How many congressmen are convicted of crimes?

27 Jun 2015 Leave a comment

in economics of crime, law and economics, occupational choice, politics - USA, Public Choice Tags: official corruption, political corruption

Russians are surprisingly trusting of their politicians

12 May 2015 Leave a comment

A 2012 poll found that 62% of British voters agreed that “politicians tell lies all the time” econ.st/1ANQGPS http://t.co/3oH0FsHf0V—

The Economist (@EconEconomics) May 10, 2015

The World’s Most Corrupt Diplomats, As Told Through Parking Tickets

30 Aug 2014 Leave a comment

in development economics, economics of crime, growth disasters, growth miracles, law and economics, liberalism Tags: crime and punishment, diplomatic corruption, diplomatic parking tickets, official corruption

Kuwait tops the list, with 246 violations per diplomat, followed by Egypt (under Mubarack), Chad, Sudan and Bulgaria. At the bottom, with no violations, are 21 diverse countries including not just the ever-polite U.K., Japan and Canada.

Most U.N. diplomats have improved their parking behaviour since 2002 when the U.S. began withholding parking fines from foreign aid payments: violations fell by 90% immediately after the measure was passed.

The British High Commissioner to New Zealand, plate DC1, nearly ran me over at pedestrian crossing yesterday outside the Wellington library, so this is not an unbiased post.

He was travelling too fast to stop in the central business district, where the speed limit is 30 kilometres per hour. You should not speed near pedestrian crossings because people are trying to walk out onto it.

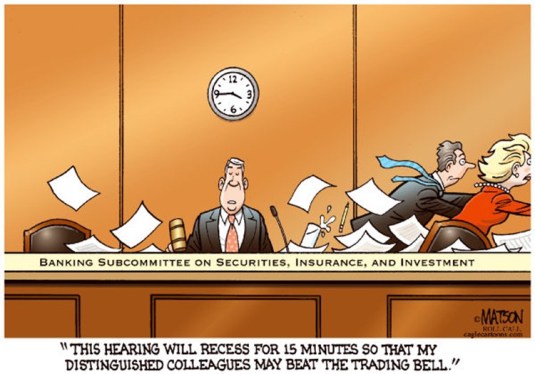

How to beat the share market

15 Aug 2014 Leave a comment

in economics of crime, financial economics, Public Choice, rentseeking Tags: insider trading, official corruption

Become a United States senator. Their share portfolios out-perform the best of the best hedge fund managers, and the best hedge fund manager was paid 3 1/2 billion dollars last year; to get on the list for the top hedge fund manager, you make at least $300 million a year. Good things that politicians know how to outperform them on their modest salaries and busy schedules of public engagements and parliamentary sittings.

Using the financial disclosures of politicians, "Abnormal Returns From the Common Stock Investments of Members of the U.S. House of Representatives," built model portfolios and charted their performance. They found that House members outperform the market by 6 percentage points. Senators do even better, the authors say, citing their own earlier research from 2004.

Senate portfolios "show some of the highest excess returns ever recorded over a long period of time, significantly outperforming even hedge fund managers," with gains that are "both economically large and statistically significant."

These results suggest that congressmen and senators have access to non-public information on particular businesses, industries or the economy as a whole and invest on the basis that information. The good returns of Senators and Congressmen last far too long to be no more than luck.

Recent Comments