That is the topic of my latest Bloomberg column, here is one excerpt: A recent study finds that, of all domestic subsidies, the most effective involve replacing the dirty production of electricity with the cleaner production of electricity. In practice, that means subsidies or tax credits for solar and wind power. Those are more than twice as effective as […]

Which are the most effective subsidies for green energy?

Which are the most effective subsidies for green energy?

26 Jul 2024 Leave a comment

in applied price theory, applied welfare economics, economics of regulation, energy economics, environmental economics, global warming, politics - Australia, politics - New Zealand, politics - USA, Public Choice, public economics, rentseeking Tags: cap and trade, carbon tax, climate alarmism

Ross McKitrick explains carbon taxes and cap & trade

05 Mar 2020 Leave a comment

in economics of bureaucracy, economics of regulation, energy economics, environmental economics, global warming, income redistribution, Public Choice, rentseeking Tags: cap and trade

The facts of carbon taxes – @RossMcKitrick

06 Jan 2020 Leave a comment

in applied welfare economics, comparative institutional analysis, energy economics, environmental economics, global warming, Public Choice Tags: cap and trade, carbon tax, climate alarmism

Ross McKitrick: a truth-based cap-and-trade linked to tropical troposphere temperature, which you can then short if a skeptic or go long if an alarmist

07 Dec 2019 Leave a comment

in applied welfare economics, comparative institutional analysis, constitutional political economy, energy economics, environmental economics, global warming, Public Choice, public economics, rentseeking Tags: cap and trade, carbon pricing, green rent seeking

The opportunity cost of expressive politics: fossil fuels disinvestment versus actually doing something that might help

17 Jun 2015 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, environmental economics, global warming, politics - Australia, politics - New Zealand, politics - USA, Public Choice, rentseeking Tags: cap and trade, carbon tax, carbon trading, climate alarmism, expressive voting, fossil fuel disinvestment, global warming, rational irrationality, Robert Stavins

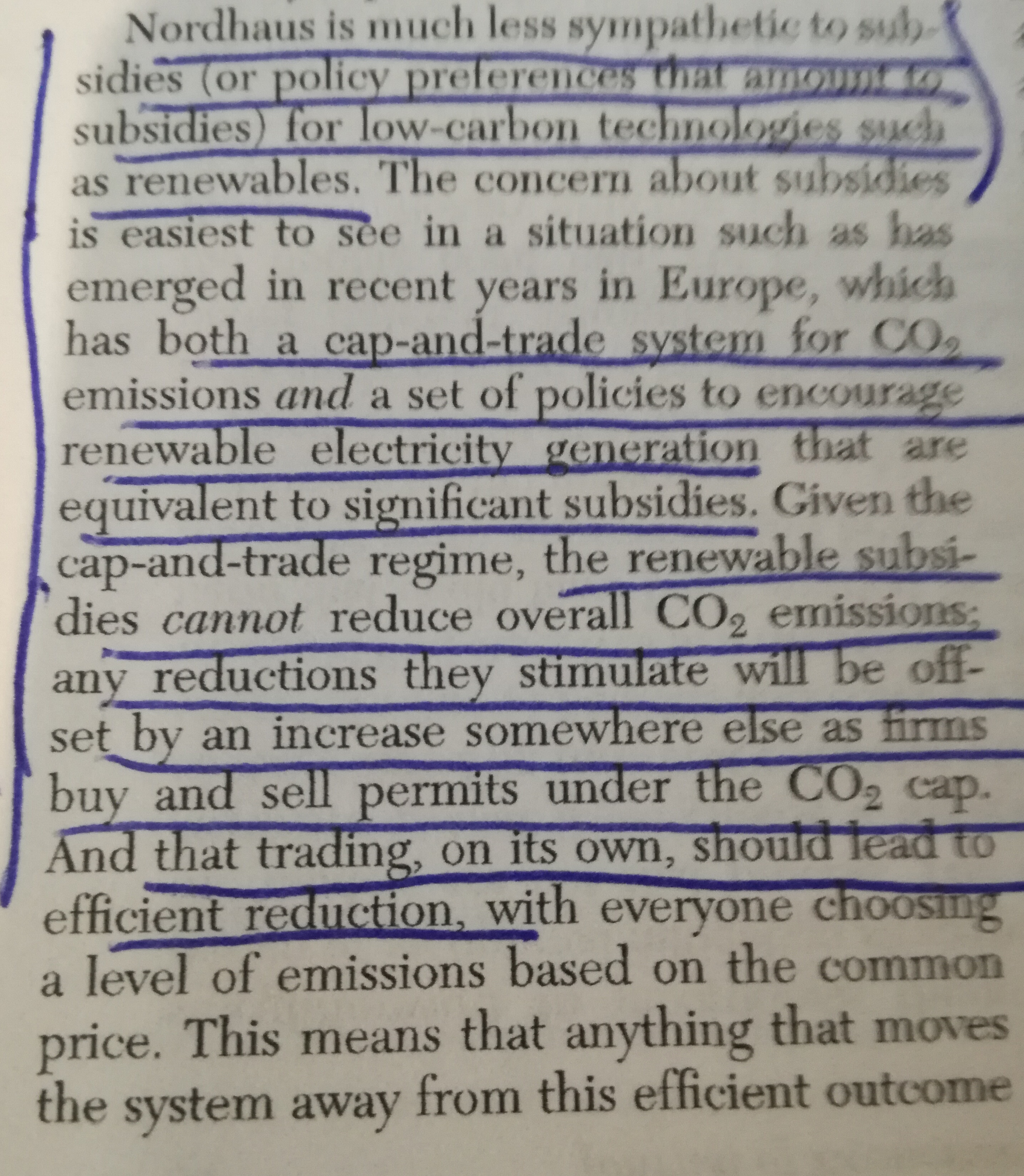

There are major differences between a carbon tax and emissions trading.

29 Jun 2014 Leave a comment

in environmental economics, global warming Tags: cap and trade, carbon tax, emissions trading, global warming, rent seeking

- The history of cap-and-trade systems suggests that the carbon emission allowances are given away to carbon emitters, which they can use or sell at market prices. The prices of energy products would rise, but governments would collect no revenue to reduce other taxes and compensate consumers.

- Agreement on a global cap-and-trade system is hard to imagine. A global carbon tax is easier to negotiate. All nations use a carbon tax to raise revenue and use the proceeds to compensate consumers with tax relief. No money needs to change hands across national borders.

- A carbon tax is now being championed by groups and political parties that previously would deny to their graves that taxes have significant incentive effects, and that taxes do not affect the supply of labour or the rate and direction of investment to any important degree. It is suspicious that groups and parties that deny tax cuts increase economic growth take time out from these foundational beliefs to support a tax because of the incentives it gives to reduce carbon consumption. They want it both ways.

National emissions regulations can have perverse global effects.

16 Jun 2014 Leave a comment

in applied price theory, environmental economics, environmentalism, global warming Tags: Brayan Caplan, cap and trade, carbon tax

If relatively clean countries switch to clean energy (via command-and-control regulations, cap-and-trade, pollution taxes, or green norms), fossil fuels don’t vanish. Instead, their world price falls – encouraging further consumption in relatively dirty countries. The net effect?

Recent Comments