Government owned mining company Solid Energy lost $182 million last year. It is already received nearly $200 million in corporate welfare in bailouts from the New Zealand taxpayer. It’s time to call a halt.

The Christchurch-based coalminer is negotiating with banks in a bid to reduce its $320 million debt. In 2013, its annual revenue dropped by a third to $631 million.

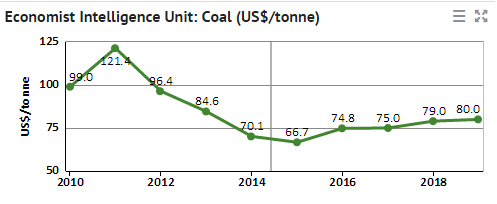

Solid Energy invested heavily on a strategy that energy prices were going to go up and up. That investment strategy was against the market sentiment of that time, much less afterwards and the collapse of oil prices.

While Prime Minister John Key said on March 2 that it was not the Government’s preferred option to put more taxpayer cash into Solid Energy, Minister of Finance Bill English flatly ruled out cash, loans or guarantees. I hope Bill English wins that political struggle at the Cabinet table for the sake of the long-suffering New Zealand taxpayer.

What is worse, the government has indemnified the directors of Solid Energy against unspecified liabilities thus giving them an open-ended cheque-book, from what I can see, to trade while insolvent:

State Owned Enterprises Minister Todd McClay confirmed last month that the Crown has offered an indemnity to the board of Solid Energy last year, but would not comment on what it was.

Asked if directors had raised concerns with him that they might be trading while insolvent, English said: “Any director of a company like this has that question uppermost in their mind. They need to be sure all the time that they’re not trading while insolvent.”

Directors’ duties regarding trading while insolvent is the last line of defence against financial irresponsibility. There are both civil liability and criminal penalties for trading while insolvent under company law.

Solid Energy has already been a black hole for nearly $200 million in taxpayers’ money as well as considerable bank write-offs of loans.

The company appeared before the Finance and Expenditure Select Committee of Parliament this morning. It told MPs the company was solvent and marginally cash positive, but looking at another significant loss this year.

It should be a matter of policy that the government, any government, should not indemnify directors of any company, be they government owned or not, for breaches of directors’ duties. It’s a matter of the rule of law and of governments not privileging itself in the marketplace at the expense of the taxpayer.

What is the point of having a State Owned Enterprises Act and setting up these businesses as companies with a duty to be as successful as a company not owned by the government if they don’t have to obey the most fundamental safeguards in company law when push comes to shove?

If these indemnities have indeed been issued by the government for breaches of directors’ duties regarding insolvency, and it seems as though they have been, what is the Crown liability to creditors if Solid Energy is indeed trading while insolvent? These indemnities may allow the creditors to pierce the corporate veil and sue the New Zealand government.

In the revenge of directors duties, the directors of banks and any other creditor will have a director’s duty to sue the New Zealand government for all it can get as a result of these indemnities.

At a minimum, the New Zealand government will have to settle out of court or go all the way to the Supreme Court because hundreds of millions of dollars are involved from the bank write-offs, past and present.

Naturally, the ideological blinkers of the opposition party in New Zealand prevents it from saying the obvious, which is calling for the Solid Energy to be put in receivership. The Labour Party spokesman on state owned enterprise attacked the stewardship of the Minister of Finance as a shareholding Minister, but had nothing to say in terms of solutions, including putting the company into receivership.

The Green Party did a little bit better in 2013 when its spokesman talked about a need for a transition to sustainable jobs – the Green party code for layoffs:

“The National Government need to take responsibility for their mismanagement of Solid Energy and cut their losses,” said Mr Hughes.

“The banks that made risky loans to Solid Energy need to bear the cost of their mistakes”. “Coal is not going to be the fuel of our future if we are to stabilise our climate”.

“New Zealanders and Solid Energy workers need a just transition into more sustainable jobs – jobs that don’t fry the planet.”

“The longer this Government effectively denies climate change, the more taxpayer money will go to subsidising coal and its foreign backers.”

Things are getting desperate when the Greens find a corporate welfare so appalling that they actually oppose it, if only because of support for lower carbon emissions. That is one green hypocrisy too many if it supported a bailout of a coal miner.

Aug 04, 2015 @ 15:12:29

Reblogged this on Utopia – you are standing in it! and commented:

LikeLike