, let´s not cry, like Stiglitz, “fiscal foul” or “growing inequality” for the “Great Malaise”:

The problems we face now, Stiglitz…

View original post 31 more words

Recent Comments