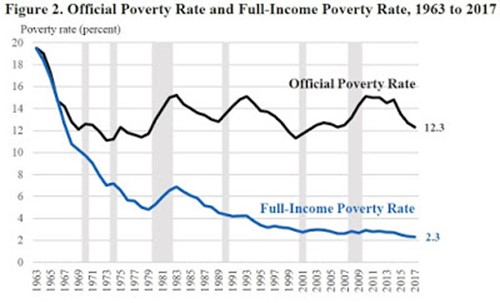

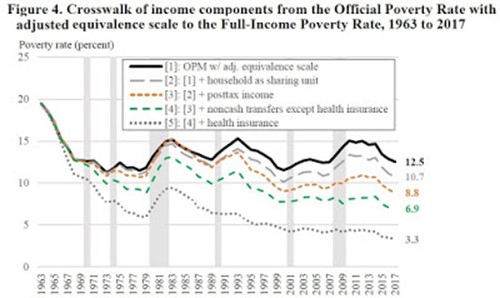

the Full-income Poverty Measure estimates the share of people in poverty using a post-tax, (comprehensive or full) post-transfer definition of income. Similar to the Official Poverty Measure, it includes market income (wages and salaries, self-employment and business income, farm income, retirement income from pensions, dividends, interest, rent and alimony) and cash transfers (Aid to Families with Dependent Children/Temporary Assistance for Needy Families, Social Security and workers’ compensation). It then adds the market value of health and non-health in-kind transfers (food stamps/SNAP, subsidized school lunches, rental housing assistance, and Medicare and Medicaid) as well as the market value of employer-provided health insurance. It subtracts Federal income and payroll taxes but adds tax credits including the Earned Income Tax Credit, Child Tax Credit, and Additional Child Tax Credit (the refundable portion of the CTC) based on estimated tax liabilities using NBER Taxsim 9.3 (Feenberg and Coutts 1993). We impute several of these income sources in the early years of our analysis because they were not collected in the CPS-ASEC.

From https://www.iza.org/publications/dp/12855/evaluating-the-success-of-president-johnsons-war-on-poverty-revisiting-the-historical-record-using-a-full-income-poverty-measure via http://conversableeconomist.blogspot.com/2020/03/us-poverty-over-time-how-to-compare.html

Recent Comments