One of the many drawbacks of the universal basic income is it will induce the recipients to cut back on their labour supply. There are studies of this labour supply effect through the study of what happens when people win the lottery – either the big one or a small prize.

Winning the lottery is the equivalent of winning an annuity equal to whatever annual income you can get it current low interest rates and share market returns.

A surprisingly number of people on the Left who deny that taxes have significant labour supply effects will nonetheless accept that winning the lottery will induce people to quit work permanently or cut back at least. The most likely reason is they buy lottery tickets too.

A study has just come out on the labour supply effects of winning the Swedish lottery. The sample in this study was really big: several million Swedish lottery winners.

Sweden seems to be like the USA in that both are awash with interesting economic data to the many other countries do not collect. Moreover, they were able to study these Swedish lottery winners over a 5 to 10-year period. Labour supply detail at that level is like going to heaven for an empirical labour economists.

Source: Labour supply responses of lottery winners | VOX, CEPR’s Policy Portal.

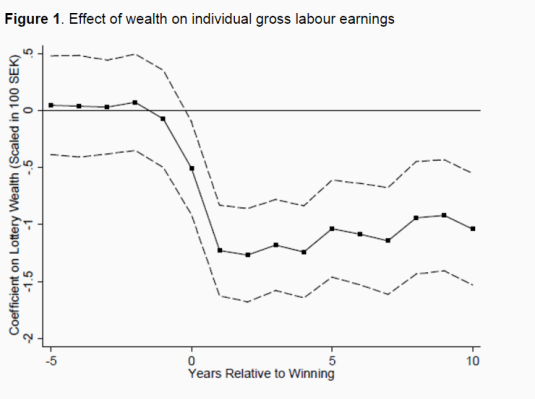

The researchers found that in common with a previous study of the labour supply of lottery winners after their win that there were

modest reductions in labour earnings suggesting every dollar of universal basic income would reduce labour earnings by roughly $0.11.

The new research also found productivity losses of $1.40 for every hundred dollars of lottery winnings and that the partners of the lottery winners cut back on their labour suppliers well. No surprise there. Taking all these labour supply effects into account, our researchers concluded that:

every dollar won in a lottery reduces lifetime after-tax labour earnings of winners by $0.10-$0.20.

All in all, the universal basic income will be a negative productivity shock built on a negative productivity shock. First of all, there is the great big new tax to fund the universal basic income. Then the recipients of the basic income will cut back on their labour supply further compounding the massive social costs of the universal basic income.

A universal basic income is a bad idea from start to finish and that is before you consider the many advantages of encouraging people to work for their living. Working for your living is a central expectation of adult life.

UPDATE: what is the magnitude of this labour supply drop from universal basic income? The usual labour supply effect of a recession as recently summarised by Richard Rogerson is as follows:

Consider by way of comparison the labour market fluctuations associated with the business cycle. Going from normal times to a fairly severe recession is usually associated with a drop in total hours worked of about 3 percent.

A universal basic income will push the New Zealand economy into recession off the back of labour supply effect from the windfall increase in incomes alone. That is before you consider the massive productivity shock pushing the economy down further through a massive increase in the taxation of capital, which is the most inefficient form of taxation.

Recent Comments