https://twitter.com/TheNewDeal/status/696864555658539008

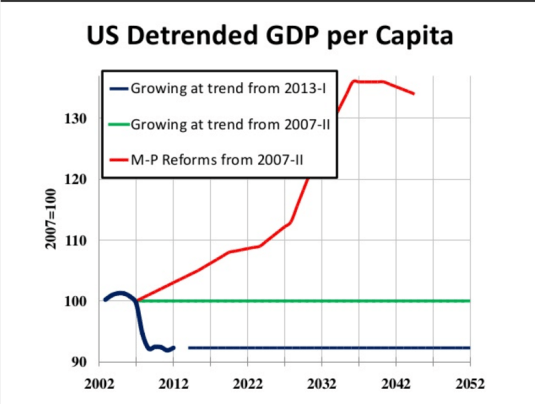

As a contrast against the Bernie Sanders tax-and-spend high-growth plan, the Edward Prescott plan is:

- mandatory savings for retirement;

- Eliminate capital income taxes;

- Broaden tax base and lower the marginal tax rate;

- Phased-in reforms so all birth-year cohorts are made better off;

- Left welfare programs and local public good shares the same; and

- Savings not part of taxable income, saving withdrawals part of taxable income – with these changes U.S. income tax would be a consumption tax.

Source: Edward C. Prescott – Importance of Good Governance for Economic Prosperity.

The difference between the Prescott and Sanders plans is Prescott delivers high growth through massive supply-side reforms that include the abolition of taxes on income from capital, mandatory savings for retirement along with much lower marginal tax rates.

The Sanders plan argues that if you tax people a lot more, there is more growth, more investment, more innovation and entrepreneurship and greater labour supply. There is no historical precedent for that as an outcome from higher taxes.

In the case of Prescott, the disagreement is over how large are his growth dividends. In the case of the Sanders band, only one economist agrees that his plan will increase growth. Despite that, he is still voting for Hillary Clinton.

Recent Comments