Berkshire Hathaway has realized a Sharpe ratio of 0.76, higher than any other stock or mutual fund with a history of more than 30 years, and Berkshire has a significant alpha to traditional risk factors. However, we find that the alpha becomes insignificant when controlling for exposures to Betting-Against-Beta and Quality-Minus-Junk factors. Further, we estimate […]

Buffett’s Alpha

Buffett’s Alpha

05 May 2025 Leave a comment

in entrepreneurship, financial economics Tags: active investing

Beating the market

23 Mar 2025 Leave a comment

in econometerics, economics of information, entrepreneurship, financial economics Tags: active investing, efficient markets hypothesis, passive investing

The Tennessee-BlackRock Settlement: A Win for Transparency and Investor Interests

24 Jan 2025 Leave a comment

in economics of climate change, economics of regulation, energy economics, environmental economics, environmentalism, financial economics, global warming, law and economics, politics - USA, property rights Tags: active investing, climate activists, climate alarmism, efficient markets hypothesis

While no settlement is perfect, this agreement represents a significant victory for transparency, accountability, and the integrity of financial markets. For Tennessee investors—and indeed, all investors across the country—it’s a step in the right direction.

The Tennessee-BlackRock Settlement: A Win for Transparency and Investor Interests

The Little Book of Common Sense Investing

24 Jan 2025 Leave a comment

in applied price theory, financial economics Tags: active investing, efficient markets hypothesis, passive investing

John Bogle, the founder of Vanguard, wrote a short book in 2006 that explains his investment philosophy. I can sum it up at much less than book length: the best investment advice for almost everyone is to buy and hold a diversified, low-fee fund that tracks an index like the S&P 500. Of course, a […]

The Little Book of Common Sense Investing

The Black-Scholes-Merton Options Pricing Equation

07 Mar 2024 Leave a comment

in applied price theory, entrepreneurship, financial economics Tags: active investing

A superb video on the history and mathematics of options pricing from Veritasium.

The Black-Scholes-Merton Options Pricing Equation

Is ESG investing illegal?

28 Feb 2024 Leave a comment

in energy economics, entrepreneurship, environmental economics, financial economics, global warming Tags: active investing

For fund managers, it may violate their fiduciary responsibility (to maximize returns) to their shareholders. Apparently, the legal risk is too big for JP Morgan, State Street, and BlackRock: Asset managers have been walking a fine legal line. GOP Attorneys General in 2022 warned that they might be violating their fiduciary obligations and antitrust laws.…

Is ESG investing illegal?

Just watched a documentary on Bernie Madoff and his gullible investors

06 Sep 2023 Leave a comment

in economic history, economics of crime, financial economics, law and economics Tags: active investing

Breakdown of Warren Buffett’s Stock Portfolio 1994 – 2021

23 Feb 2021 Leave a comment

in economic history, entrepreneurship, financial economics, industrial organisation Tags: active investing, efficient markets hypothesis

Buffett on stock values

27 Jan 2021 Leave a comment

in financial economics Tags: active investing, efficient markets hypothesis, passive investing

Are securities analysts doomed? | Lex Megatrends

29 Apr 2020 Leave a comment

in financial economics Tags: active investing, efficient markets hypothesis, passive investing

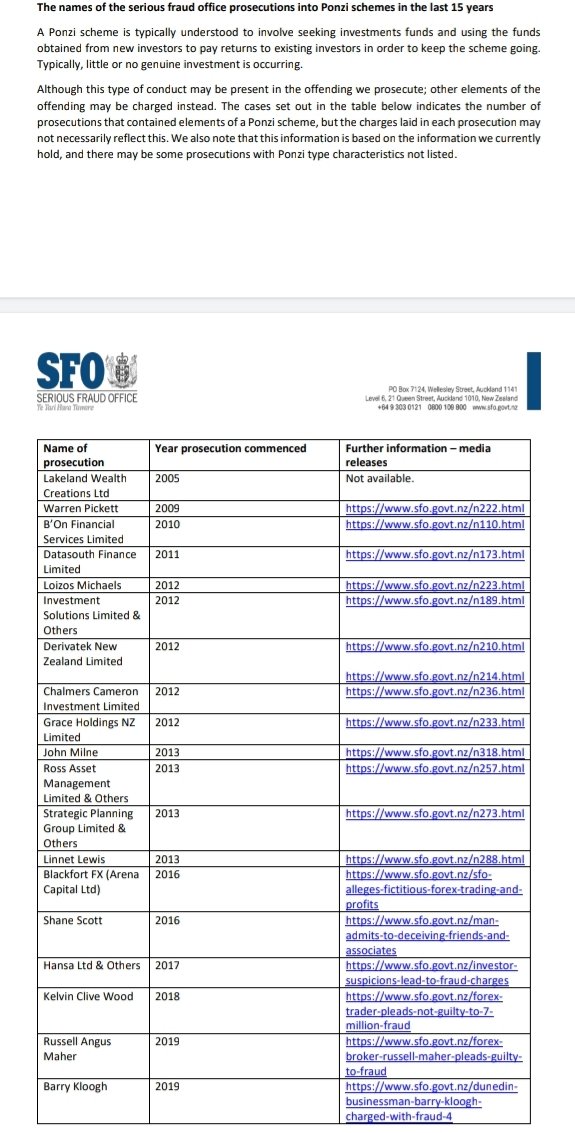

Bernie Madoff must have renewed interest in Ponzi schemes in NZ!

01 Apr 2020 Leave a comment

in economics of crime, financial economics, law and economics Tags: active investing, crime and punishment, criminal deterrence, efficient markets hypothesis, law and order

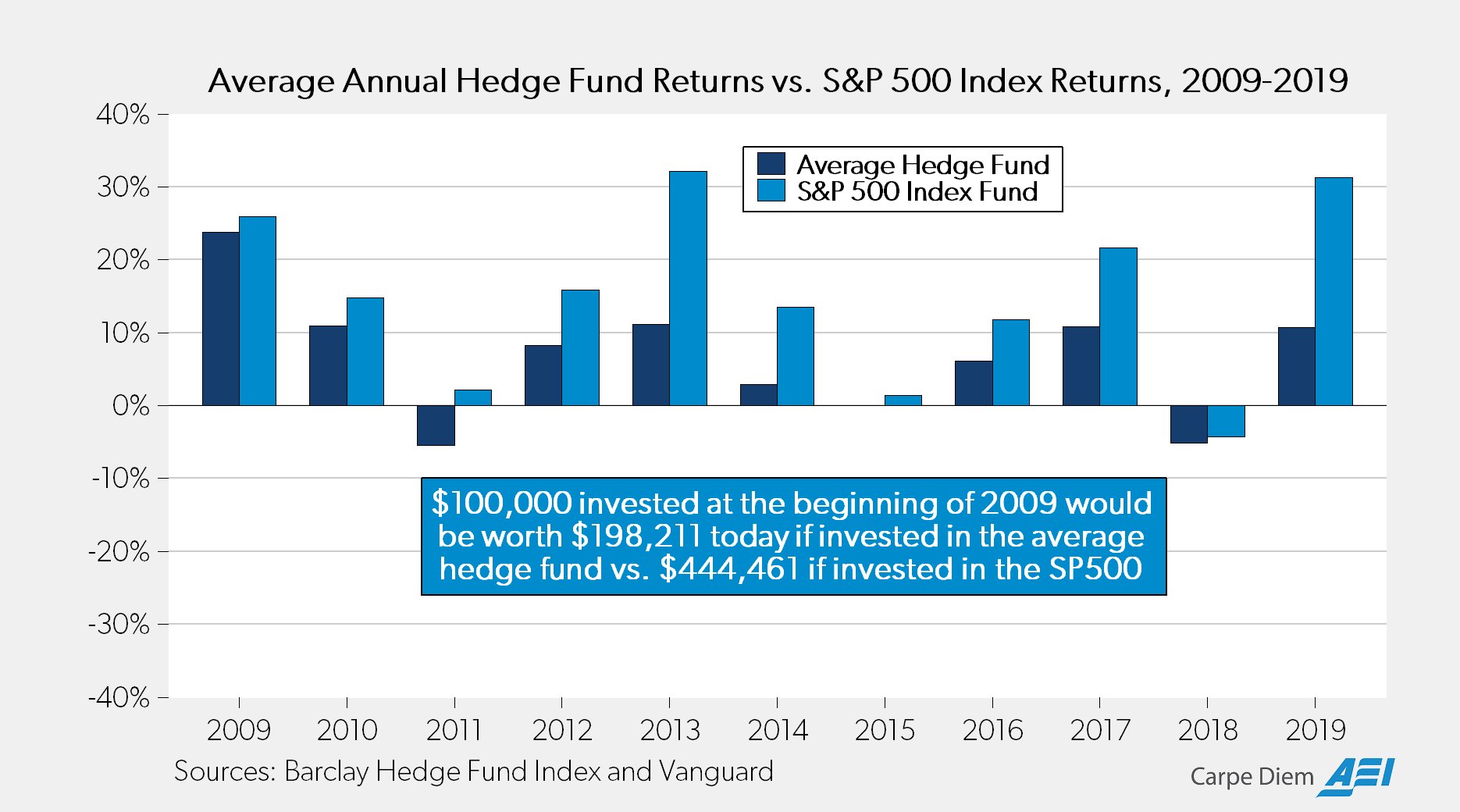

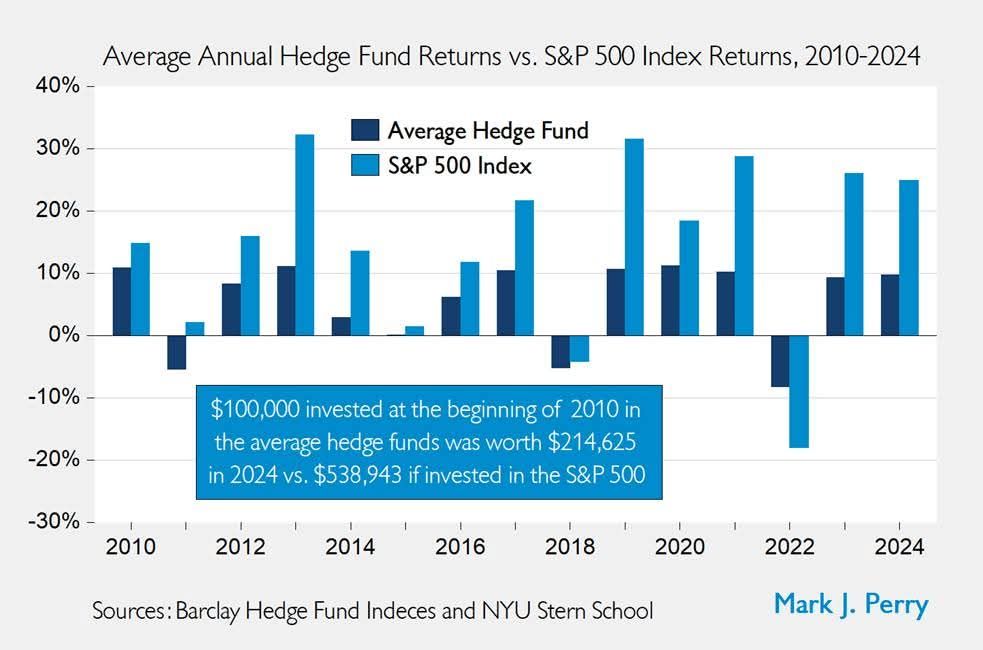

Why do Hedge Funds survive?

15 Mar 2020 Leave a comment

in entrepreneurship, financial economics Tags: active investing, efficient markets hypothesis, passive investing

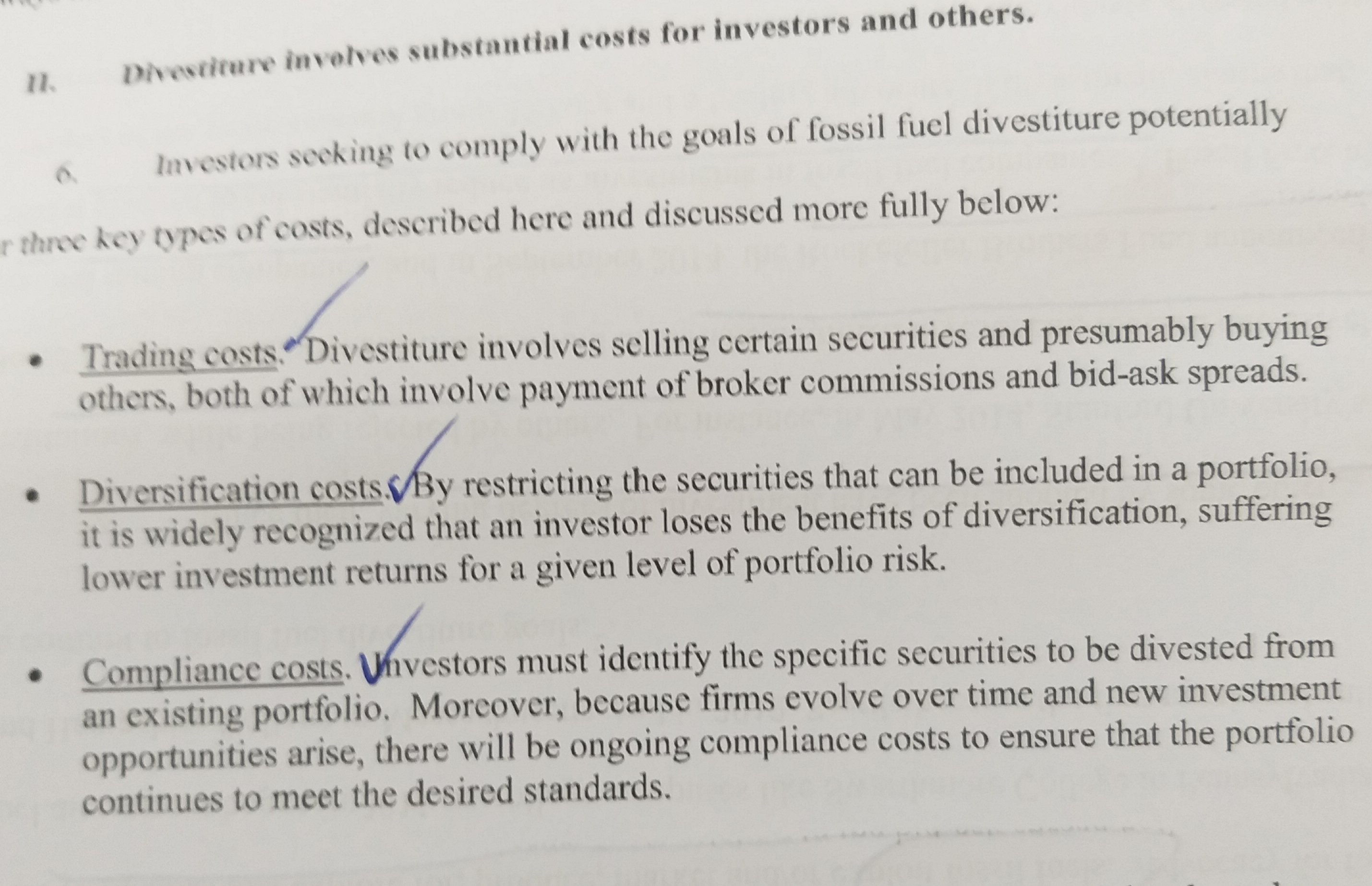

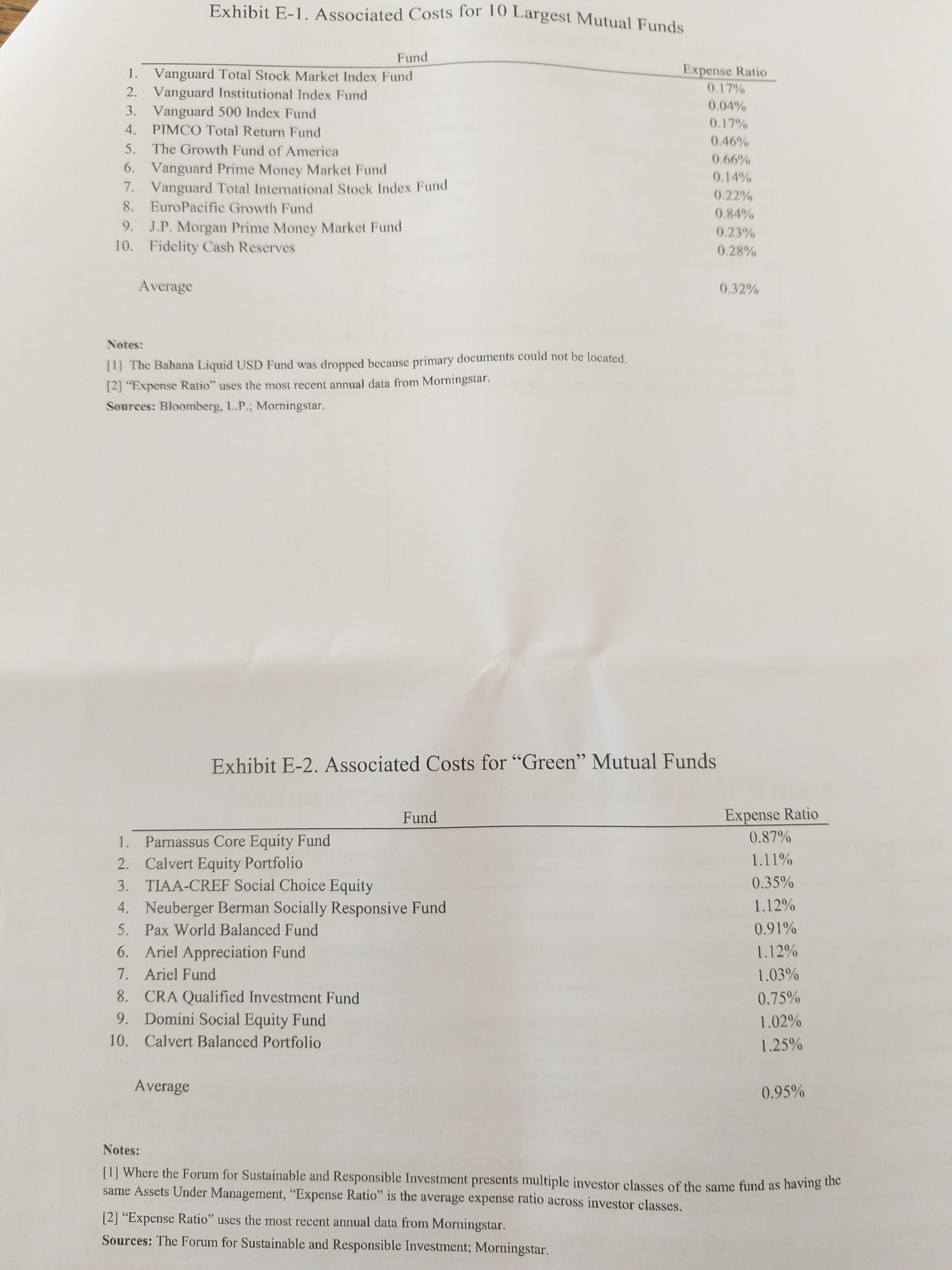

It isn’t cheap being @NZGreen @Greens @GreenpeaceAP #globalwarming #climateemergency @mfe_news @jamespeshaw

12 Mar 2020 Leave a comment

It is not easy being a Green investor @NZGreens @jamespeshaw @mfe_news @Greenpeace

02 Mar 2020 1 Comment

in energy economics, environmental economics, financial economics, global warming, politics - New Zealand, Public Choice Tags: active investing, efficient markets hypothesis, expressive voting, passive investing, pessimism bias, rational irrationality, The fatal conceit, virtue signaling

Recent Comments