Sums up modern monetary theory too

23 Jan 2020 Leave a comment

in business cycles, economic history, economics of information, financial economics, fiscal policy, macroeconomics, monetary economics Tags: hyperinflation, monetary cranks, monetary policy

Brennan and Buchanan explain modern monetary theory in The Power to Tax (1980)

03 Jan 2020 Leave a comment

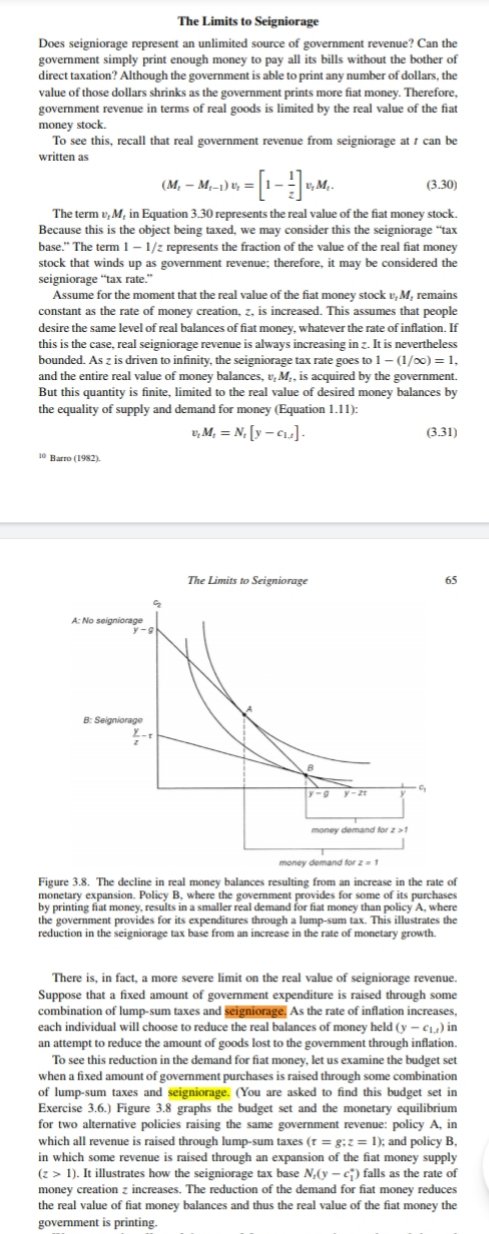

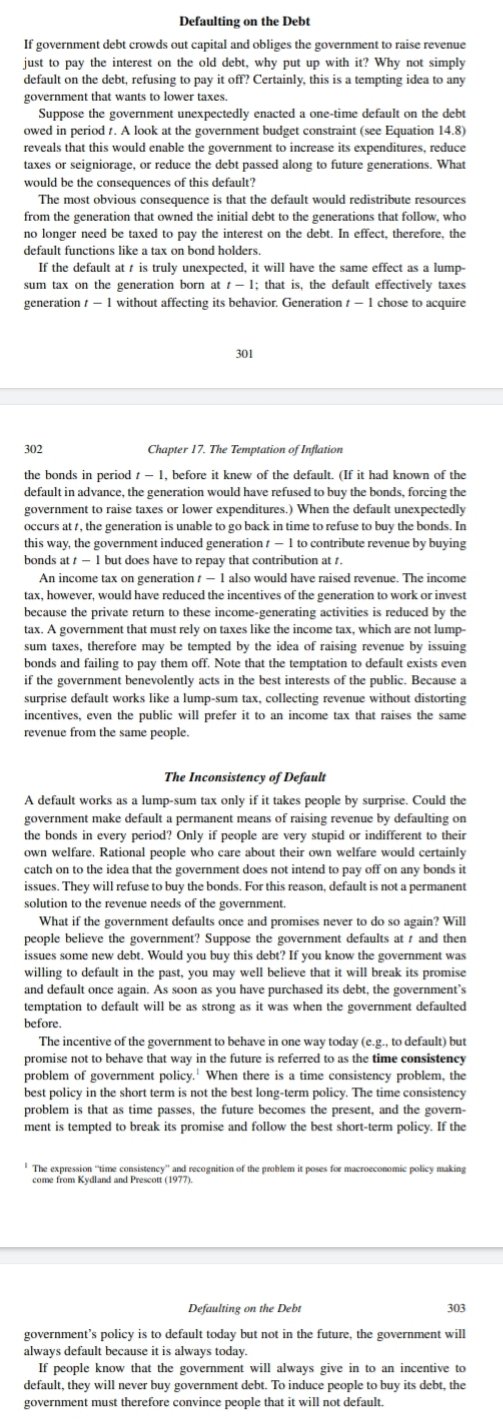

Champ and Freeman on modern monetary theory in action @AOC @BernieSanders

01 Jan 2020 Leave a comment

Champ and Freeman on modern monetary theory

31 Dec 2019 Leave a comment

in applied price theory, budget deficits, business cycles, economic history, fiscal policy, law and economics, macroeconomics, monetary economics, politics - USA, property rights Tags: 2020 presidential election, hyperinflation, monetary cranks, monetary policy

Maybe Freeman and Champ are explaining and refuting Modern Monetary Theory too

26 Aug 2019 Leave a comment

Declan Trott debunking debunker @ProfSteveKeen

08 Aug 2018 Leave a comment

in applied price theory, economics of information, economics of regulation, financial economics, history of economic thought, labour economics Tags: monetary cranks

Wouldn’t hold much hope for investors in a hedge fund founded by Steve Keen to put other’s money where his mouth is all the time

28 Apr 2018 Leave a comment

in business cycles, entrepreneurship, Euro crisis, financial economics, fiscal policy, global financial crisis (GFC), macroeconomics, monetary economics Tags: active investing, monetary cranks, revealed preference

Thomas Sargent v. @AnnPettifor on macroeconomics before the #GFC

24 Apr 2018 Leave a comment

in budget deficits, business cycles, fiscal policy, global financial crisis (GFC), great depression, great recession, macroeconomics, monetary economics, Public Choice Tags: monetary cranks, Thomas Sargent

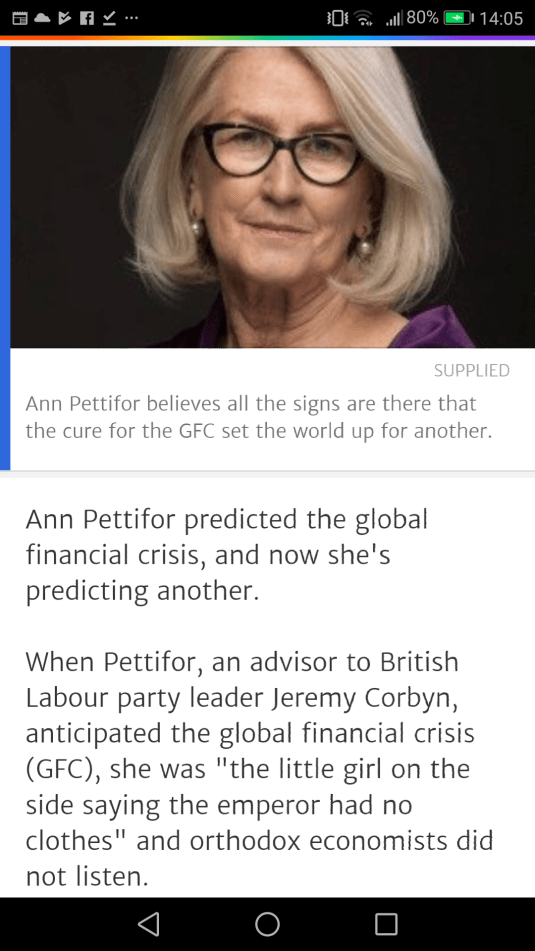

When will @AnnPettifor found a hedge fund to profit from putting other’s money where her mouth is rather than just her own retirement savings portfolio, which I am sure she did

23 Apr 2018 Leave a comment

in applied price theory, economics of information, entrepreneurship, fisheries economics, global financial crisis (GFC), macroeconomics, Marxist economics, monetary economics Tags: efficient markets hypothesis, entrepreneurial alertness, monetary cranks

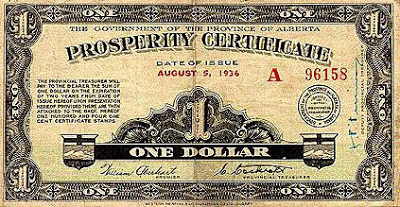

The Tobin tax or @RobinHoodTax makes those monetary cranks in the social credit movement look credible!

31 Mar 2015 1 Comment

in macroeconomics, Milton Friedman, monetary economics Tags: monetary cranks, Robin Hood tax, Tobin tax

The Case for a RobinHoodTax.org on Financial Transactions goo.gl/sbL2JL #RobinHoodTaxUSA #RHT300B http://t.co/4lTAe1OMcU—

Robin Hood Tax (@RobinHoodTax) August 07, 2015

Sweden led the way with Tobin taxes in 1986: a 0.5% tax on the purchase or sale of an equity security. The revenues from the Tobin tax were initially expected to be 1,500 million Swedish kronor per year.

The actual revenues collected did not amount to more than 80 million Swedish kronor in any year and the average was closer to 50 million. Bond trading fell by more than 80 percent and the options market died. A lesson never learned by Tobin tax advocates. As taxable trading volumes fell, so did revenues from capital gains taxes, entirely offsetting the revenues from the equity transactions tax.

During the first week of the Swedish tax, the volume of bond trading fell by 85%; futures trading fell by 98%; and the options trading market disappeared. Trading for over 50% of Swedish equities moved to London by 1990. A true Robin Hood tax: the Tobin tax robbed from the Swedish capital gains taxman and gave to the British stamp duty taxman.

The Tobin tax is named after U.S. economist James Tobin who in 1972 suggested taxing foreign-exchange trades to limit currency speculation.

The Tobin tax on foreign-exchange transactions was to provide a disincentive for traders to make so many international transfers of money. Tobin in 1978 wrote that currency speculation can have ‘serious and painful internal economic consequences’. Tobin said his Tobin tax idea was unfeasible in practice.

Tobin and his idea of taxing of currency speculation improves market efficiency is total nonsense in theory as Milton Friedman explained:

The empirical generalization about the prevalence of destabilizing speculation, which is what gives the theoretical proposition its interest, seems to be one of those propositions that has gained currency the way a rumour does— each man believes it because the next man does, and despite the absence of any substantial body of well documented evidence for it.

Is the Tobin tax designed to raise 35 billion euros in revenue, as promised by EU Tax Commissioner Algirdas Semeta, or is it designed to curb speculation as was the original motivation by James Tobin to propose this tax?

Many have extolled such a tax as a potential source of earmarked revenues for a variety of purposes. Both left-wing and right wing populists have advocated the Tobin tax or Robin Hood tax to replace existing taxes or raise additional revenue.

Both types of populist advocate replacing or augmenting the income tax with a stamp duty. Enough people are familiar when stamp duties to realise that such a tax won’t raise much revenue. But if you call the stamp duty a Robin Hood tax, the media release suspends critical judgement and cheers them on.

Advocates of the Robin Hood tax blithely assert that the revenue raised will approximately equal 0.5% of the existing share and foreign exchange market turnover with few changes in behaviour or speculative activity, despite the imposition of a tax designed to curb speculation and reduce the total number of transactions significantly.

The $3.7 trillion-a-year Eurobond market came into being after JFK imposed an interest-equalization tax in 1963 to reduce investment in foreign securities by U.S. investors and to ease a so called balance of payments deficit.

What is the point of a Tobin tax if you already have a capital gains tax?. New Zealand doesn’t have a capital gains tax but it does have a tax on assets bought with the intention of resale rather than long-term income.

Why do share markets fall after the announcement of a Tobin tax? Trading in a more stable market should be value enhancing and increase share prices? Ditto exporters and more stable currency prices etc.? Exporter share prices should increase because of less need to hedge? Numerous studies find a significant reduction in equity turnover following a stamp duty introduction.

I am sure that with the City of London as a global financial centre, the British are cheering on efforts of other EU members to sabotage their own financial markets with a Tobin tax. FX turnover in the City of London reached over $1.8 trillion every day in 2010, accounting for 36.7% of the global total. About half of European investment banking activity is conducted through London.

Ed Prescott estimates a large quantity of intermediated borrowing-lending between households – several times GDP. A large amount of resources is used in this intermediation – a conservative estimate is 4% of GNP.

Prescott also argued that the cost of transferring financial assets has fallen dramatically – from 2% towards zero on Vanguards Indexed ETF. The spread between borrowing and lending by households down – the spread on home mortgages was 3% in 1960s – now about 2%. None of these trends bode well for either a large tax base or growing tax base.

Another way to think about a Tobin tax is to consider it to be a tax on ATM withdrawals. There was such a debits tax on bank withdrawals of $.20 in my home State of Tasmania in the 1980s.

Naturally, a Tobin tax on ATM withdrawals is not a tax on any sort of real economic activity. People would simply make fewer ATM withdrawals and look for other ways to not use ATMs. It is routine for cash balances to respond to the time and other costs of replenishing money balances, and the fixed cost of using deposits for purchases.

Recent Comments