From Sergio Correia, Stephan Luck, and Emil Verner: Why do banks fail? We create a panel covering most commercial banks from 1865 through 2023 to study the history of failing banks in the United States. Failing banks are characterized by rising asset losses, deteriorating solvency, and an increasing reliance on expensive non-core funding. Commonalities across…

Failing Banks

Failing Banks

11 Sep 2024 Leave a comment

in business cycles, economic history, financial economics, global financial crisis (GFC), great depression, great recession, macroeconomics, monetary economics, politics - USA Tags: bank panics, bank runs

Contra Ben Bernanke It’s A Wonderful Life bank run due to absent-minded Uncle Billy’s embezzlement @NZTreasury @reservebankNZ

14 Mar 2020 Leave a comment

in economic history, economics of crime, industrial organisation, law and economics, macroeconomics, monetary economics, movies, survivor principle Tags: bank runs

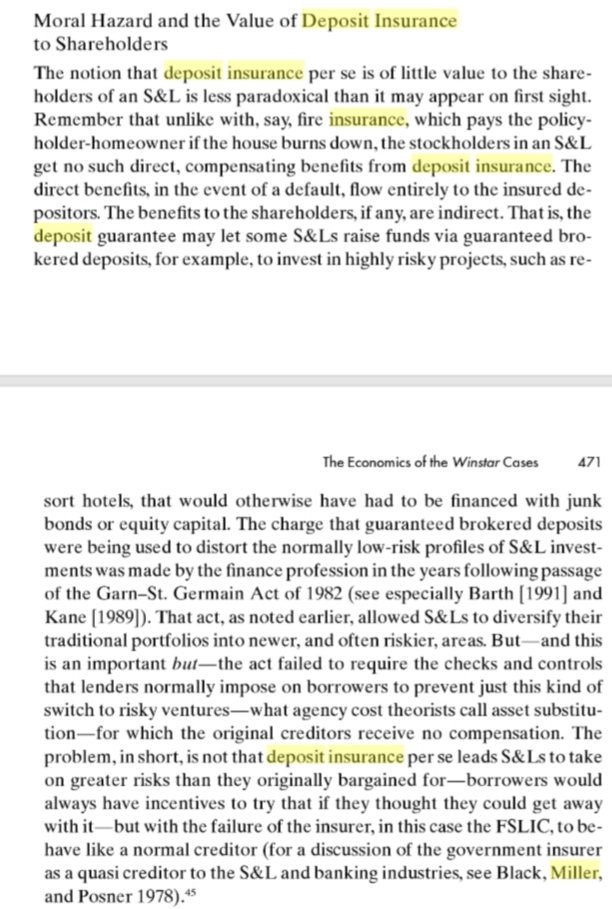

Debate: Abolish Banking Insurance?

18 Feb 2020 Leave a comment

in Austrian economics, business cycles, comparative institutional analysis, economic history, economics of information, economics of regulation, financial economics, industrial organisation, law and economics, macroeconomics, monetary economics, privatisation, survivor principle Tags: bank panics, bank runs, deposit insurance

19th century Bank of England was well on to stigma effects in a banking crisis

09 Feb 2020 Leave a comment

in applied price theory, business cycles, economic history, economics of bureaucracy, economics of information, fisheries economics, industrial organisation, law and economics, macroeconomics, monetary economics, property rights, Public Choice, survivor principle Tags: adverse selection, asymmetric information, bank runs, banking crises, banking panics, lender of last resort, monetary policy, screening

.@cwcalomiris “Thinking Historically about Banking Crises and Bailouts”

20 Jan 2020 Leave a comment

in applied price theory, business cycles, econometerics, economic history, economics of information, economics of regulation, entrepreneurship, industrial organisation, law and economics, macroeconomics, monetary economics, politics - USA, Public Choice, public economics, rentseeking Tags: bank panics, bank runs, deposit insurance

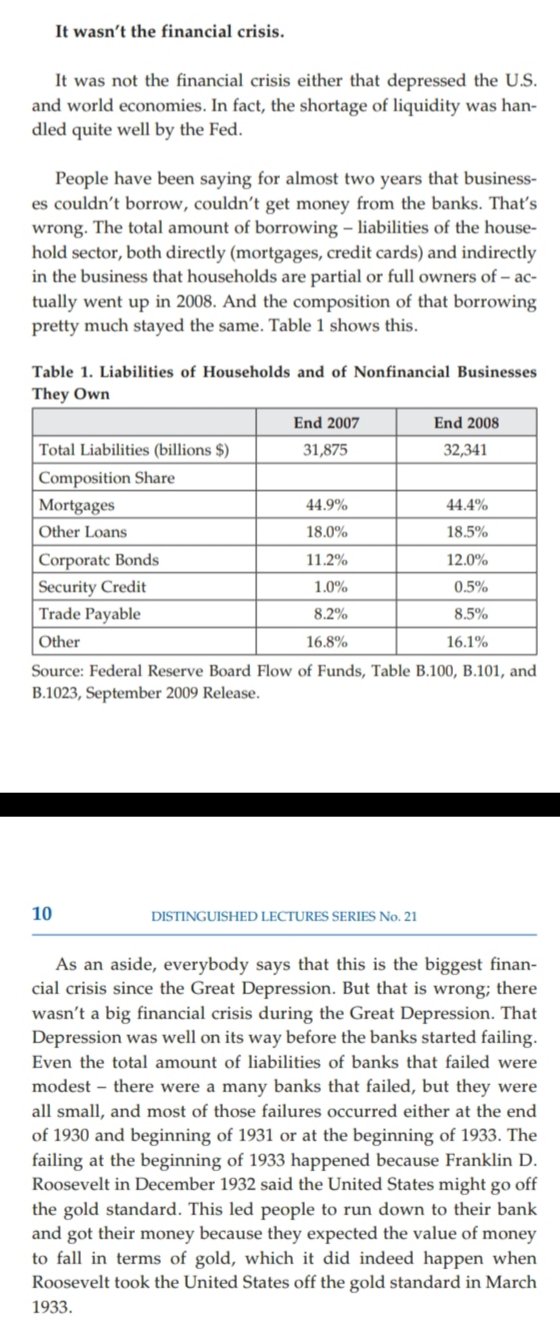

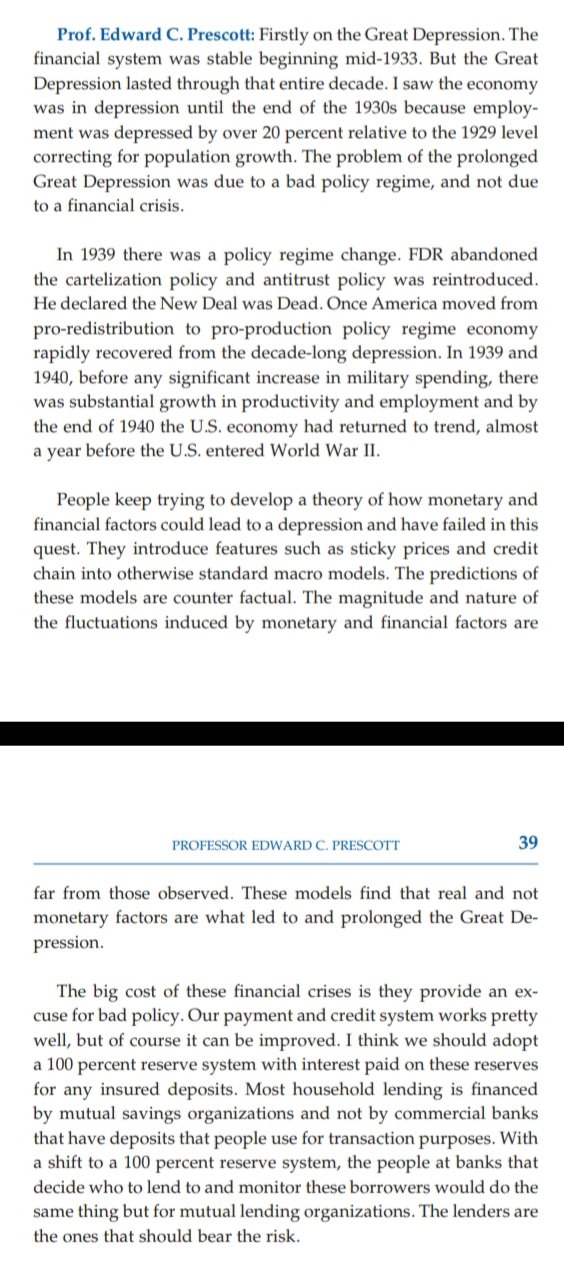

The day Minsky macroeconomics died! Instability can’t be fixed so easily?

23 Nov 2019 Leave a comment

in budget deficits, business cycles, economic history, Euro crisis, financial economics, global financial crisis (GFC), great depression, great recession, macroeconomics, monetarism, monetary economics, Public Choice Tags: asymmetric information, bank runs, banking panics, deposit insurance, economics of central banking, Keynesian macroeconomics, moral hazard, Post-Keynesian macroeconomics

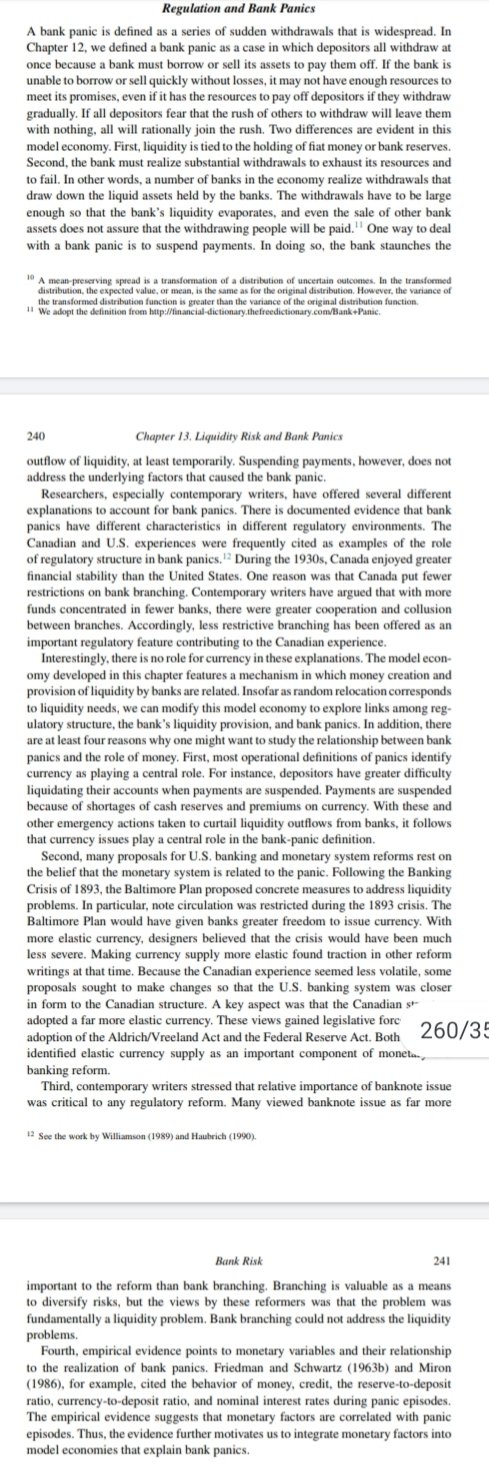

35 years later: Diamond-Dybvig model of bank runs

16 Oct 2019 Leave a comment

in applied price theory, applied welfare economics, business cycles, comparative institutional analysis, economic growth, economic history, global financial crisis (GFC), great depression, great recession, income redistribution, industrial organisation, law and economics, macroeconomics, monetary economics, property rights, Public Choice, rentseeking, survivor principle Tags: bank panics, bank runs, deposit insurance

Recent Comments