Deirdre McCloskey and Alberto Mingardi: The Myth of the Entrepreneurial State

03 Nov 2020 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, economic history, economics of regulation, entrepreneurship, history of economic thought, industrial organisation, Public Choice, public economics, rentseeking, survivor principle Tags: industry policy, picking winners

The wages of sin are still paying for the Vice Fund

15 Feb 2020 Leave a comment

in economics of regulation, entrepreneurship, financial economics, health economics Tags: active investing, efficient markets hypothesis, passive investing, picking winners

Bureaucrats a heterodox economist trusts big time to pick winners are too witless to phone to confirm her credit card details

21 Sep 2019 Leave a comment

in comparative institutional analysis, constitutional political economy, economics of bureaucracy, economics of information, Public Choice Tags: picking winners

Table of Contents

- Introduction: Thinking Big Again

- From Crisis Ideology to the Division of Innovative Labour

- Technology, Innovation and Growth

- Risk-Taking State: From ‘De-risking’ to ‘Bring It On!’

- The US Entrepreneurial State

- The State behind the iPhone

- Pushing vs. Nudging the Green Industrial Revolution

- Wind and Solar Power: Government Success Stories and Technology in Crisis

- Risks and rewards: From Rotten Apples to Symbiotic Ecosystems

- Socialization of Risk and Privatization of Rewards: Can the Entrepreneurial State Eat Its Cake Too?

- Conclusion

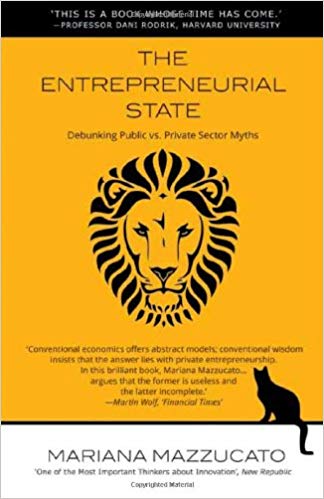

MARIANA MAZZUCATO is a Professor in Economics at the University of Sussex, where she holds the RM Phillips Chair in Science and Technology Policy. She is interested in the interactions between technological change, economic growth, and the ways that industries are structured. Her recent work has looked at the leading role of the State in fostering innovation, and hence the implications of ‘austerity’ for Europe’s ability to be an ‘Innovation Union’. In her last book The Entrepreneurial State she argues that active State investment has been the secret behind most radical innovations, and that this requires economists to analyse the State as market ‘maker’ and market ‘shaper’ not just market ‘fixer’.

Investment strategy of @NZSuperFund is against all the odds @TaxpayersUnion

10 Jan 2019 Leave a comment

in financial economics, politics - New Zealand Tags: efficient markets hypothesis, picking winners

The Injustice of Corporate Welfare

06 Jan 2019 Leave a comment

in applied price theory, industrial organisation, politics - USA, Public Choice, rentseeking, sports economics, survivor principle Tags: industry policy, picking winners

John Oliver on Economic Development

29 Oct 2018 Leave a comment

in applied price theory, industrial organisation, Public Choice, public economics, rentseeking, survivor principle Tags: industry policy, picking winners

Free To Choose 1980 – The Tyranny of Control – Hand Looms

23 Sep 2018 Leave a comment

in applied price theory, development economics, economic growth, economics of bureaucracy, economics of regulation, growth disasters, industrial organisation, market efficiency, Milton Friedman, Public Choice, rentseeking, survivor principle, television Tags: India, industry policy, picking winners

How an Island Lost Its Fortune Making a Terrible Musical

21 Jul 2018 Leave a comment

in development economics, economic history, entrepreneurship, environmental economics, financial economics, global warming Tags: efficient markets hypothesis, picking winners

Corporate welfare explained

21 Aug 2017 Leave a comment

in applied price theory, economics of bureaucracy, entrepreneurship, Public Choice, rentseeking Tags: industry policy, picking winners

Johan Norberg – Picking Winners or Losers

06 May 2017 Leave a comment

in applied price theory, economics of bureaucracy, industrial organisation, politics - New Zealand, Public Choice, rentseeking, survivor principle Tags: industry policy, picking winners

Making trouble again for @stevenljoyce for @TaxpayersUnion

21 Apr 2017 Leave a comment

in applied price theory, applied welfare economics, industrial organisation, international economics, politics - New Zealand, Public Choice, rentseeking, survivor principle Tags: picking winners

The Dutch disease for the benefit of #GarethMorgan @stevenljoyce

18 Apr 2017 1 Comment

in applied price theory, applied welfare economics, economic history, industrial organisation, international economics, politics - New Zealand, Public Choice, rentseeking, survivor principle Tags: Dutch disease, export subsidies, picking winners

I am putting in a Official Information Act request to see if anyone advise ministers that a export promotion target results in a matching increase in imports along with a large appreciation in the New Zealand dollar. Did New Zealand dodge the Dutch disease from this foolhardy export promotion policy? The Dutch Disease story is one of sectoral shifts.

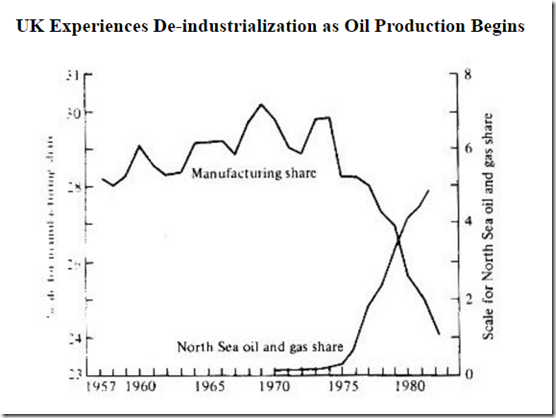

In the 1960s, with fixed exchange rates under the Bretton Woods system, the Netherlands discovered off-shore natural gas. As natural gas was extracted, it increased domestic income and spending. Investment was redirected toward the natural gas sector. Dutch wages and prices began to rise gradually. The Dutch guilder became overvalued in real terms, their industrial products became uncompetitive, and the manufacturing sector shrunk. This phenomenon of de-industrialization in the presence of rich natural resources was called the Dutch disease. They got natural gas but lost manufacturing.

In the late 1970s and early 80s, the UK experienced similar de-industrialization under a floating exchange rate regime. They discovered and exploited the North Sea oil fields. Since the global oil price was rising, the UK was expected to earn a great amount of foreign exchange in the future. But even before these earnings were realized, the British pound appreciated suddenly in both nominal and real terms. This damaged the British manufacturing sector.

Source: MF model – float

If there is an increasing demand for New Zealand exports if the Business Growth Agenda target of increasing New Zealand exports was successful, there is an increase in demand for New Zealand dollars to pay for these exports. This will result in an appreciation of the New Zealand dollar making imports cheaper. This will switch demand for New Zealand competing industries to these imports.

This process of currency appreciation and expenditure switching will continue until export match exports again. There is nothing wrong with an export boom as long as it is based on comparative advantage rather than subsidies.

Recent Comments