I lost a good 15 minutes of my life that I will not get back on my deathbed listening to some monetary cranks at a Meet the Candidates forum last night for the New Zealand general election.

Monetary cranks advocate boundless inflation and credit expansion as the patent medicine for all our economic ills:

those who have Found the Light about Money take up their pens and write, with a conviction, a persistence and a devotion otherwise only found among the disciples of a new religion.

It is easy to scoff at these productions: it is not so easy always to see exactly where they go wrong. It is natural that practical bankers, vaguely conscious that the projects of monetary cranks are dangerous to society, should cling in self-defence to the solid rock, or what they believe to be so, of tradition and accepted practice. But it is not open to the detached student of economics to take refuge from dangerous innovation in blind conservatism.

D.H. Robertson (1928)

Listening to these monetary cranks in the audience last night rates with the worst movies I have ever ever seen for time I want back my deathbed. I think the worst movie I have ever seen was Absolute Beginners starring David Bowie. After that it, might be Last Tango in Paris.

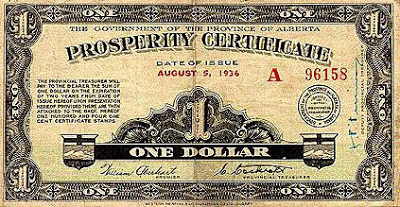

These particular monetary cranks with their obsessions about factional reserve banking are from the social credit party in New Zealand. They are followers of Major C.H. Douglas, whom Keynes referred to as a:

private, perhaps, but not a major in the brave army of heretics

Social credit and other monetary cranks believe that all the world’s problems will be sold if the reserve bank prints money and they seem to think that was really easy because there is a fractional reserve banking system.

No one in the room who knew better wanted to lose more time that they wanted back on their deathbed explaining why printing money doesn’t make you richer. The “money is wealth” error is the defining affliction of the monetary crank.

The good economist will know that money creation is no short-cut to wealth. Only the production of valued goods and services in a market which reflects the consumer’s willingness to pay can relieve poverty and promote prosperity. A people are prosperous to the extent they possess goods and services, not money. All the money in the world—paper or metallic—will still leave one starving if goods and services are not available.

Obviously, none of them were persuaded by the quantity theory of money: if you increase the supply of money without a matching increase in the rate of real growth in the production of goods and services, you’ll have more money chasing the same amount of goods so prices will go up. It’s called inflation. Printing money creates inflation.

There is a school of thought in economic school, the Austrian school of economics, does get excited about fractional reserve banking. The reason it does is to explain how fractional reserve banking creates inflation and promotes the business cycle.

A cycle of booms and busts is not looked upon as a good thing by the Austrian school of economics.

The Austrian school wants to get rid of fractional reserve banking as a way of reducing inflation and reducing the possibility of a loose monetary policy causing booms and busts in the economy.

These monetary cranks from social credit party honestly believed that printing more money will make you wealthier. Thankfully no one asked them to explain their position.

A few supporters of the monetary cranks in the audience asked other members of their views on the ideas of these monetary cranks. Sensibly, they all gave short answers that did not provoke them further and waste more of their precious life listening to them talk nonsense.

If printing money was a winner, as with any populist policy that has a half a chance of working, the parties of the centre-left and centre right would be all over it like flies to s…

Recent Comments