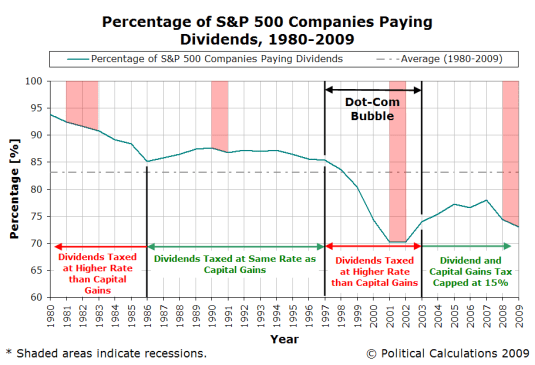

…the Taxpayer Relief Act of 1997 left dividend tax rates unchanged – they continued to be taxed at the same rates as regular income in the United States, which provided a powerful incentive for investors to treat the two kinds of stocks very differently, favouring the low-to-no dividend paying stocks over those that paid out more significant dividends.

At least, until May 2003, when the compromises that led to, and ultimately the signing of the Jobs and Growth Tax Relief Reconciliation Act of 2003 would set both the tax rates for capital gains and for dividends to once again be equal to one another, as they had been in the years from 1986 through 1997…

the founding and rapid growth of new computer and Internet technology-oriented companies in the early 1990s, which grew rapidly to become large companies and which as growth companies, did not pay significant dividends to shareholders, provided the critical mass needed for the 1997 capital gains tax cut to launch the Dot Com Bubble.

via Political Calculations: What Caused the Dot Com Bubble to Begin and What Caused It to End?.

Recent Comments