Three years ago, I shared two videos explaining taxation and deadweight loss (i.e., why high tax burdens are bad for prosperity).

Today, I have one video on another important principle of taxation. To set the stage for this discussion, here are two simple definitions

- The “average tax rate” is the share of your income taken by government. If you earn $50,000 and your total tax bill is $10,000, then your average tax rate is 20 percent.

- The “marginal tax rate” is the amount of money the government takes if you earn more income. In other words, the additional amount government would take if your income rose from $50,000 to $51,000.

These definitions are important because we want to contemplate why and how a tax cut helps an economy.

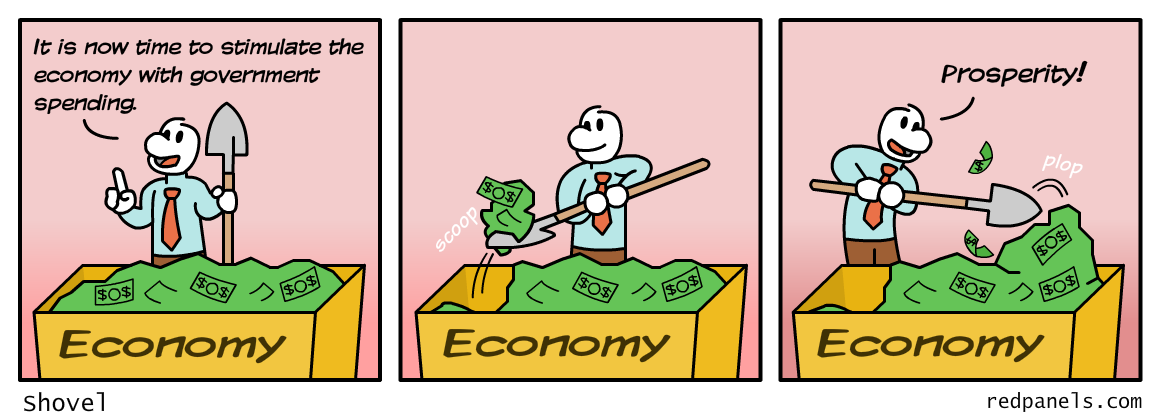

But let’s start by explaining that a tax cut doesn’t boost growth because people have more money to spend.

View original post 651 more words

Recent Comments