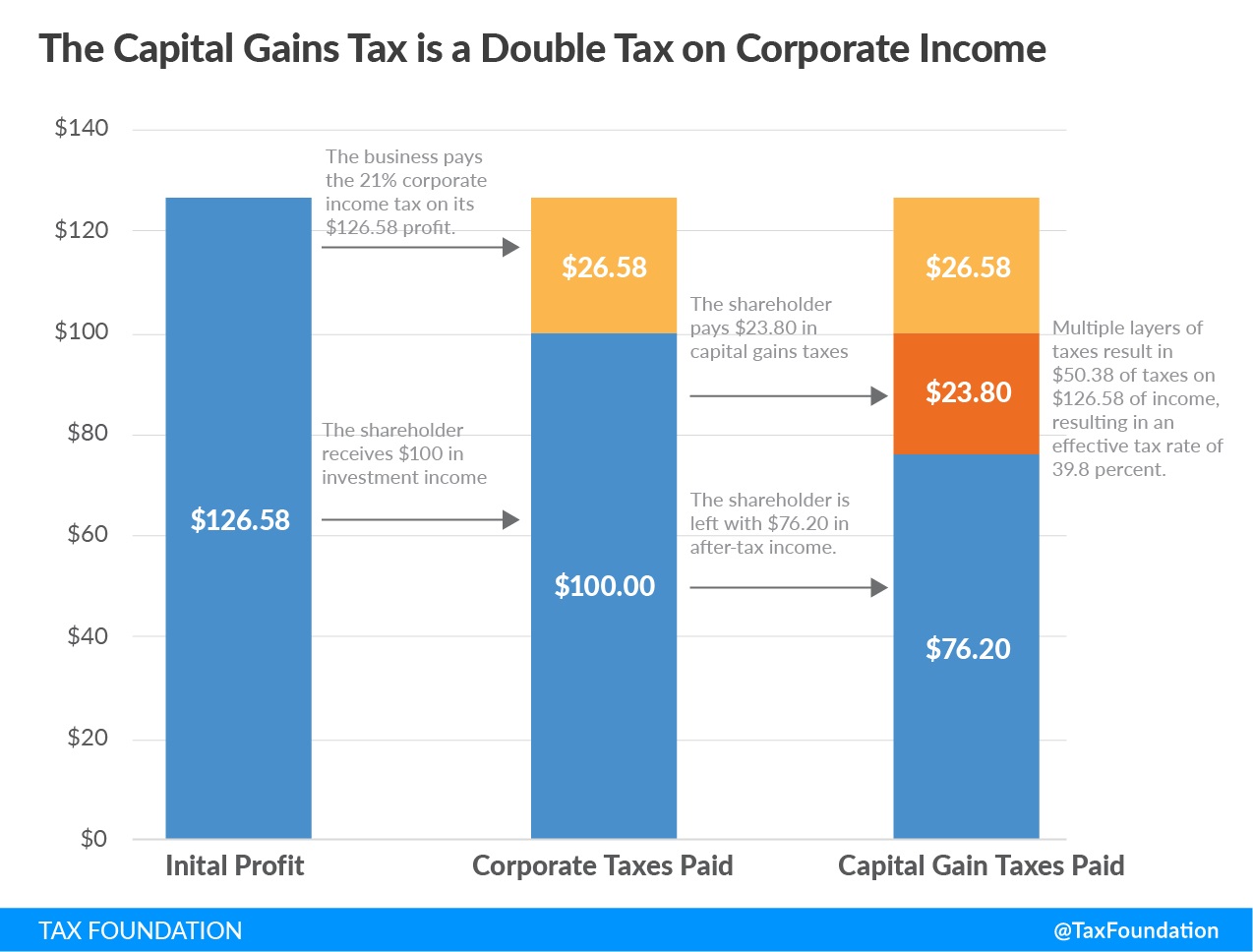

Public finance theory teaches us that the capital gains tax should not exist. Such a levy exacerbates the bias against saving and investment, which reduces innovation, hinders economic growth, and lowers worker compensation.

All of which helps to explain why President Biden’s proposals to increase the tax burden on capital gains are so misguided.

He wants a radical increase in the tax rate on capital gains – from 23.8 percent to 43.4 percent, the highest burden in the world.

He wants a radical increase in the tax rate on capital gains – from 23.8 percent to 43.4 percent, the highest burden in the world.- He wants to impose capital gains tax on assets when people die, even if assets aren’t sold and there are not any actual capital gains.

Thanks to some new research from Professor John Diamond of Rice University, we can now quantify the likely damage if Biden’s proposals get enacted.

Here’s some of what he wrote in his new study.

We use a computable general equilibrium…

View original post 601 more words

Recent Comments