The Trump tax plan, which was signed into law right before Christmas in 2017, had two very good features.

- Restricting the deduction for state and local taxes.

- A reduction of the corporate tax rate to 21 percent.

The former was important because the federal tax code was subsidizing high tax burdens in states such as New Jersey, Illinois, and California.

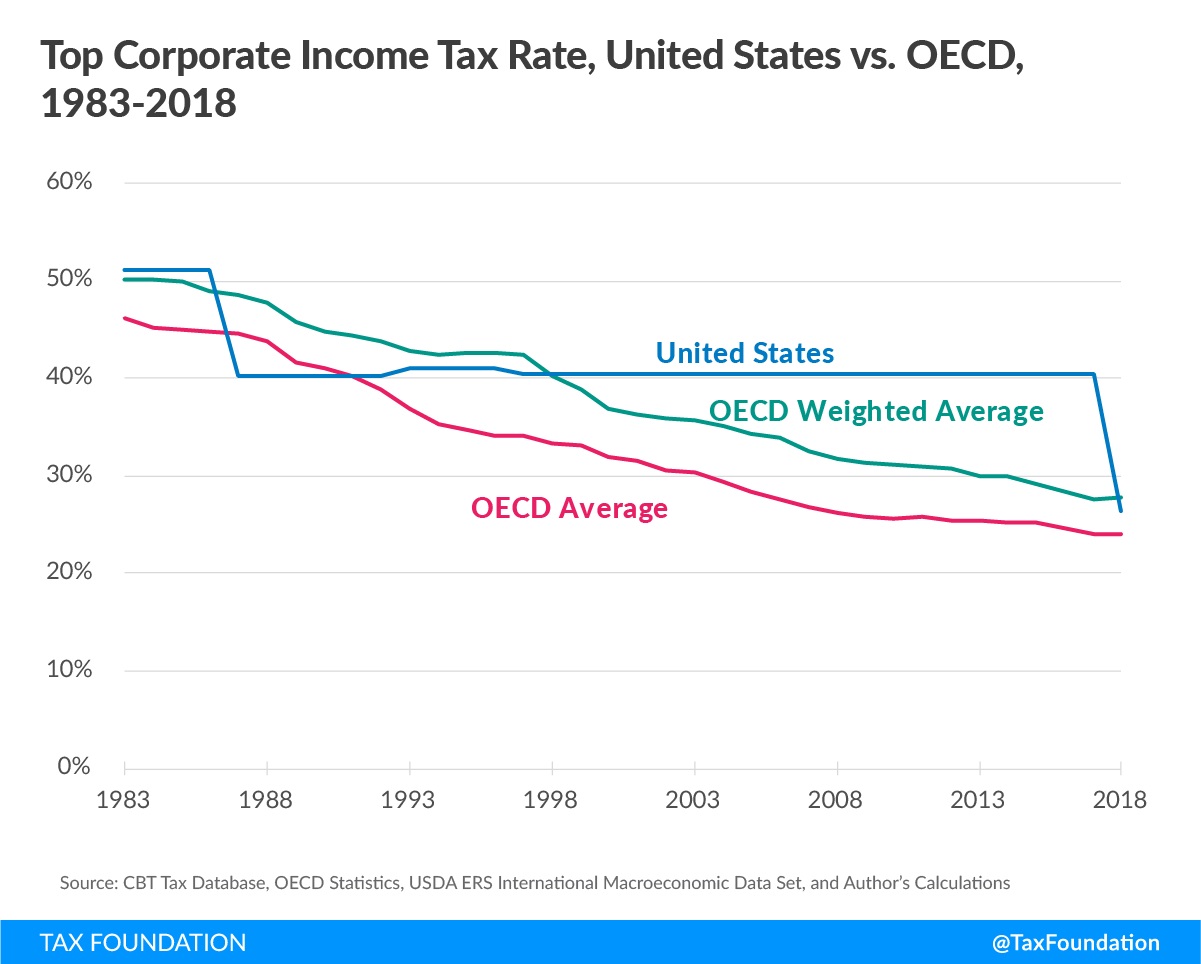

The latter was important because the United States, with a 35 percent corporate rate, had the highest tax burden on businesses among developed nations.

The 21 percent rate we have today doesn’t make us a low-tax nation, but at least the U.S. corporate tax burden is now near the world average.

There were many other provisions in the Trump tax plan, most of which moved tax policy in the right direction.

Now that a couple of years have passed, what’s been the net effect?

In

View original post 516 more words

Recent Comments