The school year is slightly above average length in New Zealand and Australia

28 May 2015 Leave a comment

in economics of education Tags: Australia, New Zealand, schools

New Zealand is on top of the world for education spending

08 May 2015 Leave a comment

in economics of education, politics - New Zealand Tags: College premium, education premium, schools

#Education expenditure in selected OECD countries –

1st NZ 21.6%

statista.com/chart/3398/whi… http://t.co/xgoHKsjNxu—

Statista (@StatistaCharts) April 20, 2015

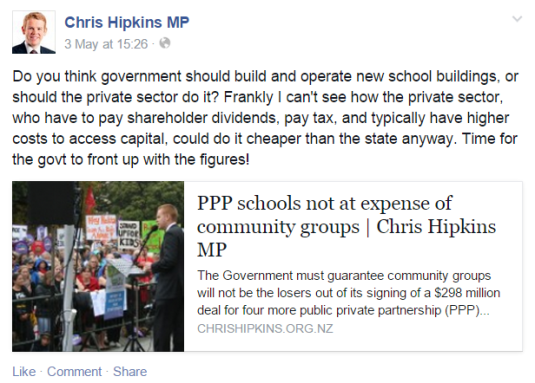

The tired Marxism of @chrishipkins MP. Is government provision cheaper because they don’t have to make a profit?

05 May 2015 1 Comment

in Austrian economics, entrepreneurship, Marxist economics, politics - New Zealand Tags: schools, state owned enterprises

At least one Labour MP must have watched the other channel when the Berlin Wall fell. How else could Chris Hipkins, MP ever think that government provision is cheaper because they don’t have to make a profit? OK, he was a teenager when the Berlin Wall fell, but even teenagers watch the headline news or pick up the gist of the headlines from friends.

The tidiest of all Marxist arguments, the saddest of all Marxist arguments is government operation of businesses is cheaper because they don’t have to make a profit. At least we were spared the cliché “people not profits”.

Leaving to one side that government school buildings are built by private contractors to the Ministry of Education, let’s focus on whether government businesses will be cheaper because they don’t have to make a profit.

No cheap shots about how the portfolio of state owned enterprises are worth $30 billion returned a profit of $20 million to New Zealand taxpayers last year or of the inherent flaws of government ownership:

On the free market, in short, the consumer is king, and any business firm that wants to make profits and avoid losses tries its best to serve the consumer as efficiently and at as low a cost as possible.

In a government operation, in contrast, everything changes. Inherent in all government operation is a grave and fatal split between service and payment, between the providing of a service and the payment for receiving it.

The government bureau does not get its income as does the private firm, from serving the consumer well or from consumer purchases of its products exceeding its costs of operation.

No, the government bureau acquires its income from mulcting the long-suffering taxpayer. Its operations therefore become inefficient, and costs zoom, since government bureaus need not worry about losses or bankruptcy; they can make up their losses by additional extractions from the public till.

The accounting profit or loss of any firm combines two rather different concepts of profit:

- normal profit – the interest paid to those who lend capital to the form either as a loan or as equity; and

- economic profit – the earnings that result from risk taking and entrepreneurship.

Normal profit is simply at the cost of raising capital from investors. This capital can be borrowed in the form of a loan or can be equity.

Chris Hipkins, MP concedes a need to borrow capital when he talks about government typically having lower costs to access capital in the screenshot above. Both private and public builders of schools will have to pay to access capital.

Economic profit is a far more complicated concept frequently misunderstood, especially by Marxists, the Left over Left and, of course, professional media commentators. As Mises explains:

If all people were to anticipate correctly the future state of the market, the entrepreneurs would neither earn any profits nor suffer any losses. They would have to buy the complementary factors of production at prices which would, already at the instant of the purchase, fully reflect the future prices of the products. No room would be left either for profit or for loss.

What makes profit emerge is the fact that the entrepreneur who judges the future prices of the products more correctly than other people do buys some or all of the factors of production at prices which, seen from the point of view of the future state of the market, are too low. Thus the total costs of production — including interest on the capital invested — lag behind the prices which the entrepreneur receives for the product. This difference is entrepreneurial profit.

Profits arise from the dynamism of the market and the ability of superior entrepreneur’s to anticipate the future better than others for which there is always only a temporary profit:

Profits are never normal. They appear only where there is a maladjustment, a divergence between actual production and production as it should be in order to utilize the available material and mental resources for the best possible satisfaction of the wishes of the public. They are the prize of those who remove this maladjustment; they disappear as soon as the maladjustment is entirely removed.

Frank Knight in Risk, Uncertainty, and Profit (1921) distinguished between interest on capital that is lend as either a loan or equity – long-run normal profits – and the short-run profits and losses earned by superior, or suffered by inferior entrepreneurs , respectively. This entrepreneurial superiority or inferiority flows from the ability to forecast the uncertain future. Those entrepreneurs “with superior knowledge and superior foresight,” wrote Frank Fetter, “are merchants, buying when they can in a cheaper and selling in a dearer capitalisation market, acting as the equalizers of rates and prices.”

Knight argued that entrepreneurs earn profits as a return for putting up with uncertainty and anticipating uncertainty faster than the rest. Many businesses are unprofitable because of rising costs or falling sales that were not anticipated. The Knightian concept is of the profit-seeking entrepreneur investing resources under uncertainty about market demand and costs in the future.

Alchian (1950) illustrated the unreliability of cost estimation with the range of bids made in government tendering processes. When contractors bid for the same project, these entrepreneurs routinely disagree over its likely cost by margins of 20 percent. These tenderers are predicting their own costs, about which they are knowledgeable, and they have an incentive to be truthful to win the initial tender.

Profits and losses, by rewarding and penalising the entrepreneurs who are not the quickest, ensures that only what consumers want is bought to the market as Henry Hazlett explains:

In a free economy, in which wages, costs, and prices are left to the free play of the competitive market, the prospect of profits decides what articles will be made, and in what quantities—and what articles will not be made at all.

If there is no profit in making an article, it is a sign that the labour and capital devoted to its production are misdirected: the value of the resources that must be used up in making the article is greater than the value of the article itself.

Profits arise as the reward for superior foresight into the future and innovation. Both of these concepts are not associated with government run businesses as Alfred Marshall explained:

A government could print a good edition of Shakespeare’s works, but it could not get them written.

As for Hipkins’ argument that governments can borrow at a cheaper rate than private firms, Bailey and Jensen (1972) said:

…we argue that efficient allocation of risk bearing is usually more difficult for government projects than it is for private ones. Therefore, if anything, the allowance for risk should be greater for government projects than it is for otherwise comparable private ones…

We find no support for the arguments in favor of using the government bond rate or any other such universally low rate for discounting costs and benefits of public projects.

We concur in Hirshleifer’s conclusion that a public project with given attributes (in terms of dispersion of possible future outcomes and of the covariance of these outcomes with those for existing portfolios) should he discounted with at least as high a rate as a similar private project.

This “same rate” should include the appropriate allowances for taxes and other distortions in private markets (as outlined by Harberger) as well as the appropriate allowances for risk, which we have outlined above.

Moreover, if private markets in risk are as “imperfect” as many have claimed, that merely tends to increase the rate that should be used, because the government is even less able to distribute risks than are these markets.

Recent Comments