LPL Financial analyzed 25 major geopolitical episodes, dating back to Japan’s 1941 attack on Pearl Harbor. “Total drawdowns around these events have been fairly limited,” Jeff Buchbinder, LPL’s chief equity strategist, wrote in a research note on Monday. (Full recoveries often “take only a few weeks to a couple of months,” he added.) Deutsche Bank analysts […]

Markets are forward-looking

Markets are forward-looking

18 Jun 2025 1 Comment

in applied price theory, defence economics, econometerics, economic growth, economic history, financial economics, macroeconomics, market efficiency, politics - USA, war and peace Tags: efficient markets hypothesis, World War II

Beating the market

23 Mar 2025 Leave a comment

in econometerics, economics of information, entrepreneurship, financial economics Tags: active investing, efficient markets hypothesis, passive investing

SEC Climate Risk Rule is Entrapment

11 Mar 2025 Leave a comment

in economic history, economics of climate change, economics of regulation, environmental economics, environmentalism, financial economics, global warming, law and economics, politics - USA, property rights Tags: climate activists, efficient markets hypothesis

Stone Washington and William Happer explain the nefarious and ill-advised decree in their article SEC’s Climate Risk Disclosure Rule Would Compel Companies to Make Scientifically False and Misleading Disclosures. Excerpts in italics with my bolds and added images. In March last year, the Securities and Exchange Commission issued its climate risk disclosure rule, called “The […]

SEC Climate Risk Rule is Entrapment

BP Faces “Existential Crisis” After Ruinous Attempt to Go Green

02 Mar 2025 Leave a comment

in applied price theory, economics of climate change, energy economics, entrepreneurship, environmental economics, environmentalism, financial economics, global warming, industrial organisation, politics - USA, survivor principle Tags: 2024 presidential election, climate activists, climate alarmism, efficient markets hypothesis, greenwashing

BP’s green pivot has backfired spectacularly, hammering profits and leaving the company vulnerable to a hedge fund siege, writes Jonathan Leake in the Telegraph.

BP Faces “Existential Crisis” After Ruinous Attempt to Go Green

Mandated Board Diversity Reduces Firm Value

27 Feb 2025 Leave a comment

in applied price theory, discrimination, econometerics, economics of regulation, financial economics, gender, industrial organisation, labour economics, occupational choice, politics - USA Tags: efficient markets hypothesis, sex discrimination

Jon Klick finds that when courts in CA surprisingly invalidated a set of DEI laws, the market value of firms subject to those laws increased: California mandated that firms headquartered in the state include women (SB 826) and underrepresented minorities (AB 979) on their corporate boards. These laws, passed in 2018 and 2020 respectively, were […]

Mandated Board Diversity Reduces Firm Value

Interview with Eugene Fama: For Whom are Financial Markets Efficient?

28 Jan 2025 Leave a comment

in applied price theory, economics of information, entrepreneurship, financial economics Tags: efficient markets hypothesis, Internet

Joe Walker interviews Eugene Fama (Nobel ’13) with the title “For Whom is the Market Efficient?” (The Joe Walker podcast, December 31, 2024). Here are some bits and pieces of their exchange that caught my eye. Are financial markets efficient? WALKER: Gene, I was talking with a few friends who work in high finance in preparation…

Interview with Eugene Fama: For Whom are Financial Markets Efficient?

The Tennessee-BlackRock Settlement: A Win for Transparency and Investor Interests

24 Jan 2025 Leave a comment

in economics of climate change, economics of regulation, energy economics, environmental economics, environmentalism, financial economics, global warming, law and economics, politics - USA, property rights Tags: active investing, climate activists, climate alarmism, efficient markets hypothesis

While no settlement is perfect, this agreement represents a significant victory for transparency, accountability, and the integrity of financial markets. For Tennessee investors—and indeed, all investors across the country—it’s a step in the right direction.

The Tennessee-BlackRock Settlement: A Win for Transparency and Investor Interests

The Little Book of Common Sense Investing

24 Jan 2025 Leave a comment

in applied price theory, financial economics Tags: active investing, efficient markets hypothesis, passive investing

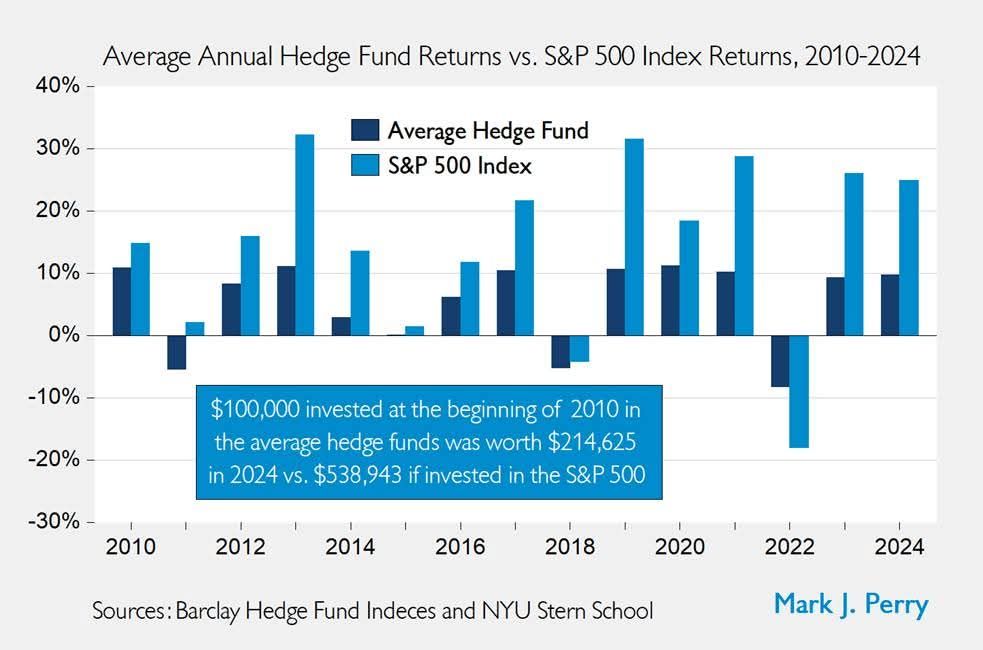

John Bogle, the founder of Vanguard, wrote a short book in 2006 that explains his investment philosophy. I can sum it up at much less than book length: the best investment advice for almost everyone is to buy and hold a diversified, low-fee fund that tracks an index like the S&P 500. Of course, a […]

The Little Book of Common Sense Investing

Is ESG investing illegal? In TX it is.

13 Jan 2025 Leave a comment

in financial economics, politics - USA Tags: efficient markets hypothesis, regressive left

Breaking: …US District Judge Reed O’Connor found that the airline breached its fiduciary duty … by prioritizing ESG considerations over the financial interests of participants. … The court criticized American Airlines for allowing its asset manager, BlackRock, to advance goals unrelated to maximizing returns for plan participants. “ERISA does not permit a fiduciary to pursue…

Is ESG investing illegal? In TX it is.

‘A Huge Win’: Woke ‘Cartel’ Of Financial Giants Dealt Death Blow 11 Days Before Trump Takes Office

13 Jan 2025 Leave a comment

in applied price theory, economics of climate change, energy economics, entrepreneurship, environmental economics, environmentalism, financial economics, global warming, politics - USA, Public Choice, rentseeking Tags: efficient markets hypothesis

“The news of BlackRock’s departure from NZAM should be music to the ears of every American consumer,” Will Hild, executive director of conservative nonprofit Consumers’ Research, told the Daily Caller News Foundation. “NZAM is an illegitimate cartel of asset managers pushing harmful and costly net zero policies across the entire economy. The activities of NZAM and its members raise prices on Americans everywhere from the gas pump to the grocery store.”

‘A Huge Win’: Woke ‘Cartel’ Of Financial Giants Dealt Death Blow 11 Days Before Trump Takes Office

Prediction Markets As Investments

04 Jun 2024 Leave a comment

in applied price theory, financial economics Tags: efficient markets hypothesis

Supporters of prediction markets tend to emphasize how they are great tools for aggregating information to produce accurate forecasts. If you want to know e.g. who is likely to win the next election, you can watch every poll and listen to pundits for hours, or you can take ten seconds to check the odds. This […]

Prediction Markets As Investments

DON BRASH: BANKS AND CLIMATE CHANGE: THE LAW IS AN ASS

30 Mar 2024 Leave a comment

in energy economics, entrepreneurship, environmental economics, financial economics, global warming Tags: climate alarmism, efficient markets hypothesis

As everybody who is not blind and deaf is aware, there is a huge political preoccupation with climate change at the moment, a widespread (though by no means unanimous) belief that global temperatures are rising mainly as a result of the greenhouse gases created by humankind, and a strong view that all countries have a…

DON BRASH: BANKS AND CLIMATE CHANGE: THE LAW IS AN ASS

Real ESG

30 Oct 2023 Leave a comment

in financial economics Tags: efficient markets hypothesis

If you care about corporate social impact, start measuring consumer surplus. From the NBER:An Economic View of Corporate Social ImpactHunt Allcott, Giovanni Montanari, Bora Ozaltun & Brandon TanWORKING PAPER 31803ISSUE DATE October 2023The growing discussions of impact investing and stakeholder capitalism have increased interest in measuring companies’ social impact. We conceptualize corporate social impact as the…

Real ESG

How Congress Gets Rich from Insider Trading

13 Jun 2023 Leave a comment

in economics of crime, financial economics, law and economics, politics - USA, Public Choice Tags: efficient markets hypothesis, insider trading

Share market crashes

16 Jun 2022 Leave a comment

in economic history, financial economics Tags: efficient markets hypothesis

Recent Comments