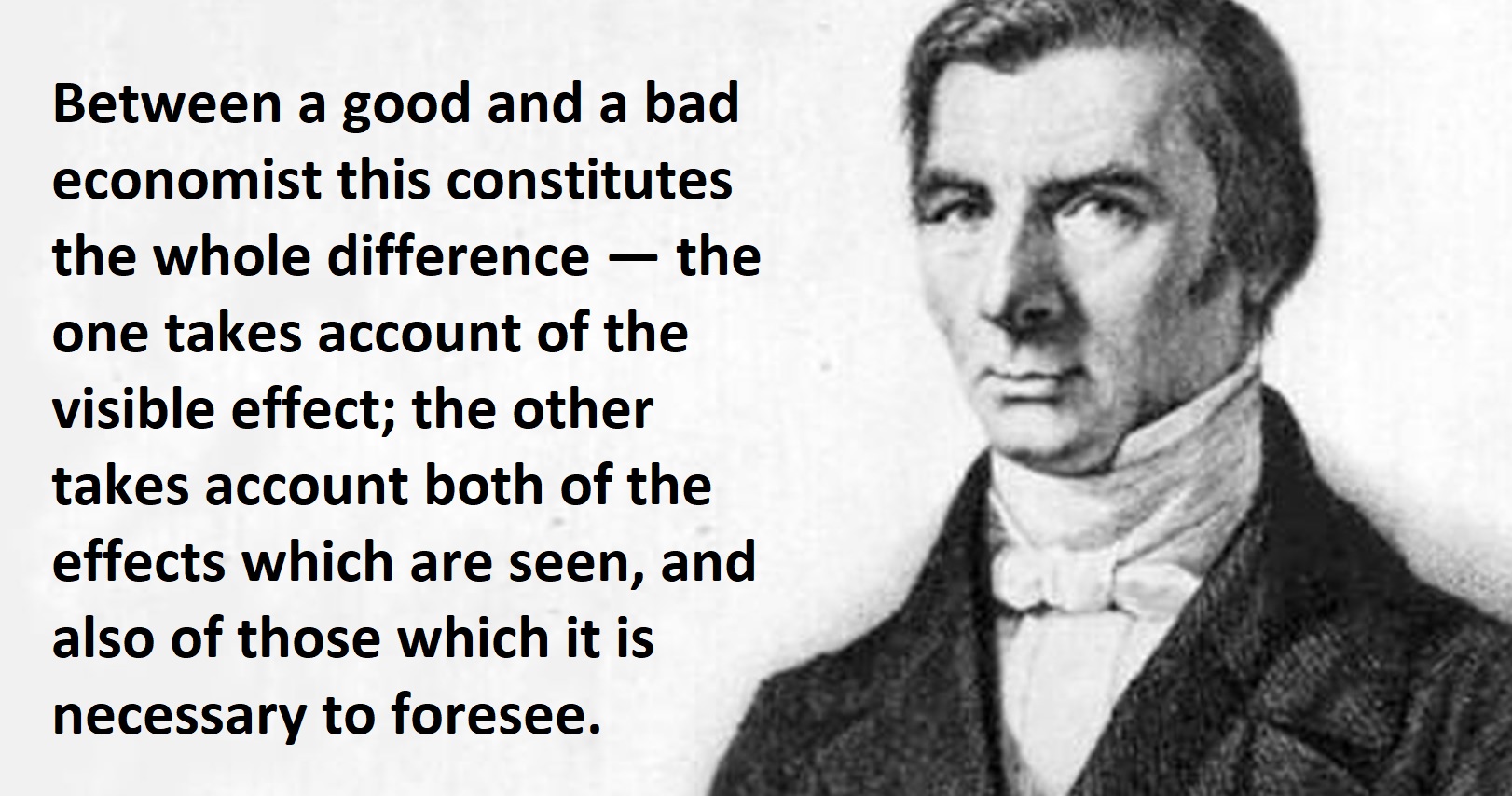

As Frederic Bastiat sagely observed nearly 200 years ago, a good economist considers the indirect or secondary effects of any action.

For instance, a politician might claim we can double tax revenue by doubling tax rates, but a sensible economist will warn that higher tax rates will discourage work, saving, investment, and entrepreneurship.

For instance, a politician might claim we can double tax revenue by doubling tax rates, but a sensible economist will warn that higher tax rates will discourage work, saving, investment, and entrepreneurship.

And those changes in behavior (along with increases in evasion and avoidance) will result in less economic activity, which means lower taxable income. So tax revenues will not double. In some cases, they might even fall.

This analysis also applies to regulatory policy.

In an article for the Competitive Enterprise Institute, James Broughel explains how red tape actually causes needless death because of less economic growth.

Regulations can contribute to an increased death toll by imposing costs that eat into disposable income. As spending power dwindles, so too does the potential for spending on risk management…

View original post 266 more words

Recent Comments