Is Growth of Government Inevitable? | Sam Peltzman video

12 Nov 2014 Leave a comment

in economics of regulation, income redistribution, liberalism, Public Choice, public economics, rentseeking, Sam Peltzman Tags: growth of government, Sam Peltzman

State owned enterprises continue to be a bad investment for the NZ taxpayer

12 Nov 2014 2 Comments

in industrial organisation, Marxist economics, politics - New Zealand, public economics Tags: privatisation, state owned enterprises

In a Briefing to the Incoming Minister just released, the Treasury said that in 2013, total shareholder return from state owned enterprises to the taxpayer was just 3 per cent. This is a little bit better than leaving the money in the bank.

Note: KiwiRail is excluded because of significant changes in its valuation methodologies over the past few years, including the significant write down in its asset values in 2012. . Total shareholder return for 2012 has been restated to include Solid Energy.

KiwiRail lost $248 million in 2013, after a $174.4 million loss a year earlier. Solid Energy lost $182 million last year last year. This $182m loss follows a $335.4m loss in the June 2013 year and a $40m loss the year before that.

Working for Families and work incentives

08 Nov 2014 Leave a comment

in labour economics, labour supply, politics - New Zealand, public economics, taxation, welfare reform Tags: effective marginal tax rates, tax – welfare system interactions

There are 3.38 million individual taxpayers. Of these, about 120,000 (3.4 percent) face EMTRs over 60%, 120,000 (3.4 percent) face EMTRs between 50% and 60%, and 160,000 (4.5 percent) face EMTRs between 40% and 50%. Slightly more than 88 percent of taxpayers face EMTRs below 40%.

HT: New-Zealand-tax-system-and-how-it-compares-internationally

The left-wing bias of economists alert: How textbooks are biased toward favouring tax hikes

03 Oct 2014 Leave a comment

The Economics of Europe’s Insane History of Putting Animals on Trial and Executing Them

02 Oct 2014 Leave a comment

in applied price theory, economics of religion, law and economics, Public Choice, public economics, rentseeking, taxation Tags: economics of religion, follow the money, Peter Leeson, rent seeking

The fantastically creative and insightful Peter Leeson published an article in the Journal of Law and Economics in 2013 on the practice of putting animals on trial in the Medieval ages.

Abstract

For 250 years insects and rodents accused of committing property crimes were tried as legal persons in French, Italian, and Swiss ecclesiastic courts under the same laws and according to the same procedures used to try actual persons.I argue that the Catholic Church used vermin trials to increase tithe revenues where tithe evasion threatened to erode them.

Vermin trials achieved this by bolstering citizens’ belief in the validity of Church punishments for tithe evasion: estrangement from God through sin, excommunication, and anathema.

Vermin trials permitted ecclesiastics to evidence their supernatural sanctions’ legitimacy by producing outcomes that supported those sanctions’ validity. These outcomes strengthened citizens’ belief that the Church’s imprecations were real, which allowed ecclesiastics to reclaim jeopardized tithe revenue

Leeson’s paper is also closely connected to Ekelund, Herbert, and Tollison’s (1989, 2002, 2006) and Ekelund et al.’s (1996) work. They study the medieval Catholic Church as a firm. They discuss how ecclesiastics used supernatural sanctions to protect the Church’s monopoly on spiritual services against heretical competition.

HT: Wired – fantastically-wrong-europes-insane-history-putting-animals-trial-executing/

The Tyranny of the Taxi Medallions

01 Oct 2014 Leave a comment

in economics of religion, Public Choice, public economics, rentseeking Tags: taxi regulation

Churchill on capitalism

14 Sep 2014 Leave a comment

in applied welfare economics, constitutional political economy, market efficiency, Public Choice, public economics, technological progress Tags: capitalism, Winston Churchill

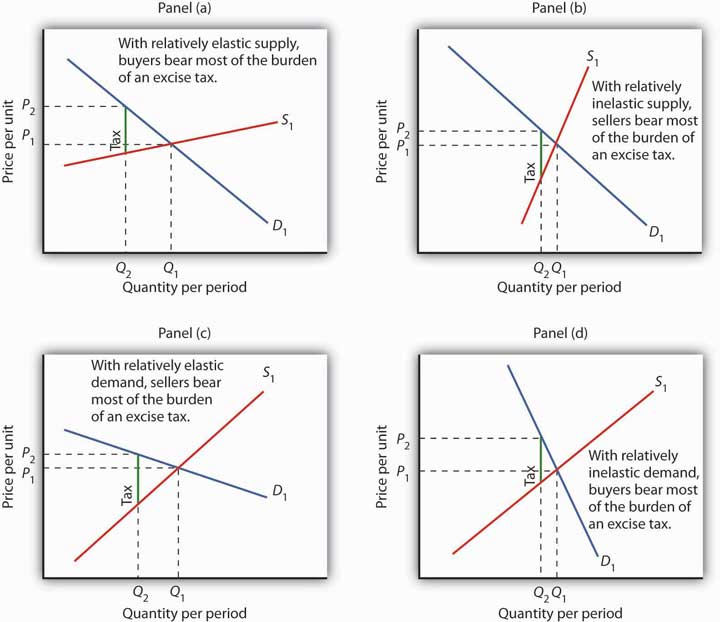

The most forgotten diagrams in the political economy of taxation-updated

30 Jul 2014 Leave a comment

in applied price theory, public economics, taxation Tags: incidence of taxes, the burden of taxes

The ability to pass the burden of the tax depends on price elasticity of demand and price elasticity of supply.

Recent Comments