I, Pencil is a 1958 classic economics polemic by Leonard Read explaining about how nobody knows how even the most basic items in a consumer society are made and more importantly, they don’t need to know.

The relevance of I, Pencil to environmental activists on Global Disinvestment Day is they pretend to know enough about the vast number of products made by the many companies within the average share portfolio to be out of work out whether these companies are investing in fossil fuels so they can sell their shares in them.

I, Pencil made the point that people simply don’t know how the most basic products are made, much less who made them, and with what. Even if they did know, this information would become rapidly out of date. The marvel of the market is the remarkably small amount of information that people need to go about their business. Prices summarise much of what people need to know.

The whole point of the separation of ownership and control in modern corporations such as those listed on share markets is shareholders simply have no chance of monitoring the day to day affairs of companies in which they invest.

Many shareholders have too small a stake to gain from monitoring managerial effort, employee performance, capital budgets, the control of costs and investment policies (Manne 1965; Fama 1980; Fama and Jensen 1983a, 1983b; Williamson 1985; Jensen and Meckling 1976). This lack of interest by small and diversified investors does not undo the status of the firm as a competitive investment.

Day-to-day management and risk bearing are split into separate tasks with various governance structures developed to ensure that the professional management teams serve the interests of the owners who invested in the company, along with their many other investments that compete for their attention. Large firms are run by managers hired by diversified owners because this outcome is the most profitable form of organisation to raise capital and then find the managerial talent to put this pool of capital to its most profitable uses (Fama and Jensen 1983a, 1983b, 1985; Demsetz and Lehn 1985; Alchian and Woodward 1987, 1988).

Firms who are not alert enough to develop cost effective solutions to incentive conflicts and misalignments will not grow to displace rival forms of corporate organisation and methods of raising equity capital and loans, allocating legal liability, diversifying risk, organising production, replacing less able management teams, and monitoring and rewarding employees (Fama and Jensen 1983a, 1983b; Fama 1980; Alchian 1950).

Indeed, our friends on the Left do go on about the power of boards of directors to set their own exorbitant salaries because shareholders lack of control them because they know so little about what they do.

That is, according to our friends on the Green Left, shareholders are not supposed to know enough about company performance and operations to work out if the salaries of top executives are justified. Top executive pay is always published in annual reports of companies.

Activist shareholders concerned about fossil fuel use nonetheless will be able to work out what the companies in their share portfolios are investing in and whether these investments are in fossil fuels. Details of these investments are much less public than the pay of top executives.

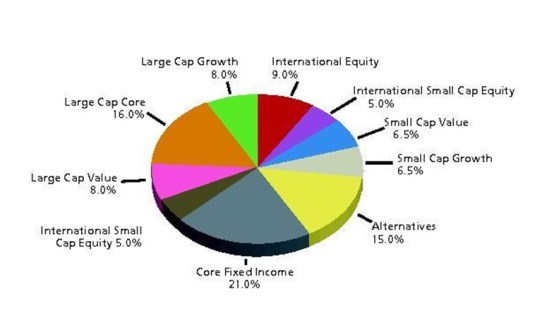

This continuous monitoring of corporate investment policies and associated buying and selling of shares will make investing in small parcels of shares in smaller companies listed on the share market rather expensive. Diversified share portfolios in index linked funds can have hundreds of companies in them. Some of these companies receive next to no media coverage that will simplify the cost to activist shareholders of monitoring their investments in fossil fuels.

Recent Comments