Will @NZGreens @Greenpeace lead the way?

03 Sep 2019 Leave a comment

in energy economics, environmental economics, global warming Tags: Fossil Fuels, solar power, wind power

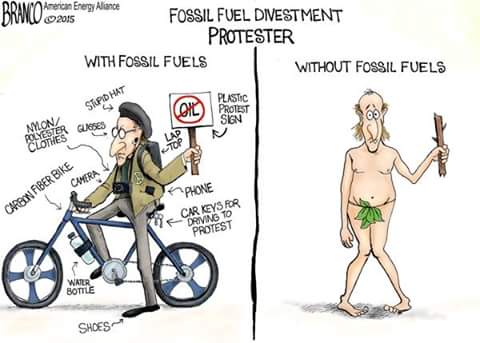

What does #EndOil mean for the anti-science left?

02 Jun 2019 Leave a comment

in energy economics, environmental economics, global warming Tags: Fossil Fuels, The fatal conceit

The role of fossil fuels in The Great Escape

30 Dec 2016 Leave a comment

in development economics, economic history, energy economics, environmental economics, growth miracles Tags: energy poverty, Fossil Fuels, Oil prices, The Great Escape

Alex Epstein – The Moral Case for Fossil Fuels

03 Dec 2016 Leave a comment

in energy economics Tags: Fossil Fuels

Fossil Fuels: The Greenest Energy

20 Nov 2016 Leave a comment

in economic history, energy economics, politics - Australia, politics - New Zealand, politics - USA Tags: Fossil Fuels

Fossil Fuels: The Greenest Energy #earthday @Oxfam

23 Apr 2016 Leave a comment

in economics of media and culture, energy economics, environmental economics, global warming Tags: Fossil Fuels

@RusselNorman Why 1.3 billion people without access to electricity can’t afford to divest from fossil fuels

20 Feb 2016 Leave a comment

in applied welfare economics, economics, energy economics, environmental economics, global warming, growth disasters, growth miracles Tags: fossil fuel disinvestment, Fossil Fuels, rational irrationality

@RusselNorman @JulieAnneGenter a hedge fund specialises in shorting renewable energy shares @Greenpeace

03 Feb 2016 Leave a comment

in defence economics, economic history, economics of regulation, energy economics, entrepreneurship, environmental economics, financial economics, global warming Tags: active investing, disinvestment, entrepreneurial alertness, ethical investing, Fossil Fuels, green rentseeking, hedge funds, passive investing, renewable energy, solar power, Vice Fund, wind power

Just as the Vice Fund specialises in investing in tobacco, alcohol, gaming and defence shares, Cool Futures Funds Management is starting-up to specialise in betting against global warming by shorting green stocks:

…instead of renewables being our energy future, they’re betting on the subsidies drying up and the whole industry collapsing; instead of fossil fuels being left in the ground as “stranded assets”.

An example of the nice little earners this hedge fund can come across is anticipating when particular investors will want to disinvest from fossil fuels.

When institutional investors ranging from universities to sovereign investment funds such as the New Zealand Superannuation Fund seek to disinvest from fossil fuels, that will be a good time to buy cheap shares.The

Is Paris the end of fossil fuel era?

04 Dec 2015 Leave a comment

in economic history, energy economics, environmental economics, global warming Tags: climate alarmism, Fossil Fuels, global warming, nuclear power, renewable energy, solar energy, wind power

Matt Ridley on How Fossil Fuels are Greening the Planet

26 Jul 2015 Leave a comment

in economic history, energy economics Tags: Fossil Fuels, The Great Enrichment, The Great Escape, The Great Fact

Fossil fuels and the Great Escape in winter

24 May 2015 Leave a comment

in economic history, energy economics, politics - Australia, politics - New Zealand, politics - USA, technological progress Tags: Fossil Fuels, The Great Fact

As Earth Day closes, let’s appreciate the fossil fuel treasures from Mother Nature | Carpe Diem Blog

22 Apr 2015 Leave a comment

in energy economics, entrepreneurship, environmental economics Tags: Earth Day, Fossil Fuels, renewable energy

Air quality has improved in the countries that use the most fossil fuels

27 Mar 2015 Leave a comment

in energy economics, environmental economics Tags: air pollution, Fossil Fuels, The Great Escape

Source: U.S. EPA National Emissions Inventory Air Pollutant Emissions Trends Data

via via 9 Graphs That Prove Using Fossil Fuels Hasn’t Harmed The Planet | The Daily Caller.

Fossil fuels will continue to provide most of the world’s energy, supplying 81% of global supply in 2035

01 Mar 2015 Leave a comment

in energy economics, environmental economics, global warming Tags: climate alarmism, Fossil Fuels, global warming

Is fossil fuels disinvestment a cheap or expensive futile gesture?

15 Feb 2015 Leave a comment

in environmentalism, financial economics, Public Choice Tags: expressive politics, Fossil Fuels, futile gestures, Global disinvestment day

It is actually expensive to divest from fossil fuels both from the trading costs of selling, and more particularly, continuously monitoring your portfolio to make sure that fossil fuel companies have not entered surreptitiously in the course of companies in your portfolio buying shares in other companies that have subsidiaries in the fossil fuel industry.

Fischel’s study bases its conclusions on a historical comparison of two hypothetical, diversified, value-weighted stock indices for the period 1965-2014. One index included typical fossil fuel stocks, the other did not. The result: The fund that excluded the fossil fuel investments performed worse than the one that included them. Adding in a variety of other factors — attitudes toward risk, compliance and transaction costs — the analysis suggests that the climate-friendly fund would have earned 23 percent less over the last 50 years.

The Guardian quotes studies that argue the following:

Here are some studies, not funded by the oil industry, which indicate recent divestment would, if anything, have had a positive impact on returns and can reduce investment risk

That actually makes their arguments a wee suspicious. Too good to be true. It’s too much of a happy coincidence that moral choices such as disinvestments are also profitable.

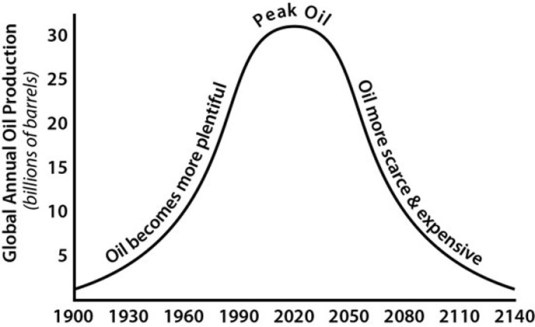

Indeed, if disinvestment was profitable, actively managed portfolios would already have disinvested or marked down the returns and exposure from those shares already to account for the risks of fossil fuel and the temporary profits of peak oil.

The environmental movement manages to believe in both peak oil – oil will run out in the next two decades or so – and global warming based on runaway carbon emissions for the rest of the century burning the increasingly expensive and increasingly scarce crude oil that had ran out a long time ago previously. Global warming will solve itself as long as we are willing to accept that the environmental movement is genuine in its predictions about peak oil.

At bottom, the Guardian is trying to argue that an actively managed portfolio offers superior returns to an index linked passive portfolio that minimises trading costs. Furthermore, that form of active management requires detailed monitoring of the entire portfolio to ensure that fossil fuel investments do not inadvertently re-enter through the investment decisions of each company in that portfolio.

I can’t remember whether its 70% or 80% of actively managed share portfolios fail to beat the market in any one year. The Guardian’s previously warned in its business pages about actively managed share portfolios swallowing up to 1/3rd of investment returns as management fees.

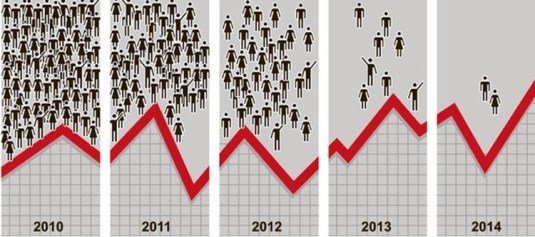

Figure 1: Who Routinely Trounces the Stock Market?

Actively managed portfolios fail to beat a passively managed portfolio with the same composition and diversification as the whole share market itself which trades in shares only for liquidity and to rebalance the portfolio to match new compositions of the share market. Just 2 out of 2,862 actively managed funds managed to beat the market five years a row in the US stock market.

Divestiture from fossil fuels is not a one-off act. There are continual compliance costs and an investment strategy that forecloses using a whole range of low-cost index linked passive investment share portfolio managers. That cannot be denied. . American University said that divesting from these companies would require that AU investments be withdrawn from index funds and commingled funds in favour of more actively managed funds [and] estimated this withdrawal would cause management fees to double.

Recent Comments