Berkshire Hathaway has realized a Sharpe ratio of 0.76, higher than any other stock or mutual fund with a history of more than 30 years, and Berkshire has a significant alpha to traditional risk factors. However, we find that the alpha becomes insignificant when controlling for exposures to Betting-Against-Beta and Quality-Minus-Junk factors. Further, we estimate […]

Buffett’s Alpha

Buffett’s Alpha

05 May 2025 Leave a comment

in entrepreneurship, financial economics Tags: active investing

In Praise of the Danish Mortgage System

30 Apr 2025 Leave a comment

in applied price theory, entrepreneurship, financial economics

When interest rates go up, the price of bonds goes down. As Tyler and I discuss in Modern Principles, the inverse relationship between interest rates and prices holds for any asset that pays out over time. In particular, as Patrick McKenzie points out, when interest rates go up, the value of a loan goes down. […]

In Praise of the Danish Mortgage System

Why the housing market imploded

29 Apr 2025 Leave a comment

in applied price theory, behavioural economics, economic history, economics of information, financial economics, global financial crisis (GFC), great recession, macroeconomics, monetary economics

In a recent paper, Christopher L. Foote, Kristopher S. Gerardi, and Paul S. Willen report (pdf): This paper presents 12 facts about the mortgage market. The authors argue that the facts refute the popular story that the crisis resulted from financial industry insiders deceiving uninformed mortgage borrowers and investors. Instead, they argue that borrowers and […]

Why the housing market imploded

When Genius Failed

10 Apr 2025 1 Comment

in applied price theory, business cycles, economic growth, economics of information, economics of regulation, entrepreneurship, financial economics, global financial crisis (GFC), history of economic thought, industrial organisation, macroeconomics, politics - USA

Myron Scholes was on top of the world in 1997, having won the Nobel Prize in economics that year for his work in financial economics, work that he had applied in the real world in a wildly successful hedge fund, Long Term Capital Management. But just one year later, LTCM was saved from collapse only […]

When Genius Failed

At the end of World War I, Britain was in heavy financial debt to the U.S. The question of repayments would bedevil both countries for decades

27 Mar 2025 Leave a comment

in defence economics, economic history, financial economics, international economic law, international economics, International law, war and peace Tags: British politics France, World War I

See ‘Mellon vs. Churchill’ Review: The Payback Problem by Benn Steil. He reviewed the book Mellon vs. Churchill: The Untold Story of Treasury Titans at War by Jill Eicher. Excerpts:”In a nutshell, the debt story of the 1920s goes like this. Following World War I, 10 countries owed the U.S. more than $10 billion ($190 billion…

At the end of World War I, Britain was in heavy financial debt to the U.S. The question of repayments would bedevil both countries for decades

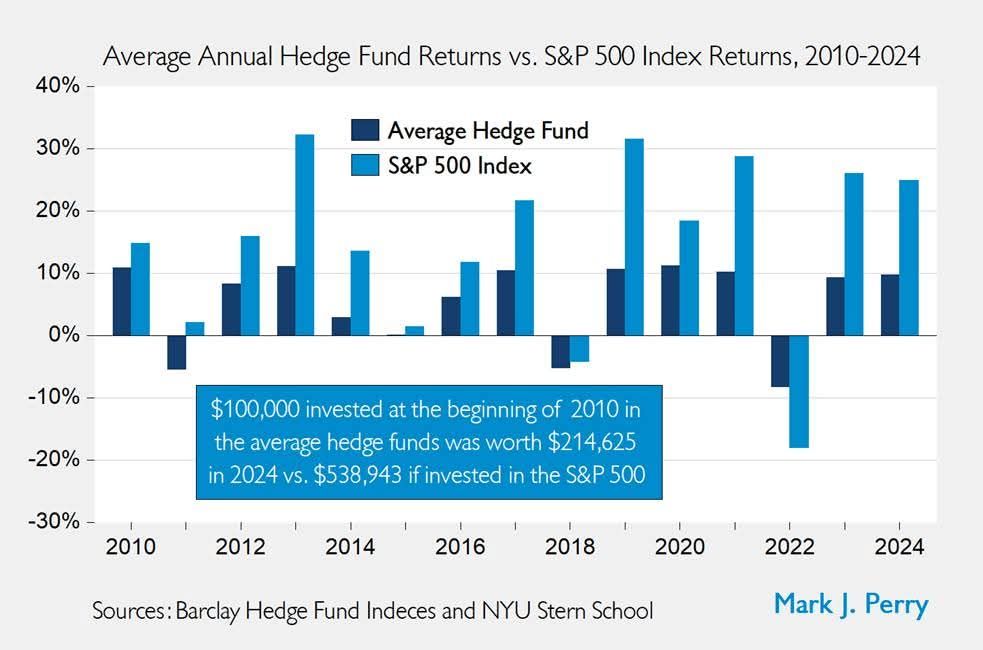

Beating the market

23 Mar 2025 Leave a comment

in econometerics, economics of information, entrepreneurship, financial economics Tags: active investing, efficient markets hypothesis, passive investing

SEC Climate Risk Rule is Entrapment

11 Mar 2025 Leave a comment

in economic history, economics of climate change, economics of regulation, environmental economics, environmentalism, financial economics, global warming, law and economics, politics - USA, property rights Tags: climate activists, efficient markets hypothesis

Stone Washington and William Happer explain the nefarious and ill-advised decree in their article SEC’s Climate Risk Disclosure Rule Would Compel Companies to Make Scientifically False and Misleading Disclosures. Excerpts in italics with my bolds and added images. In March last year, the Securities and Exchange Commission issued its climate risk disclosure rule, called “The […]

SEC Climate Risk Rule is Entrapment

Bernanke on inflation targeting

09 Mar 2025 Leave a comment

in applied price theory, budget deficits, business cycles, economic growth, economic history, financial economics, fiscal policy, history of economic thought, inflation targeting, labour economics, macroeconomics, monetary economics, politics - New Zealand, unemployment Tags: monetary policy

Former chairman of the Federal Reserve Board of Governors (and FOMC), Ben Bernanke, was yesterday the first of two keynote speakers at the Reserve Bank’s conference to mark 35 years of inflation targeting, which first became a formalised thing here in New Zealand. He indicated that he’d be speaking about inflation targeting in general and […]

Bernanke on inflation targeting

Driving a Stake Through Stakeholder Capitalism

07 Mar 2025 Leave a comment

in economics of climate change, economics of regulation, energy economics, entrepreneurship, environmental economics, environmentalism, financial economics, global warming, politics - USA Tags: climate activists, greenwashing, regressive left

E, S, G does not cover core financial risks. We’re looking to assess financially-relevant environmental, social and governance factors, not financially-relevant financial factors.” Got that? Yup. It’s total hogwash.

Driving a Stake Through Stakeholder Capitalism

BP Faces “Existential Crisis” After Ruinous Attempt to Go Green

02 Mar 2025 Leave a comment

in applied price theory, economics of climate change, energy economics, entrepreneurship, environmental economics, environmentalism, financial economics, global warming, industrial organisation, politics - USA, survivor principle Tags: 2024 presidential election, climate activists, climate alarmism, efficient markets hypothesis, greenwashing

BP’s green pivot has backfired spectacularly, hammering profits and leaving the company vulnerable to a hedge fund siege, writes Jonathan Leake in the Telegraph.

BP Faces “Existential Crisis” After Ruinous Attempt to Go Green

Mandated Board Diversity Reduces Firm Value

27 Feb 2025 Leave a comment

in applied price theory, discrimination, econometerics, economics of regulation, financial economics, gender, industrial organisation, labour economics, occupational choice, politics - USA Tags: efficient markets hypothesis, sex discrimination

Jon Klick finds that when courts in CA surprisingly invalidated a set of DEI laws, the market value of firms subject to those laws increased: California mandated that firms headquartered in the state include women (SB 826) and underrepresented minorities (AB 979) on their corporate boards. These laws, passed in 2018 and 2020 respectively, were […]

Mandated Board Diversity Reduces Firm Value

The American Rōnin: How Displaced “Disinformation Experts” Are Seeking New Opportunities in Europe and Academia

27 Feb 2025 Leave a comment

in economics of bureaucracy, economics of education, economics of information, economics of media and culture, entrepreneurship, financial economics, industrial organisation, law and economics, liberalism, Marxist economics, politics - USA, property rights, Public Choice, rentseeking Tags: 2024 presidential election, free speech, political correctness, regressive left

Below is my column in the Hill on the new American emigres: “disinformation experts” who are finding themselves unemployed with the restoration of free speech protections. Here is the column:

The American Rōnin: How Displaced “Disinformation Experts” Are Seeking New Opportunities in Europe and Academia

Does the Feldstein-Horioka Puzzle mean National’s Foreign Investment Ambitions Won’t Raise NZ Productivity?

26 Feb 2025 Leave a comment

in applied price theory, econometerics, economic history, financial economics, history of economic thought, international economics, macroeconomics, politics - New Zealand Tags: foreign investment

The NZ Herald’s Editor has declared its journalists will be promoted or fired on the basis of factors like how many clicks they get on their articles. Yes, the Herald is now officially “click bait”. We’re trying to avoid the mistake of writing shallow nonsense at this Blog. So on that note, here’s a somewhat…

Does the Feldstein-Horioka Puzzle mean National’s Foreign Investment Ambitions Won’t Raise NZ Productivity?

Equinor Cut Green Investment In Half

07 Feb 2025 Leave a comment

in economics of climate change, energy economics, environmental economics, environmentalism, financial economics, global warming Tags: greenwashing

By Paul Homewood h/t Ian Cunningham More bad news for the idiot Miliband: Norwegian energy giant Equinor is halving investment in renewable energy over the next two years while increasing oil and gas production.

Equinor Cut Green Investment In Half

Recent Comments