In the world of public finance, Ireland is best known for its 12.5 percent corporate tax rate.

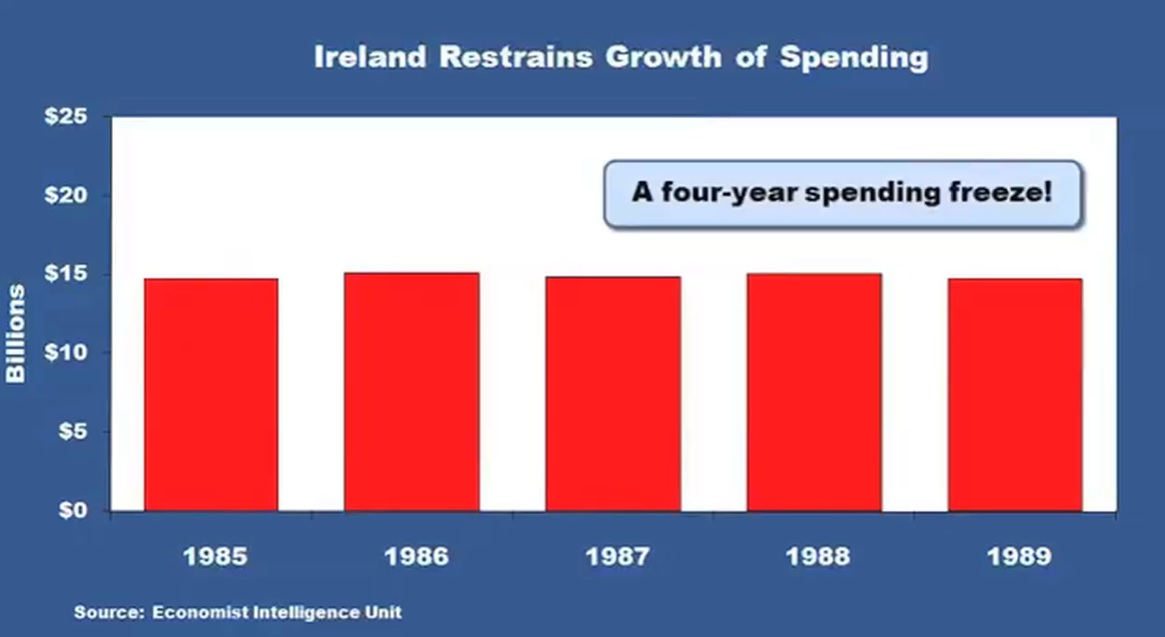

That’s a very admirable policy, as will be momentarily discussed,  but my favorite Irish policy was the four-year spending freeze in the late 1980s.

but my favorite Irish policy was the four-year spending freeze in the late 1980s.

I discussed that fiscal reform in a video about 10 years ago, and I subsequently shared data on how spending restraint reduced the overall burden of government in Ireland and also lowered red ink.

It’s a great case study showing the beneficial impact of my Golden Rule.

Spending restraint also paved the way for better tax policy, and that’s a perfect excuse to discuss Ireland’s pro-growth corporate tax system. The Wall Street Journalopined last week about that successful supply-side experiment.

Democrats want a high global minimum tax that would end national tax competition and reduce the harm from their huge tax increase on U.S. business. But…

View original post 402 more words

Recent Comments