It will be a slow train coming before the Morgan Foundation calls for a cut in the tobacco tax because the optimal Pigovian tax on it is already too high from the perspective of externalities or the burden on the public health budget.

Source: Cigarette Taxation and the Social Consequences of Smoking | Heartland Institute.

I think smoking is disgusting and unhealthy but that does not give me the right to regulate the disgusting habits of others. Where would I start in regulating risk-taking? I would have to start with swimming, tramping and biking. They are all high-risk activities of the self-righteous? Not everything others do that I do not like causes an externality.

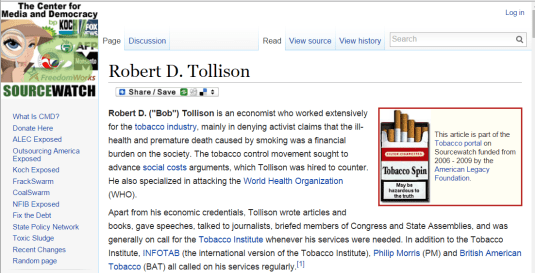

Few economists work on the economics of smoking other from the starting point that it should be reduced. Those that do not share that starting point such as Robert Tollison, Gary Anderson and William Shughart are subject to relentless personal abuse. They are immediately denounced as the paid whores of the tobacco industry.

That was one of the reasons I got interested in the economics of smoking. There must be something in the case made by Robert Tollison and others questioning tobacco taxes if the first line of argument against them is you are saying that because someone paid, you low down dog.

Feb 24, 2016 @ 11:50:08

Tollison left GMU just before I arrived there as a grad student. Wish I’d gotten to take classes with him; he was legendary.

LikeLike

Feb 24, 2016 @ 11:57:23

Tollison is prolific. Your only frustration after reading his beautifully written articles is you wish they were longer.

LikeLike