As part of yesterday’s column about the comparatively tiny – and temporary – tax cut in the Republican tax reform plan, I quoted a leftist columnist for US News & World Report, who argued that there should be a big tax increase (including a big tax hike on middle-income taxpayers) and that such a tax hike would not hurt the economy.

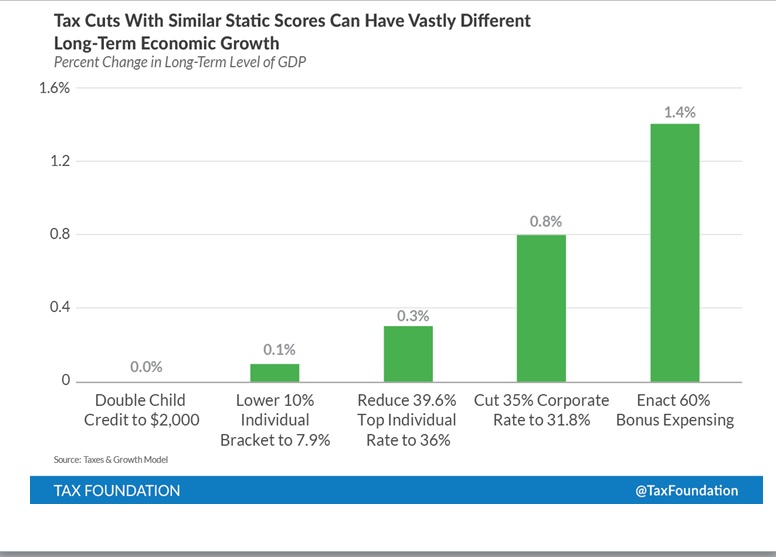

Today, I want to address the latter argument about taxes and economic growth. When this topic arises, I normally cite both public-finance theory and empirical research to make the case that taxes do impact economic performance, and I try to always stress that not all taxes are created equal.

Today, I want to address the latter argument about taxes and economic growth. When this topic arises, I normally cite both public-finance theory and empirical research to make the case that taxes do impact economic performance, and I try to always stress that not all taxes are created equal.

And if the focus is corporate taxation, I usually share my primer on the issue, and then link to research from Australia, Canada, Germany, and the United Kingdom.

But maybe it will be more persuasive…

View original post 741 more words

Recent Comments