via Friday Funny – the scientific method | Watts Up With That?.

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

24 May 2014 Leave a comment

in climate change, environmentalism Tags: data mining

07 May 2014 Leave a comment

in econometerics, history of economic thought Tags: data mining, publication bias

A mathematician, an economist and an econometrician apply for the same job.

The interviewer calls in the mathematician and asks

What do two plus two equal?

The mathematician replies

Four.

The interviewer asks

Four, exactly?

The mathematician looks at the interviewer incredulously and says

Yes, four, exactly.

Then the interviewer calls in the economist and asks the same question

What do two plus two equal?

The economist says

On average, four – give or take ten per cent, but on average, four.

Then the interviewer calls in the econometrician and poses the same question “What do two plus two equal?”

The econometrician gets up, locks the door, closes the shade, sits down next to the interviewer and says,

What do you want it to equal?

Three econometricians went out hunting, and came across a large deer.

The first econometrician fired, but missed, by a meter to the left.

The second econometrician fired, but also missed, by a meter to the right.

The third econometrician didn’t fire, but shouted in triumph,

We got it! We got it!

26 Apr 2014 Leave a comment

in economics Tags: data mining, publication bias

19 Apr 2014 Leave a comment

in economics, personnel economics, politics Tags: data mining, fraud

Economics got on just fine before the attack of the econometricians and their data mining and publication bias:

From ‘The Scientific Illusion in Empirical Macroeconomics’, Lawrence H. Summers , The Scandinavian Journal of Economics, Vol. 93, No. 2, Proceedings of a Conference on New Approaches to Empirical Macroeconomics. (June 1991), pp. 129-148.

A baser reason for holding out against the latest empirical is in Most Published Research Findings Are False, John Ioannidis says that:

There is increasing concern that in modern research, false findings may be the majority or even the vast majority of published research claims. However, this should not be surprising. It can be proven that most claimed research findings are false

Ioannidis goes on the say that

Simulations show that for most study designs and settings, it is more likely for a research claim to be false than true. Ioannidis also says that for many current scientific fields, claimed research findings may often be simply accurate measures of the prevailing bias.

Now let The Guardian finish matters with “False positives: fraud and misconduct are threatening scientific research: High-profile cases and modern technology are putting scientific deceit under the microscope”:

Cases of scientific misconduct tend to hit the headlines precisely because scientists are supposed to occupy a moral high ground when it comes to the search for truth about nature.

The scientific method developed as a way to weed out human bias. But scientists, like anyone else, can be prone to bias in their bid for a place in the history books.

Increasing competition for shrinking government budgets for research and the disproportionately large rewards for publishing in the best journals have exacerbated the temptation to fudge results or ignore inconvenient data.

Massaged results can send other researchers down the wrong track, wasting time and money trying to replicate them. Worse, in medicine, it can delay the development of life-saving treatments or prolong the use of therapies that are ineffective or dangerous.

Malpractice comes to light rarely, perhaps because scientific fraud is often easy to perpetrate but hard to uncover.

16 Apr 2014 Leave a comment

in global financial crisis (GFC), great recession, macroeconomics, Milton Friedman Tags: data mining, Edward Leamer, forecasting, lags on monetary policy

Most early discussions argued against econometric forecasting in principle:

A long tradition argued that social relationships were too complex, too multifarious and too infected with capricious human choices to generate enduring, stable relationships that could be estimated.

These objections came before Hayek’s point that much of all social knowledge is not capable of summation in statistics or even language.

The limitations of forecasting are well-known. Forecasts are conditional on a number of variables; there are important unresolved analytical differences about the operation of the economy; and large uncertainties about the size and timing of responses to macroeconomic changes. Shocks to the output, prices, employment and other variables are partly permanent and partly transitory.

At the practical level, forecasting requires that there are regularities on which to base models, such regularities are informative about the future and these regularities are encapsulated in the selected forecasting model.

We have very little reliable information about the distribution of shocks or about how the distributions change over time. Forecast errors arise from changes in the parameters in the model, mis-specification of the model, estimation uncertainty, mis-measurement of the initial conditions and error accumulation.

In the 1980s, data mining and publications bias were so strong and statistical inferences were so fragile that Ed Leamer’s 1983 Let’s Take the Con out of Econometrics paper made up-and-coming applied economists despair for their professional field and for their own careers:

The econometric art as it is practiced at the computer terminal involves fitting many, perhaps thousands, of statistical models. One or several that the researcher finds pleasing are selected for reporting purposes.

This search for a model is often well intentioned, but there can be no doubt that such a specification search invalidates the traditional theories of inference….

[A]ll the concepts of traditional theory…utterly lose their meaning by the time an applied researcher pulls from the bramble of computer output the one thorn of a model he likes best, the one he chooses to portray as a rose.

… This is a sad and decidedly unscientific state of affairs we find ourselves in.

Hardly anyone takes data analyses seriously.

Or perhaps more accurately, hardly anyone takes anyone else’s data analyses seriously.

Like elaborately plumed birds who have long since lost the ability to procreate but not the desire, we preen and strut and display our t-values [which measure statistical significance].

Leamer still doubts the progress towards techniques that separate sturdy from fragile inferences. Economists by and large simply do not want to hear that they cannot make major conclusions from the data sets. But not that they really do, but that is for a forthcoming post.

Before the great moderation spread wide, Brunner and Meltzer found that in the 1970s and 1980s, the 95% confidence intervals on next year’s forecasts for Gross Domestic Product and the Consumer Price Index are such that government and private forecasters in the USA and Europe could not distinguish between a recession and a boom, nor say whether inflation will be zero or ten per cent.

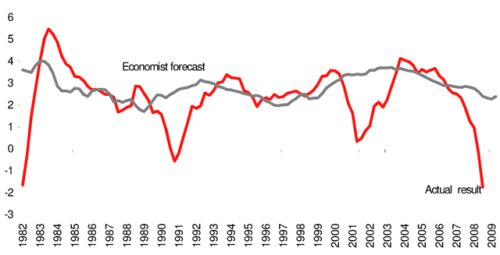

A review this week by Ahir and Lounganishows found that recent forecasting by the private and public sector has not improved:

none of the 62 recessions in 2008–09 was predicted as the previous year was drawing to a close.

Figure 1. Number of recessions predicted by September of the previous year

Source: Ahir and Loungani 2014, “There will be growth in the spring”: How well do economists predict turning points?” http://www.voxeu.org/

A policy-maker who adjusts policy based on forecasts for the following year has little reason to be confident that he has changed policy in the right direction.

While at graduate school, I wrote what was published as Official Economic Forecasting Errors in Australia 1983-96.

Australian Treasury forecasting errors were so large relative to the mean annual rate of change in real GDP and the inflation rate that, on average, forecasters could not distinguish slow growth from a deep recession or stable prices from moderate inflation.

The biography of Paul Keating by Edwards suggested that the Government of the day was well aware of the poor value of forecasts. So much so that forecasts may not have actually played a significant role in monetary policy making in Australia in the late 1980s onwards. John Stone said this to Keating when he assumed office as Treasurer in 1983:

As you know, we (and I in particular) have never had much faith in forecasting.

Not infrequently, our forecasts turn out to be seriously wrong.

… We simply do the best we can, in as professional manner as we can — and, if it is any consolation, no one seems to be able to do any better, at least in the long haul.

We always emphasize the uncertainties that attach to the forecasts — but we cannot ensure that such qualifications are heeded and plainly they often are not

To cast my results in Milton Friedman’s nomenclature for monetary lags, the recognition lag on a forecasting based monetary policy appears to be infinite because forecasters do not know if there will be a recession or 10% inflation afoot when their monetary policy changes take hold in 18 to 24 months.

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Scholarly commentary on law, economics, and more

Beatrice Cherrier's blog

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Why Evolution is True is a blog written by Jerry Coyne, centered on evolution and biology but also dealing with diverse topics like politics, culture, and cats.

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

A rural perspective with a blue tint by Ele Ludemann

DPF's Kiwiblog - Fomenting Happy Mischief since 2003

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

The world's most viewed site on global warming and climate change

Tim Harding's writings on rationality, informal logic and skepticism

A window into Doc Freiberger's library

Let's examine hard decisions!

Commentary on monetary policy in the spirit of R. G. Hawtrey

Thoughts on public policy and the media

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Politics and the economy

A blog (primarily) on Canadian and Commonwealth political history and institutions

Reading between the lines, and underneath the hype.

Economics, and such stuff as dreams are made on

"The British constitution has always been puzzling, and always will be." --Queen Elizabeth II

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

WORLD WAR II, MUSIC, HISTORY, HOLOCAUST

Undisciplined scholar, recovering academic

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Res ipsa loquitur - The thing itself speaks

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Researching the House of Commons, 1832-1868

Articles and research from the History of Parliament Trust

Reflections on books and art

Posts on the History of Law, Crime, and Justice

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Exploring the Monarchs of Europe

Cutting edge science you can dice with

Small Steps Toward A Much Better World

“We do not believe any group of men adequate enough or wise enough to operate without scrutiny or without criticism. We know that the only way to avoid error is to detect it, that the only way to detect it is to be free to inquire. We know that in secrecy error undetected will flourish and subvert”. - J Robert Oppenheimer.

The truth about the great wind power fraud - we're not here to debate the wind industry, we're here to destroy it.

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Economics, public policy, monetary policy, financial regulation, with a New Zealand perspective

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Restraining Government in America and Around the World

Recent Comments