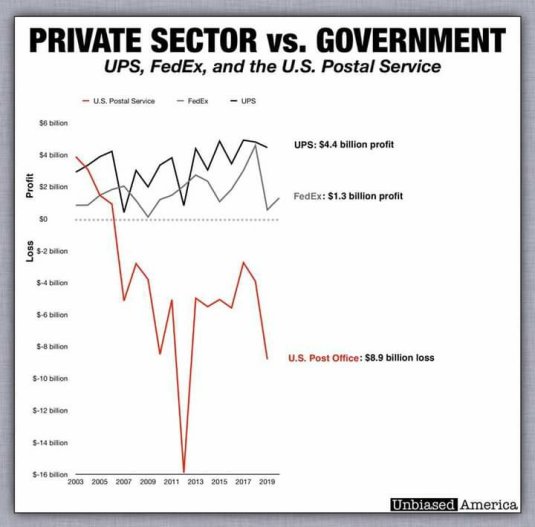

Spot the government owned business @AOC @BernieSanders

18 Aug 2020 Leave a comment

in applied price theory, economics of bureaucracy, entrepreneurship, industrial organisation, law and economics, managerial economics, market efficiency, Marxist economics, organisational economics, personnel economics, politics - USA, privatisation, property rights, Public Choice, survivor principle, transport economics Tags: offsetting behaviour, The fatal conceit, unintended consequences

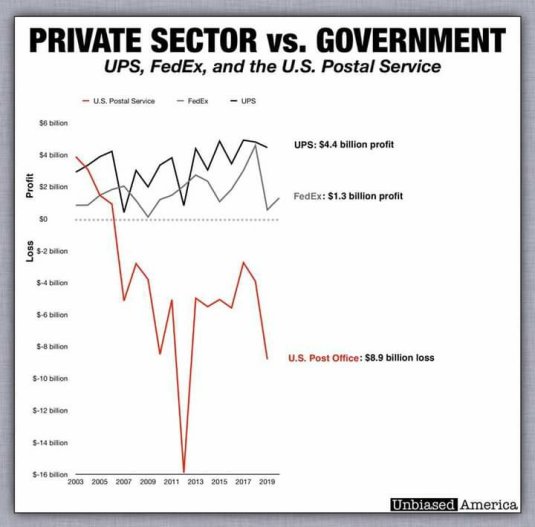

Best Anti-Stimulus Argument in 2009 was from Kevin Murphy @TaxpayersUnion @JordNZ

16 Aug 2020 Leave a comment

in applied price theory, applied welfare economics, business cycles, fiscal policy, macroeconomics, politics - USA, Public Choice, public economics, unemployment

From https://www.bradford-delong.com/2011/10/hoisted-from-the-archives-evaluating-fiscal-stimulus.html and see too https://www.wsj.com/articles/SB123423402552366409

At https://www.chicagobooth.edu/research/igm/events-forums/myron-scholes-forum/speaker-series/2009-01-16 Murphy says

Kevin Murphy sketched out a simple equation—into which anyone could easily plug their own assumptions—to compare the benefits and costs of stimulus spending. The advantage, he argued, is the equation helps everyone to be clear about exactly what they are assuming and why it supports their approach to the stimulus. According to Murphy, the main items everyone should be clear about are: the fraction of the economy’s resources that are idle; the value of keeping those resources idle (e.g., most people value their time, and will not work without compensation); the deadweight loss from raising taxes in the future to pay for the spending; and the cost of allocating spending through government, if it is allocated less efficiently as a result (this can be negative —i.e., a benefit—if government is better than the private sector at allocating resources).

Murphy did not consider the stimulus a good proposal, but he explained how his assumptions about each element of his framework differed from those of president-elect Obama’s team. “It’s easy to see what you have to assume in order to make the stimulus make sense,” Murphy said. Regarding the tax cut measures in the stimulus plan, Murphy thought they were designed in an especially inefficient way. Since marginal tax rates are what matter for incentives, he argued, it was not helpful that the Obama plan would give tax cuts in the form of direct credits to certain taxpayers without lowering rates. That the president would likely address the resulting deficit by raising rates in the future would exacerbate the problem.

And Robert Lucas adds

Robert Lucas pointed out that the US economy was already 4 percent below its long-term trend level in January 2008. In addition, consensus forecasts—which “mean a lot” over short horizons such as a year—suggested the economy would be 8 percent below after another year. This would be larger than any other postwar recession, though nowhere near as bad as the 30 percent gap in the 1930s. “It’s not the worst in my lifetime, but it’s the worst in Obama’s,” Lucas said, “and it would be foolish not to take some actions to deal with it.”

Monetary measures to deal with the recession make a lot of sense, said Lucas, who added that many of the Fed’s actions were beneficial. The trouble was the fiscal stimulus did not seem designed to deal with the real problem. A good approach, Lucas said, would be to use the fiscal stimulus “as another way of getting cash into circulation in the private sector.” He mentioned hypothetical examples that Milton Friedman—dropping money from helicopters—and John Maynard Keynes—paying people to dig and refill ditches—had posed as ways of achieving this. “If fiscal stimuli are designed to be effective, they’re going to be effective because they carry along a monetary policy of the sort that raises the dollar spending level,” Lucas said. Based on the plans and information he had seen from president-elect Obama’s advisors, however, Lucas said that this did not seem to be what the new administration was planning. Instead, he said, “all they’re talking about is transferring resources, additional levels of spending, from one use to another,” which, he argued, would have no substantial effect on the average level of spending and thus would not help fight the recession.

@oxfam @Greenpeace @jeremycorbyn @BernieSanders @SenWarren @Greens @NZGreens @AOC

15 Aug 2020 Leave a comment

Glenn C. Loury on Ethics of Affirmative Action in Higher Education

15 Aug 2020 Leave a comment

in discrimination, economics of education, human capital, income redistribution, labour economics, law and economics, occupational choice, politics - USA, poverty and inequality, Public Choice, rentseeking Tags: affirmative action, racial discrimination, regressive left

Thomas Sowell – Wealth Disparity

14 Aug 2020 Leave a comment

in discrimination, economics of education, entrepreneurship, gender, human capital, income redistribution, industrial organisation, labour economics, labour supply, law and economics, occupational choice, occupational regulation, poverty and inequality, property rights, survivor principle, Thomas Sowell, unemployment, welfare reform Tags: child poverty, family poverty, pessimism bias

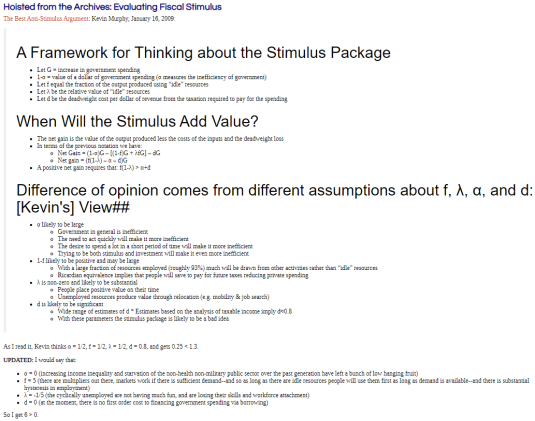

Where @Greens @NZGreens @AOC @BernieSanders trip-up

09 Aug 2020 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, constitutional political economy, development economics, economic history, growth disasters, income redistribution, Marxist economics, politics - Australia, politics - New Zealand, politics - USA, Public Choice, public economics, rentseeking Tags: The fatal conceit

Was the Glorious Revolution a Dutch Conquest?

09 Aug 2020 Leave a comment

in defence economics, economic history, economics of bureaucracy, economics of religion, international economics, International law, Public Choice, war and peace Tags: Glorious revolution, Protestant Reformation

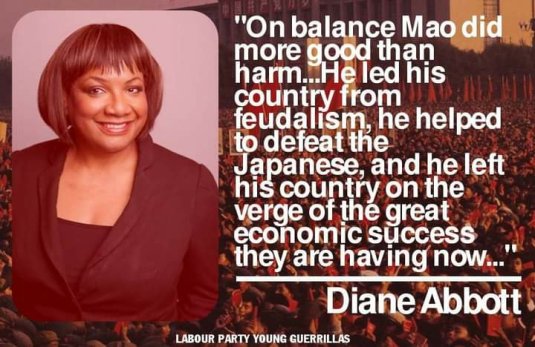

Another useful idiot

08 Aug 2020 Leave a comment

in development economics, economic history, economics of bureaucracy, economics of crime, growth disasters, law and economics, Marxist economics, Public Choice Tags: capitalism and freedom, The Great Escape, useful idiots

Kamala Harris attacks sleepy @JoeBiden’s record on race

08 Aug 2020 Leave a comment

in discrimination, economics of bureaucracy, economics of education, law and economics, politics - USA, Public Choice Tags: 2020 presidential election, affirmative action, racial discrimination

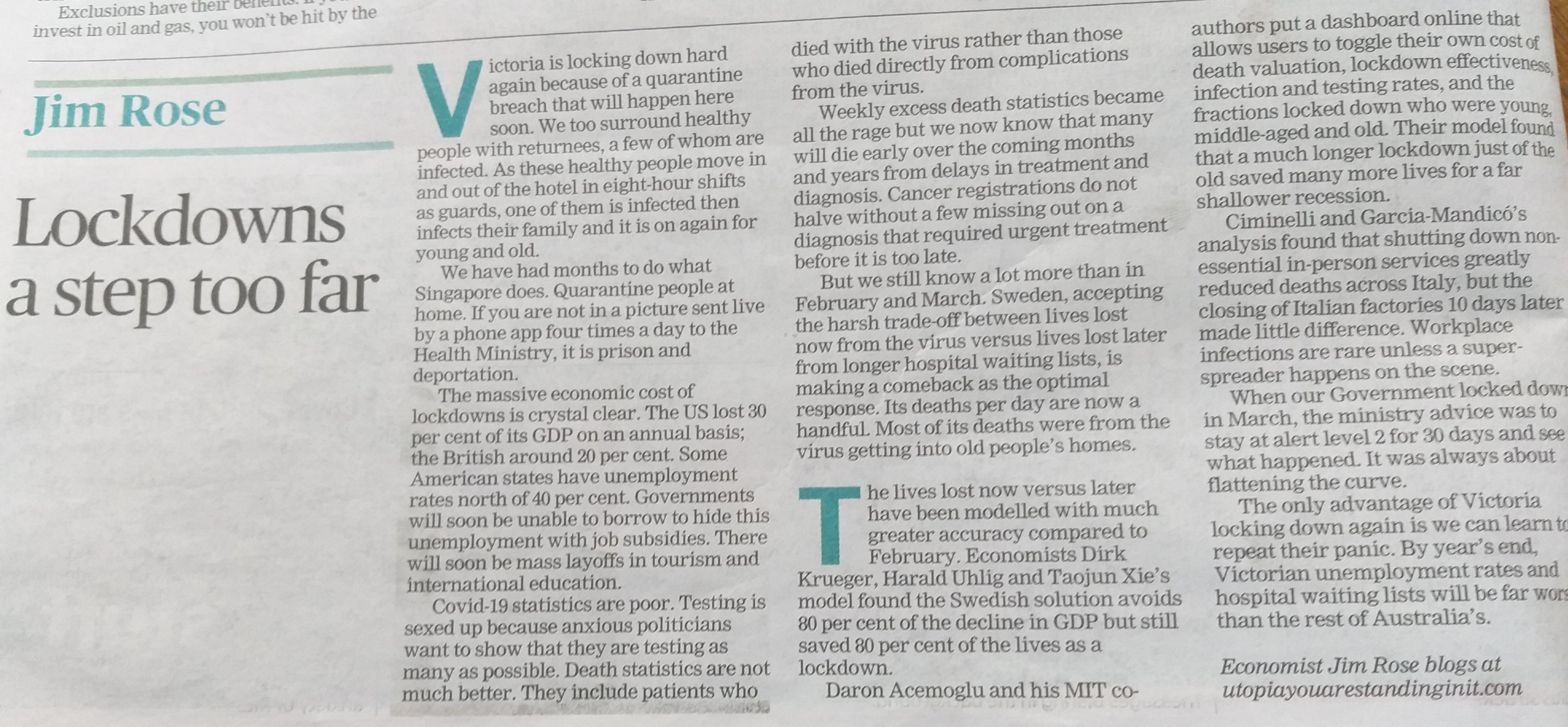

How many lockdowns are one too many? #COVID19 op-ed in @DomPost

07 Aug 2020 Leave a comment

in applied welfare economics, behavioural economics, economics of bureaucracy, health economics, law and economics, politics - Australia, politics - New Zealand, politics - USA, Public Choice Tags: economics of pandemics, offsetting behaviour, pessimism bias, The fatal conceit, unintended consequences

David Seymour’s adjournment speech 2020

07 Aug 2020 Leave a comment

in comparative institutional analysis, constitutional political economy, economic growth, economics of bureaucracy, economics of crime, economics of regulation, health economics, income redistribution, law and economics, Marxist economics, politics - New Zealand, property rights, Public Choice, rentseeking Tags: 2020 New Zealand election, economics of pandemics, regressive left

Freedom, Friedman, & Family Trajectory: David Friedman – Blue Frontiers Podcast E09

05 Aug 2020 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, constitutional political economy, David Friedman, economics of regulation, history of economic thought, law and economics, Milton Friedman, Public Choice, public economics

Yet another reason why legal cannabis shops will not out-compete the gangs @NZDrug! Out of the way locations

01 Aug 2020 Leave a comment

in economics of bureaucracy, economics of crime, economics of regulation, entrepreneurship, health economics, industrial organisation, law and economics, politics - New Zealand, Public Choice, survivor principle Tags: anti-market bias, marijuana decrimilization, meddlesome preferences, nanny state, regressive left, The fatal conceit, unintended consequences

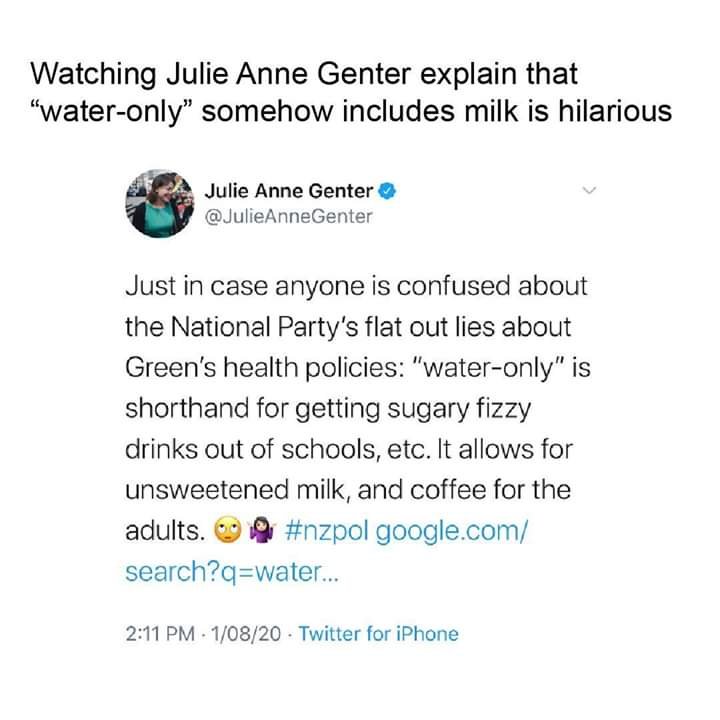

A wise man doesn’t fall into a hole a clever man can climb out of: @JulieAnneGenter just kept digging

01 Aug 2020 Leave a comment

in economics of bureaucracy, health economics, Marxist economics, politics - New Zealand, Public Choice, public economics, sports economics Tags: 2020 New Zealand election, meddlesome preferences, nanny state

Recent Comments