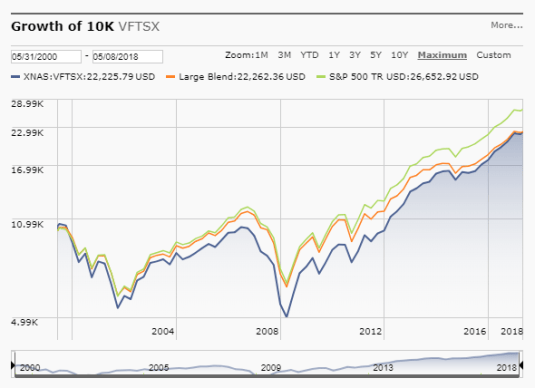

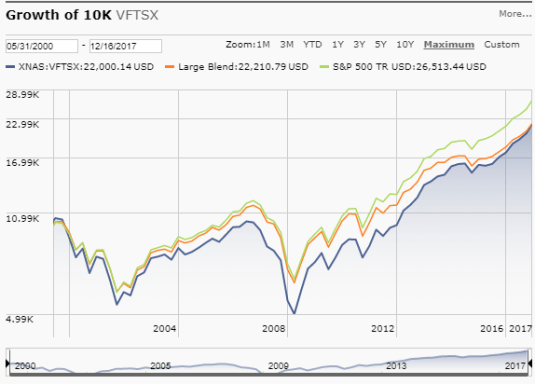

Vanguard FTSE Social Index is a dog of an investment

09 May 2018 Leave a comment

in environmental economics, financial economics

Climate change suits versus disclosures of threats to tax bases to the municipal bond market – interview with Stephen Winterstein

03 May 2018 Leave a comment

in economics of crime, economics of information, environmental economics, financial economics, global warming, law and economics, politics - USA, Public Choice, public economics, rentseeking Tags: climate alarmism, securities fraud

Wouldn’t hold much hope for investors in a hedge fund founded by Steve Keen to put other’s money where his mouth is all the time

28 Apr 2018 Leave a comment

in business cycles, entrepreneurship, Euro crisis, financial economics, fiscal policy, global financial crisis (GFC), macroeconomics, monetary economics Tags: active investing, monetary cranks, revealed preference

35 years later: Diamond-Dybvig model of bank runs

26 Apr 2018 1 Comment

in business cycles, financial economics, global financial crisis (GFC), macroeconomics, monetary economics Tags: bank panics, bank runs

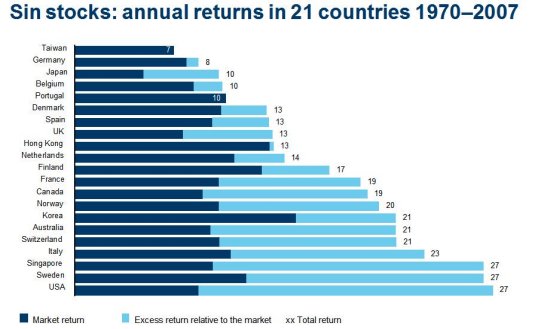

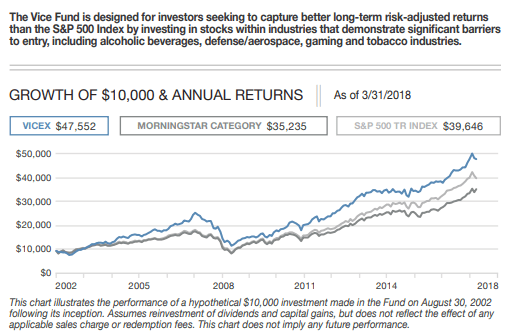

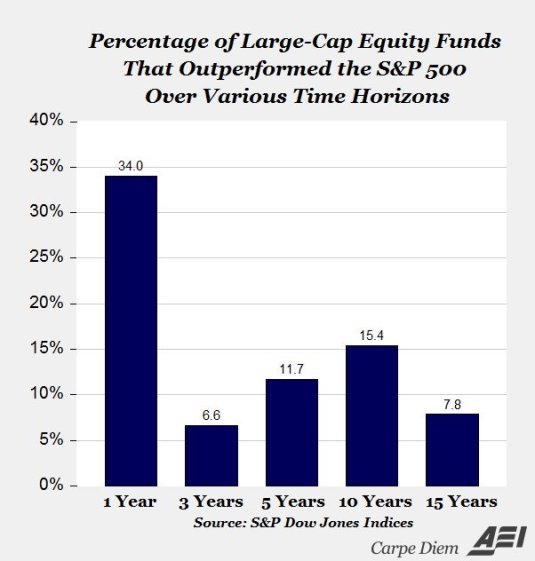

The wages of sin

23 Apr 2018 Leave a comment

in economics of regulation, financial economics Tags: active investing

Didn’t know Starbucks and McDonald’s were doing so well

16 Mar 2018 Leave a comment

in economic history, entrepreneurship, financial economics, industrial organisation, survivor principle

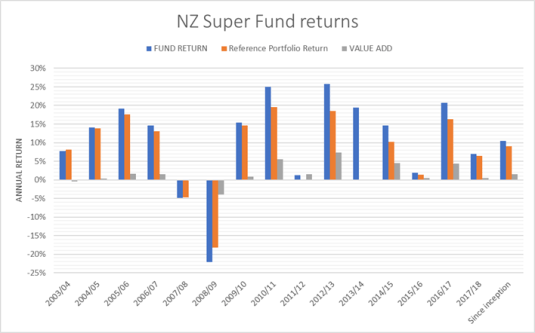

.@NZSuperFund still struggles to beat reference portfolio @TaxpayersUnion; 1.45% p.a. since inception

26 Nov 2017 Leave a comment

from https://www.nzsuperfund.co.nz/performance-investment/monthly-returns

Little wonder that no hedge fund headhunts from the New Zealand superannuation fund. Their staff turnover ratios are below 10% and often 5% and the CEO is paid a pittance by hedge fund standards.

Page 32 of "An Illustrated Guide to Income" more economic #dataviz at: bit.ly/12SEI9p http://t.co/HYm0II2UNI—

Catherine Mulbrandon (@VisualEcon) May 08, 2013

Page 33 of "An Illustrated Guide to Income" more economic #dataviz at: bit.ly/10M7lqR http://t.co/FcmaqZWB32—

Catherine Mulbrandon (@VisualEcon) May 09, 2013

A century of America’s 10 largest companies

21 Nov 2017 Leave a comment

in economic history, financial economics, industrial organisation, survivor principle

Eugene Fama Why Small Caps and Value Stocks Outperform

11 Oct 2017 Leave a comment

in entrepreneurship, financial economics

Recent Comments