More than 50% of US corporate profits earned abroad are made in nations considered tax havens on.wsj.com/1h2Uitv http://t.co/6L8Hqislxd—

Nick Timiraos (@NickTimiraos) September 29, 2015

I do wonder how much less wages, innovation, entrepreneurship and investment in capital would be but for the valiant efforts of tax havens to limit the size of government and the burden of business taxation in the developed countries.

Source: Abolish the Corporate Income Tax – The New York Times.

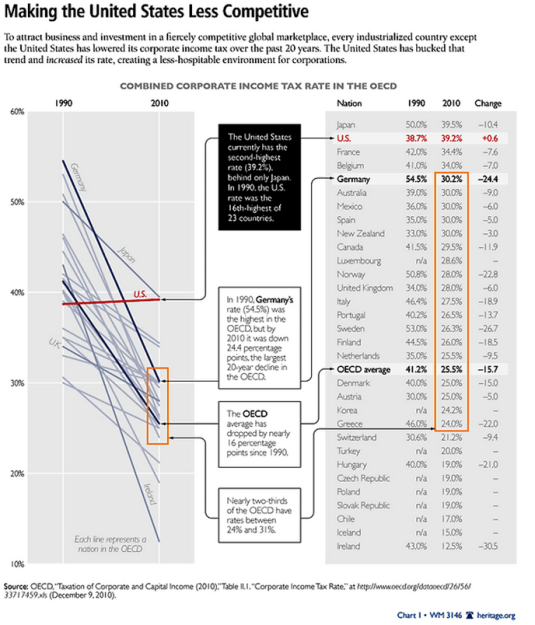

But for the possibility of capital flight, company taxes would be much higher in the industrialised countries.

Why effective tax rates paid by U.S. corporations look a lot lower than the base 35% rate on.wsj.com/1h2Uitv http://t.co/PgRq4FZqOr—

Nick Timiraos (@NickTimiraos) September 29, 2015

Tax havens are working class heroes because of their contribution they make to increasing the returns to corporate savings and private capital formation so vital to high wages everywhere.

Dec 03, 2015 @ 11:39:21

Reblogged this on Utopia – you are standing in it! and commented:

LikeLike