Wouldn’t hold much hope for investors in a hedge fund founded by Steve Keen to put other’s money where his mouth is all the time

28 Apr 2018 Leave a comment

in business cycles, entrepreneurship, Euro crisis, financial economics, fiscal policy, global financial crisis (GFC), macroeconomics, monetary economics Tags: active investing, monetary cranks, revealed preference

35 years later: Diamond-Dybvig model of bank runs

26 Apr 2018 1 Comment

in business cycles, financial economics, global financial crisis (GFC), macroeconomics, monetary economics Tags: bank panics, bank runs

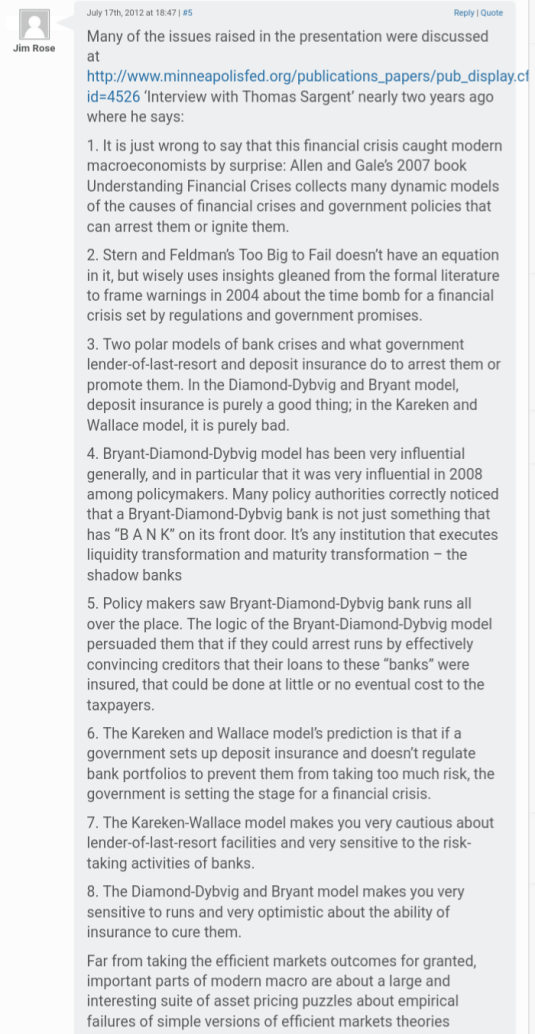

Thomas Sargent v. @AnnPettifor on macroeconomics before the #GFC

24 Apr 2018 Leave a comment

in budget deficits, business cycles, fiscal policy, global financial crisis (GFC), great depression, great recession, macroeconomics, monetary economics, Public Choice Tags: monetary cranks, Thomas Sargent

When will @AnnPettifor found a hedge fund to profit from putting other’s money where her mouth is rather than just her own retirement savings portfolio, which I am sure she did

23 Apr 2018 Leave a comment

in applied price theory, economics of information, entrepreneurship, fisheries economics, global financial crisis (GFC), macroeconomics, Marxist economics, monetary economics Tags: efficient markets hypothesis, entrepreneurial alertness, monetary cranks

The GFC did not bring down the Celtic Tiger; the Irish government did by overreacting in a crisis

07 Mar 2018 2 Comments

in global financial crisis (GFC), macroeconomics, monetary economics, Public Choice

Timothy J. Kehoe and Gonzalo Fernandez de Cordoba wrote this for the Annual Report Essay of the Federal Reserve Bank of Minneapolis in 2008 on the eve of the financial crisis in Ireland:

Different sorts of shocks can start financial crises. Some shocks are external to the economy. In the cases of Chile and Mexico, the shock was the increase in world interest rates and the decrease in international commodity prices, and in the case of Finland, it was collapse in trade with the former Soviet Union. Some shocks are internal. In the case of Japan, the shock was the fall in the prices of commercial real estate, and, currently in North America and Western Europe, it is the fall in the prices of residential real estate. The analysis of great depressions shows that the type of shock that starts the depression is less important than reaction to the shock by the economy and, in particular, the government.

The screen snapshot below shows that the Irish government did not bail out the depositors of a bank, they bailed out the bondholders. It is only when there is a bank run by depositors of a large bank is a financial system under threat. Bondholders are on their own.

FROM https://www.vanityfair.com/news/2011/03/michael-lewis-ireland-201103

Game of Theories: The Great Recession

06 Dec 2017 Leave a comment

in budget deficits, business cycles, Euro crisis, fiscal policy, global financial crisis (GFC), great recession, macroeconomics, Public Choice, rentseeking

Financial regulation and financial crisis | Sam Peltzman

11 Oct 2017 Leave a comment

in applied price theory, economics of regulation, financial economics, global financial crisis (GFC), macroeconomics, monetary economics, Sam Peltzman Tags: offsetting behaviour, unintended consequences

The GFC, fiscal stimulus and the crisis in modern macroeconomics

08 Feb 2017 1 Comment

in fiscal policy, global financial crisis (GFC), macroeconomics

The Great Recession

14 Nov 2016 Leave a comment

in Euro crisis, fiscal policy, global financial crisis (GFC), great recession, macroeconomics

Jeffrey Lacker on the inherent instability of the financial system

03 Oct 2016 Leave a comment

in economic history, global financial crisis (GFC)

Did @AnnPettifor correctly predict the global financial crisis in 2003?

21 Sep 2016 1 Comment

in economic history, global financial crisis (GFC), macroeconomics, monetary economics

You are not much of a leftover Marxist if you are not predicting a crisis in capitalism is on the horizon.

https://twitter.com/PolicyObsAUT/status/778456702655995904

Capitalism is supposed to collapse under its own inner contradictions.

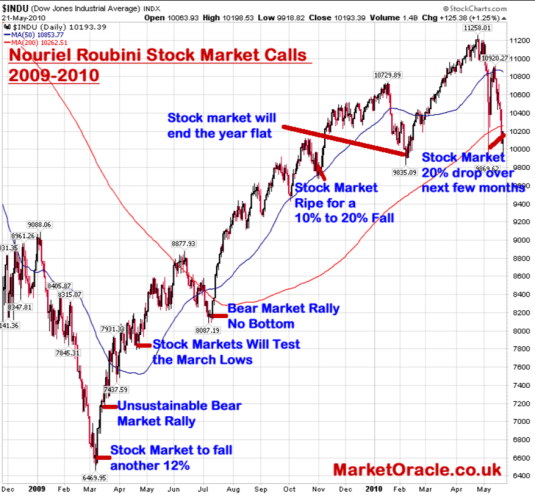

Professional stock market tipsters are notorious from specialising in predicting doom as well and they still get listened too despite terrible forecasting records.

Plenty of people warned of dark days ahead in the lead up to the global financial crisis. An essay anyone can read with profit is Ross Levine’s An Autopsy of the U.S. Financial System: Accident, Suicide, or Negligent Homicide? His abstract says

The evidence is inconsistent with the view that the collapse of the financial system was caused only by the popping of the housing bubble (“accident”) and the herding behavior of financiers rushing to create and market increasingly complex and questionable financial products (“suicide”).

Rather, the evidence indicates that senior policymakers repeatedly designed, implemented, and maintained policies that destabilized the global financial system in the decade before the crisis. Moreover, although the major regulatory agencies were aware of the growing fragility of the financial system due to their policies, they chose not to modify those policies, suggesting that “negligent homicide” contributed to the financial system’s collapse.

The New York Times warned in 1999 that Fannie Mae was taking on so much risk that an economic downturn could trigger a “rescue similar to that of the savings and loan industry in the 1980s,” and emphasised this point again in 2003. Greenspan testified before a Senate committee in 2004 that the increasingly large and risky Fannie Mae and Freddie Mac portfolios could have enormously adverse ramifications.

You predict a financial crisis by pointing to adjustments in your share portfolio to take advantage of shorting the market and then showing how big a profit you made afterwards.

The movie The Big Short highlights that its protagonists had skin in the game. They were investing in mortgages or shorting the same in the expectation of the crash they were predicting. Much of the drama in the film is about how long their foretelling of a crash took to come true.

There were no windbags and armchair critics in The Big Short talking gloom and doom on the horizon without investing their own money to profit from their forecasts.

Recent Comments