Data from New Zealand’s inflation-indexed bond market has been a bit of a mystery for some time.

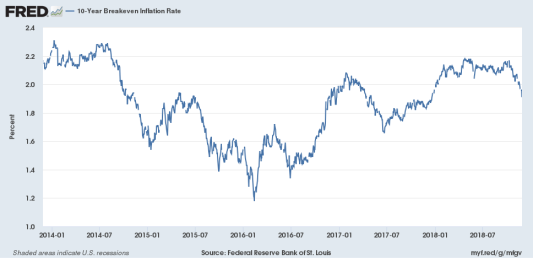

If one looks at US data, the gap between conventional and indexed government bond yields – the “breakeven” or implied inflation expectation – makes sense. Here is the data for the last five years or so.

The US inflation target is around 2 per cent and for the last couple of years the breakevens have been pretty close to that. There was a period of real weakness in 2015/16 but it didn’t last that long, and even then the breakevens were only averaging around 1.5 per cent. If you were inclined to focus on the severe limitations US monetary policy will face in the next serious recession, you might even think 2 per cent breakevens for the average of the next 10 years is a bit high – after all, the Fed…

View original post 1,288 more words

Recent Comments