Steven N.S. Cheung on comparative institutional analysis

21 Jun 2019 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, economics of information, economics of regulation, history of economic thought, industrial organisation, law and economics, property rights Tags: government failure, market failure, transaction costs

Pirates & the Theory of the Firm – Intro to Political Economy, Lecture17 Mike Munger

10 Dec 2018 Leave a comment

in applied price theory, comparative institutional analysis, economic history, economics of crime, entrepreneurship, human capital, industrial organisation, labour economics, law and economics, managerial economics, occupational choice, organisational economics, personnel economics, property rights, survivor principle, theory of the firm Tags: asymmetric information, moral hazard, transaction costs

Gary Libecap: Global environmental externalities, property rights, and public policy

02 May 2018 Leave a comment

in applied price theory, comparative institutional analysis, economics of regulation, environmental economics, law and economics, property rights, Public Choice Tags: common property, externalities, tragedy of the commons, transaction costs

The firm has nothing to do with economies of scale

08 Jan 2016 Leave a comment

in applied price theory, industrial organisation, Ronald Coase, theory of the firm Tags: transaction costs

“Trapped” in Rental Contracts | Organizations and Markets

17 Aug 2014 Leave a comment

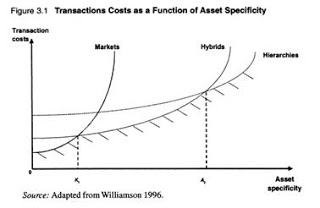

in applied price theory, Armen Alchian, comparative institutional analysis, entrepreneurship, industrial organisation, Ronald Coase, survivor principle, theory of the firm Tags: long-term contracts, mutual dependency, relationship dependent assets, transaction costs, vertical integration

- Mercedes and BMW drivers trapped in lease contracts, rather than buying their cars with cash or credit

- Individuals trapped in wage and salary contracts, rather than raising the capital, arranging the inputs, and bearing the uncertainties to be sole proprietors

- Companies trapped in outsourcing agreements, rather than owning all upstream and downstream production processes directly, as vertically integrated firms

- Vacationers trapped in resort hotels, rather than owning their own vacation condos or timeshares

- Readers trapped by downloading and reading books on their Kindles, essentially “renting” them from Amazon, rather than buying physical books

- Movie fans trapped in DVD rental agreements with Netflix, rather than owning massive DVD libraries

via “Trapped” in Rental Contracts | Organizations and Markets.

Addressing Global Environmental Externalities: Transaction Costs Considerations

20 Jun 2014 Leave a comment

in applied welfare economics, economics of climate change, Public Choice Tags: Gary Libecap, global commons, global environmental externalities, global warming, property rights, transaction costs

Gary D. Libecap, “Addressing Global Environmental Externalities: Transaction Costs Considerations.” Journal of Economic Literature (2014).

Abstract

Is there a way to understand why some global environmental externalities are addressed effectively, whereas others are not?

The transaction costs of defining the property rights to mitigation benefits and costs is a useful framework for such analysis. This approach views international cooperation as a contractual process among country leaders to assign those property rights.

Leaders cooperate when it serves domestic interests to do so. The demand for property rights comes from those who value and stand to gain from multilateral action.

Property rights are supplied by international agreements that specify resource access and use, assign costs and benefits including outlining the size and duration of compensating transfer payments, and determining who will pay and who will receive them.

Four factors raise the transaction costs of assigning property rights:

(i) scientific uncertainty regarding mitigation benefits and costs;

(ii) varying preferences and perceptions across heterogeneous populations;

(iii) asymmetric information; and

(iv) the extent of compliance and new entry.

These factors are used to examine the role of transaction costs in the establishment and allocation of property rights to provide globally valued national parks, implement the Convention on the International Trade in Endangered Species of Wild Fauna and Flora, execute the Montreal Protocol to manage emissions that damage the stratospheric ozone layer, set limits on harvest of highly-migratory ocean fish stocks, and control greenhouse gas emissions.

Alchian, Demsetz and the efficiency enhancing roles of unions

31 Mar 2014 Leave a comment

in Armen Alchian, labour economics, theory of the firm Tags: transaction costs, unions

Many look at unions as a cartel that raises wages at the expense of non-members.

What has been under-sold is the efficiency enhancing role of unions in Alchian and Demsetz (1972) – their modern classic on the theory of the firm.

Employee unions, whatever else they do, act as monitors for employees.

- Are correct wages paid on time? Usually, this is easy to check.

- But some forms of employer performance on the employment contract are less easy to meter and is at risk to employer shirking.

Medical, hospital, and accident insurance and retirement pensions are contingent payments paid in kind by employers to employees. Each employee cannot judge the character of such payments as easily as with money wages.

A specialist monitor – a union hired by the employees – monitors those aspects of employer payments that are more difficult for employees to monitor. As an example, many unions sit on the board of directors of pension funds as an employee watch dog.

Because of economies of scale in monitoring and enforcing contracts, unions may arise as an institution to reduce the costs of contracting for employees with investments in specific human capital and back-loaded pay, including employee pension plans.

In addition to these narrow contract-monitoring economies of scale, a union creates a continuing long-term employment relationship that eliminates the last-period (or transient employee) contract-enforcement problem and creates bargaining power (a credible strike threat) to more cheaply punish a firm that violates the employment contract.

- As a union makes it more costly for a firm to cheat an individual worker in his last period of work, workers are more likely to invest in specific human capital and accept back-loaded pay schemes, both of which raises their career wages and productivity.

- A strike is a cheaper way to enforce a contract than is litigation. Many firms stop dealing with a bad customer/unreliable supplier until a bill or problem is fixed. A quick strike is no different.

Unions are more likely to exist when the opportunistic cheating problem is greater, namely, when there is more firm-specific human capital present in the employment relationship.

Unions perform many of the functions carried out by professional agents in the sports and entertainment industries. These specialists know the going rate for specific talents; act as a credible and informed negotiating agent; warn their clients off working for bad employers; and punish bad employers by not referring future clients to them.

The traditional literature on unions argues that unions act as a productivity shock and give employee voice in workplace affairs, which lowers job turnover. Unions as an institution to reduce contract negotiation and enforcement costs is better nested in the modern theory of the firm. Of course, unions can also act as cartels.

The next blog on unions will be on the withering away of the union wage premium. The final blog will be on how strikes can enhance the profits of employers!

Recent Comments