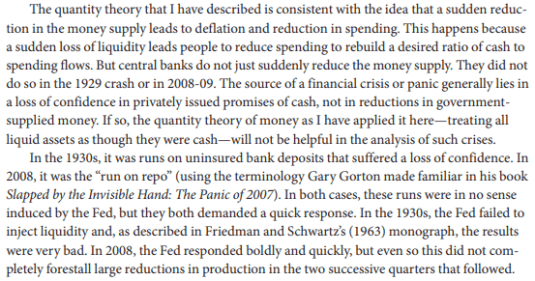

Lucas, the quantity theory and the GFC

23 Apr 2022 Leave a comment

in business cycles, global financial crisis (GFC), macroeconomics, monetary economics, Robert E. Lucas

The Lucas critique summarised by Freeman and Champ

22 Apr 2022 Leave a comment

in budget deficits, business cycles, economic growth, labour economics, labour supply, macroeconomics, monetarism, monetary economics, Robert E. Lucas

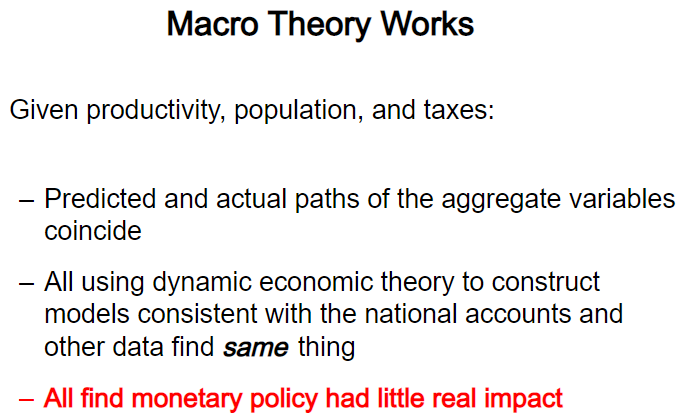

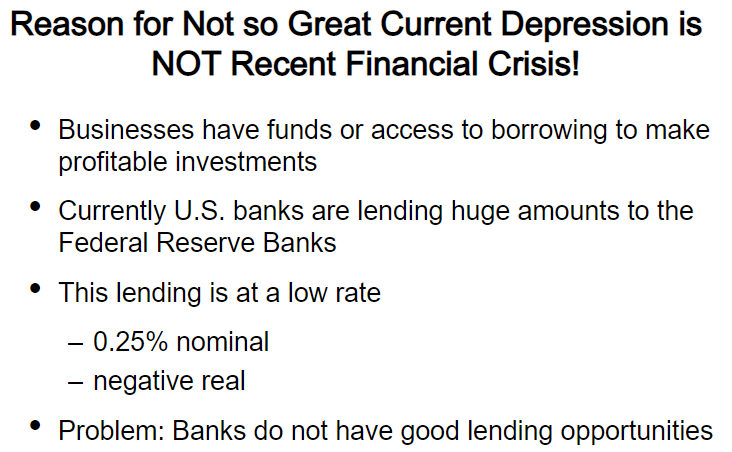

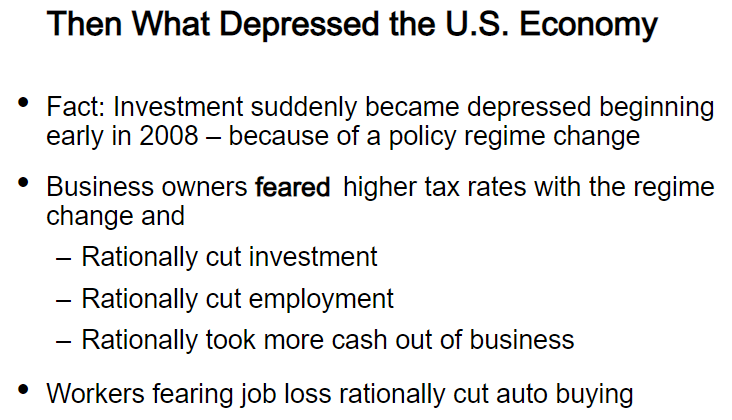

Edward Prescott doesn’t hold back on macroeconomics and central banks

21 Apr 2022 Leave a comment

in business cycles, Edward Prescott, global financial crisis (GFC), great recession, history of economic thought, macroeconomics, monetary economics

Margaret Jacobson on how Roosevelt jump started the #economy in 1933

20 Apr 2022 Leave a comment

in budget deficits, business cycles, economic growth, financial economics, fiscal policy, great depression, history of economic thought, macroeconomics, Milton Friedman, monetarism, monetary economics

A New Theory on What Causes Inflation with Economist John Cochrane

16 Apr 2022 Leave a comment

in budget deficits, business cycles, fiscal policy, history of economic thought, macroeconomics, Milton Friedman, monetarism, monetary economics

Freeman and Champ explain the Lucas revolution

15 Apr 2022 Leave a comment

in business cycles, economic growth, history of economic thought, labour economics, labour supply, macroeconomics, monetarism, monetary economics, Robert E. Lucas, unemployment

Thomas Sargent pioneered the fiscal theory of the price level by studying both the end of hyper-inflations and moderate inflations

07 Apr 2022 Leave a comment

in budget deficits, business cycles, economic history, fiscal policy, history of economic thought, macroeconomics, monetarism, monetary economics

From Stopping Moderate Inflations: The Methods of Poincaré and Thatcher (1982) by Thomas Sargent

Can the central bank cause a recession?

04 Mar 2022 Leave a comment

in business cycles, economic history, Edward Prescott, financial economics, history of economic thought, macroeconomics, monetary economics

(QE) — the Fed’s massive purchases of Treasuries and other assets to push down long-term interest rates

24 Feb 2022 Leave a comment

in business cycles, financial economics, macroeconomics, monetary economics

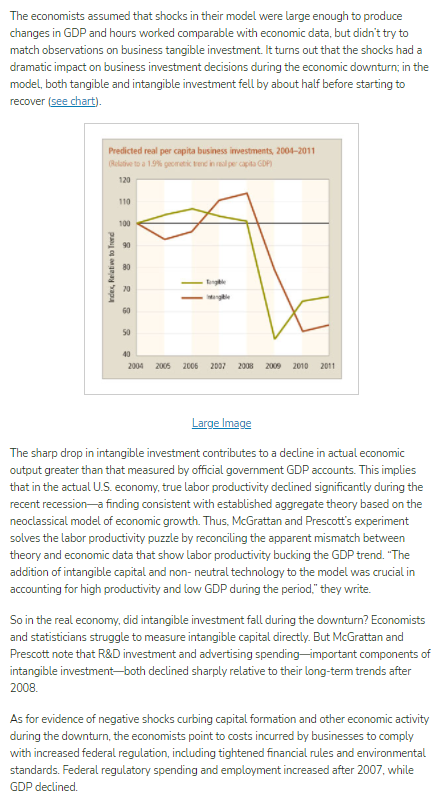

We wanted to see what happens if you don’t have the usual financial factors in there—not one word about banks, the Federal Reserve, the collapse of Lehman Brothers, et cetera

22 Feb 2022 Leave a comment

in business cycles, Edward Prescott, global financial crisis (GFC), great recession, macroeconomics, monetary economics

For McGrattan and Prescott, two leading proponents of the use of quantitative, dynamic business cycle modeling to analyze macroeconomic trends, including intangible capital investment in total economic output is the key to making sense of head-scratching countercyclical movements in labor productivity over the past 25 years.

From https://www.minneapolisfed.org/article/2012/unmeasured-investment

Recent Comments